Intraday Shooting Star Strategy

Here is a simple intraday trading setup based on Candlestick pattern. The chart timeframe for this intraday candlestick pattern strategy is 3 minutes.

Interestingly, you can use this setup to trade stocks, equity indices, commodities or even currencies. Further, you can use any instrument to trade it i.e. cash (equity shares), futures or options. Also, with this strategy you can trade in a bullish as well as a bearish market.

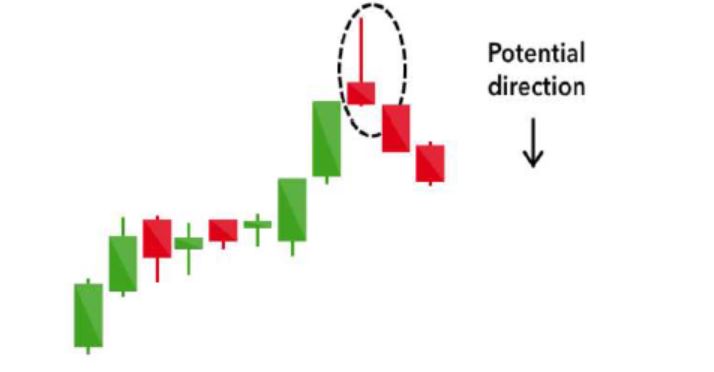

The ** candlestick pattern** that we are going to trade is a Shooting Star Candlestick Pattern. It’s a bearish reversal pattern. Shooting star is also called an Inverted hammer pattern. The key is to spot a shooting star pattern in specific zones to take best advantage of the movement that can follow post the pattern.

Let’s understand the step by step process as to how we analyze and trade this strategy. This is an Intraday sell strategy. You will sell first and then buy later to square off your position.

Steps of the setup: We are analysing the Nifty spot chart in the example below.

Step 1 : Identify a shooting star pattern after an uptrend.

There are two ways to identify a shooting star.

-

It should have a small lower wick, small body and a long upper wick.

-

It shouldn't have a lower wick, but it should have a small body and a long upper wick.

Both of them can be qualified as shooting stars. We will show you a classic Inverted hammer pattern after an uptrend with a help of an image below

You can see the shooting star circled in black. Here, it has a tiny lower wick/shadow and small body (thick square shaped body) with a long upper wick/shadow. This is a perfect shooting star pattern.

As you can see, the inverted hammer is after an uptrend. It is important to spot an inverted hammer after a clear uptrend and not after a downtrend or a sideways (consolidating) trend.

You may have a question looking at the hammer thinking if we need to see a red inverted hammer or a green inverted hammer. As mentioned above, since an inverted hammer is a bearish reversal pattern, we have to look for a red inverted hammer pattern**.** Red candle also indicates there are more sellers than the buyers and gives that extra confidence to trade.

Step 2 : Spot an inverted hammer near it’s previous resistance zone.

As mentioned above. It is very important to look for a hammer pattern in a specific zone. In our strategy our specific zone is a resistance zone. A resistance zone is a zone where the price makes a high and reverses downwards from that high. You may also call it a swing high wherein the price is in an uptrend, it pauses at a certain zone or it halts at a certain zone and moves downwards. We will look at a price chart on Upstox pro web platform to understand step 2 in detail.

The PURPLE line drawn at 16530.73 is our resistance zone or the swing high zone because the price reversed has reversed from this zone previously. . After a brief uptrend, the price formed an inverted hammer pattern exactly near our previous resistance zone of 16530.73 suggesting that we may see a trend reversal from bullish to bearish.

Now that we know how to spot an inverted hammer and where to spot an inverted hammer, let’s see how we can trade the same.

Step 3 : Let's understand with the help of a chart as to what price do we enter, where do we keep our stop loss and when do we exit (target)

We can see the GREEN line (16526) that's where we got the confirmation of an inverted hammer pattern at the resistance zone. Once the price of the inverted hammer pattern is broken, our entry is triggered. We will enter around those levels at 16526. Since Nifty spot can’t be traded, you can look to trade Nifty futures or options. If you choose to trade options, one way to go about it is that you can buy an ATM (at the money) strike price call option to trade. In our example, the market price is at 16526 and the nearest strike seems to be 16550 put option. Since it’s an intraday trade, we can go for weekly expiry rather than a monthly expiry contract.

Let’s come to the stop-loss. We can see the RED line (16536) which is the high price of the inverted hammer. That's 10 points above the entry point of 16526. If the Nifty goes up and hits 16536 (our stop loss) we will take a loss and exit our position.

Since it’s an intraday and a Nifty trade, the timeframe of the chart is 3 minutes, we will aim for a risk to reward of 1:1. In our example the risk being 10 points, we will aim for a target of 10 points too from our entry price which comes to 16516 (16526-10)

You can see the PURPLE line (16516**)**. Once our price hits 16516, we will exit our 16550 put option position and come out with our profit.

We hope this simple inverted hammer pattern strategy was simple and easy to understand. You can try spotting it on charts and see if you are able to identify such setups.

We’ll be coming with a lot of strategies on candlestick patterns which will help to identify trade setups easily.

Until then, happy trading!