How to Trade in Lead Mini Contracts

Did you know that Lead is a vital component in your car's battery?

Lead is also an essential commodity that provides backup power during power failures in computer installations, banks, telephone exchanges, and aircraft control towers. Let's understand what Lead is and how you can use it in trading.

Lead is also an essential commodity that provides backup power during power failures in computer installations, banks, telephone exchanges, and aircraft control towers. Let's understand what Lead is and how you can use it in trading.

What is Lead?

Lead, typically found in the form of Galena, is a metal that often occurs with other metals like copper, zinc, and silver. The primary use of lead is in producing batteries for cars and industries because of its high corrosion resistance. Additionally, lead's poor conductivity of electricity makes it an ideal material for lining batteries. Lead also finds use in protecting nuclear reactors from radiation.

MCX (Multi Commodity Exchange) offers trading in Lead futures, and they have recently introduced mini contracts for traders who want to invest in smaller lot sizes.

What are Lead Mini Contracts?

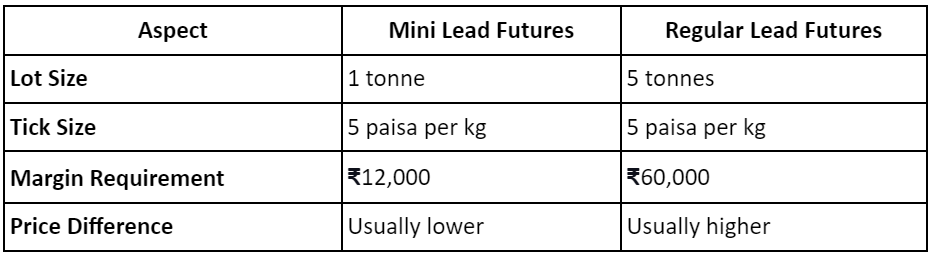

Lead mini contracts are smaller versions of regular lead futures contracts. While the size of a regular lead futures contract is 5 tonnes, the length of a mini lead contract is 1 tonne. Lead mini contracts have a tick size of 5 paisa per kg. Now, as the lot size is 1 tonne, every rupee move will give a profit or loss of ₹1000.

Lead mini contracts are similar to regular lead futures contracts but with a smaller size. While the standard lead futures contract size is 5 tonnes, mini lead contracts are 1 tonne in size.

Mini Lead Futures vs Regular Lead Futures

Note: Margin requirements and price difference may vary depending on market conditions.

How do Lead Mini Contracts Work?

-

Lead mini contracts are futures contracts for buying or selling lead at a predetermined price on a future date.

-

Traders deposit a margin amount and can take a long or short position on the contract.

-

Contract size is smaller than standard lead contracts, settlement is in cash, and it has an expiration date.

-

Traders can close out positions or roll them over.

Benefits of Trading Lead Mini Contracts

There are several benefits to trading lead mini contracts, including:

-

Lower margin requirements: Lead mini contracts have a smaller lot size of 1/5th that of regular contracts, which leads to lower margin requirements. At the current rates, Lead mini contracts to have a margin of about Rs. ₹12,000.

-

Trading Flexibility: Mini contracts give you more options. If you have a specific trading size in mind, but the available contract size is too big, you might have to skip the trade or take on too much risk. With mini contracts, you can adjust your position to fit your needs.

-

Exit positions: If you only want to sell a portion of your position to take some profits, mini contracts make it easier. For example, if you own 5 tonnes of lead mini, you could sell 1 tonne and keep the other 4.

Factors Affecting Lead Prices

Several factors can affect lead prices, including:

-

Economic events: International economic events such as inflation, recession, and global industrial growth can affect lead prices.

-

Production-related factors: Commissioning new production facilities, unexpected mine or plant closures due to natural disasters, accidents, strikes, etc., can also affect lead prices.

Trading lead mini contracts on Upstox is pretty simple. However, you must pay attention to how the delivery mechanism works. Unlike cash-settled crude oil mini contracts, lead mini contracts are marked with compulsory physical delivery. However, that doesn't mean you must bring tons of lead home.

Important: Upstox does not offer a physical settlement of mini-lead contracts. Thus open positions are squared off before the start of the tender period. The tender period generally starts five trading days before the expiry day including it.