HP Adhesives IPO – All you need to know

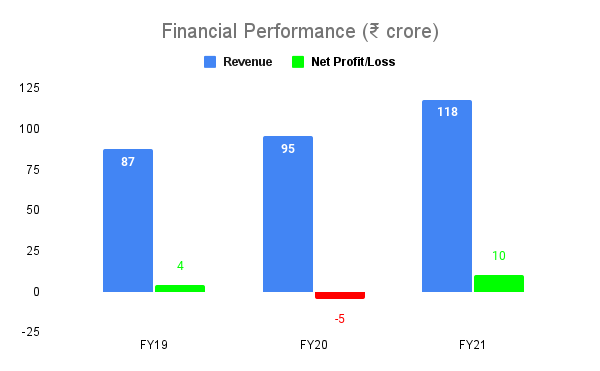

Founded by the Motwani family in 1978, HP Adhesives is a leading manufacturer of adhesives and sealants in India. From plumbing, sanitary, drainage and water distribution to footwear and automotive, the company’s products have a wide range of applications. Over the last three years, the company’s financial performance has been a mixed bag. In FY20, the company suffered a loss of ₹4.6 crore. But it managed to bounce back in the following year and reported a profit of ₹10 crore in FY21. Now, the company is all set to launch its IPO and use the net proceeds to fuel its expansion.

Offer details

-

Start date: 15 December 2021

-

End date: 17 December 2021

-

Price band: ₹262

-

₹274 per share

-

Minimum investment: ₹13,700

-

IPO size: ₹125 crore

All about the IPO

In the 1970s, when usage of plastic was at its nascent stage, the Motwani family decided to foray into the solvent cement business (used to join plastic pipes and fittings). This gave the company a headstart. About five decades later, HP Adhesives is among the fastest-growing multi-product adhesives and sealants companies.

Over the last 11 years, its revenue from operations has grown rapidly at a CAGR of 37.5% to ₹118 crore in FY21. It is a well-established brand, selling products in 21 countries. It has 750 distributors who cater to 50,000 dealers across India.

Financials

Revenue: 16.2%; Net Profit.Loss: NA (FY19-21 CAGR)

Strengths

-

Is a well-established brand, which offers high quality products with efficient pricing

-

Is the largest manufacturer of PVC adhesive with a 14-16% market share

-

Has a wide portfolio of products which enables it to cross-sell to a large customer base

-

Has multiple SKUs in terms of grades and pack sizes to meet the needs of a diverse customer base

Risks

-

The new variant could dent its sales. In April and May 2020, its average monthly sales dropped drastically due to the pandemic

-

Low utilisation of the capacity. In FY21, the capacity utilisation for solvent cement, other adhesive and sealants stood at 51%, 34% and 52%, respectively.

-

Fluctuation in prices of petro-chemicals could affect its ability to price products competitively

-

A significant portion of its domestic sales (47% in FY21) is derived from the west zone

-

Pidilite Industries dominates the Indian consumer adhesive market with a share of 60%-65%

Good to know

India’s consumer adhesive market is expected to clock 9%-10% CAGR between 2021 and 2026 driven by economic recovery and growth in end-user industries. Being one of the leading companies in this segment, HP Adhesives is well-positioned to benefit from this stellar growth. Also, the rising demand for wooden furniture could be a major tailwind for the company.