IPO Alert: Ami Organics opens on 1 September 2021

The IPO party is far from over on D-Street. In September, more companies are set to go public and raise money from the markets. One of them is Gujarat-based specialty chemical maker Ami Organics.

We bring you all the key details about the latest public issue.

Key details

-

IPO size: ₹570 crore

-

Fresh issue: ₹200 crore

-

Price band: ₹603-₹610

-

Lot size: 24

-

Cost per lot: ₹14,640

-

Issue opens: 1 September 2021

-

Issue closes: 3 September 2021

-

Basis of allotment date: 8 September 2021

-

Initiation of refunds: 9 September 2021

-

Credit of shares to demat account: 13 September 2021

-

Expected listing date: 14 September 2021

If you planning to invest in Ami Organics IPO, learn about its business model and fundamentals:

About Ami Organics

Incorporated in 2004, Gujarat-based Ami Organics is a research and development (R&D) driven specialty chemicals manufacturer. The company focuses on developing and manufacturing advanced pharmaceutical intermediates for generic active pharmaceutical ingredients (APIs) and new chemical entities (NCEs). It also makes key starting material for agrochemical and fine chemicals.

It has developed and commercialised more than 450 pharma intermediates for APIs and NCEs, with a strong focus on select high-growth and margin therapeutic areas such as anti-retroviral, anti-inflammatory, antipsychotic, anti-cancer, anti-Parkinsons, antidepressant and anti-coagulant.

Besides having a presence in the domestic market, the company also supplies to various multinationals that cater to markets in Europe, China, Japan, Israel, UK, Latin America and the US. The company derives around half of its revenue from exports.

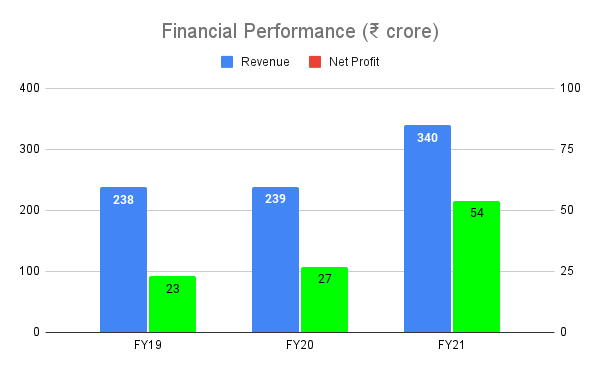

Over the last three years, the company has posted strong financial performance. The revenue from operations and net profit have grown at a CAGR of 19.5% and 52.2%, respectively.

About the issue

The offer for sale comprises 6,059,600 equity shares. The fresh issue is of ₹200 crore, which will be used for repayment of financial facilities, working capital requirement and general corporate purposes.

IPO allocation quota

| QIB | NIB | Retail |

| --

| --

- | --

- | --

- |

| 50% | 15% | 35% |