How To Get Capital Gains Statement For Mutual Fund Investments

The last date to file your taxes for the Financial Year 2020-21 is 31 December 2021. And one of the essential documents that you need to keep handy while filing your tax return is your mutual fund capital gains statement. It is crucial to determine your capital gains and file your tax returns appropriately.

If you invest in mutual funds, the capital gain is your profit on your mutual fund investment. E.g., if your investment of ₹50,000 becomes ₹75,000 and you redeem the entire investment, the capital gains would be ₹25,000.

As capital gain is an income, you need to show the realised gains from the mutual fund investments in the previous financial year.

In this article, we will see two simple ways to get your mutual fund capital gains statement from any Registrar and Transfer Agent (RTA).

Registrar and Transfer Agent (RTA)

You can use RTAs like CAMS and Karvy’s consolidated capital gains statement mailback service if you have investments across many investment platforms or through the physical route. RTAs take care of mutual funds’ back-office operations so that fund houses can concentrate on investment management and other opportunities. Franklin Templeton Mutual Fund and Sundaram Mutual Fund are exceptions as they have their own RTAs.

Instead of getting capital gains statements from individual mutual fund companies, you can get reports from RTAs, which will contain information on capital gains from all mutual fund houses they their service.

How to Download Consolidated Capital Gains Statement from CAMS

CAMS services a large number of fund houses. The process for downloading the Consolidated Capital Gains Statement from CAMS is as follows:

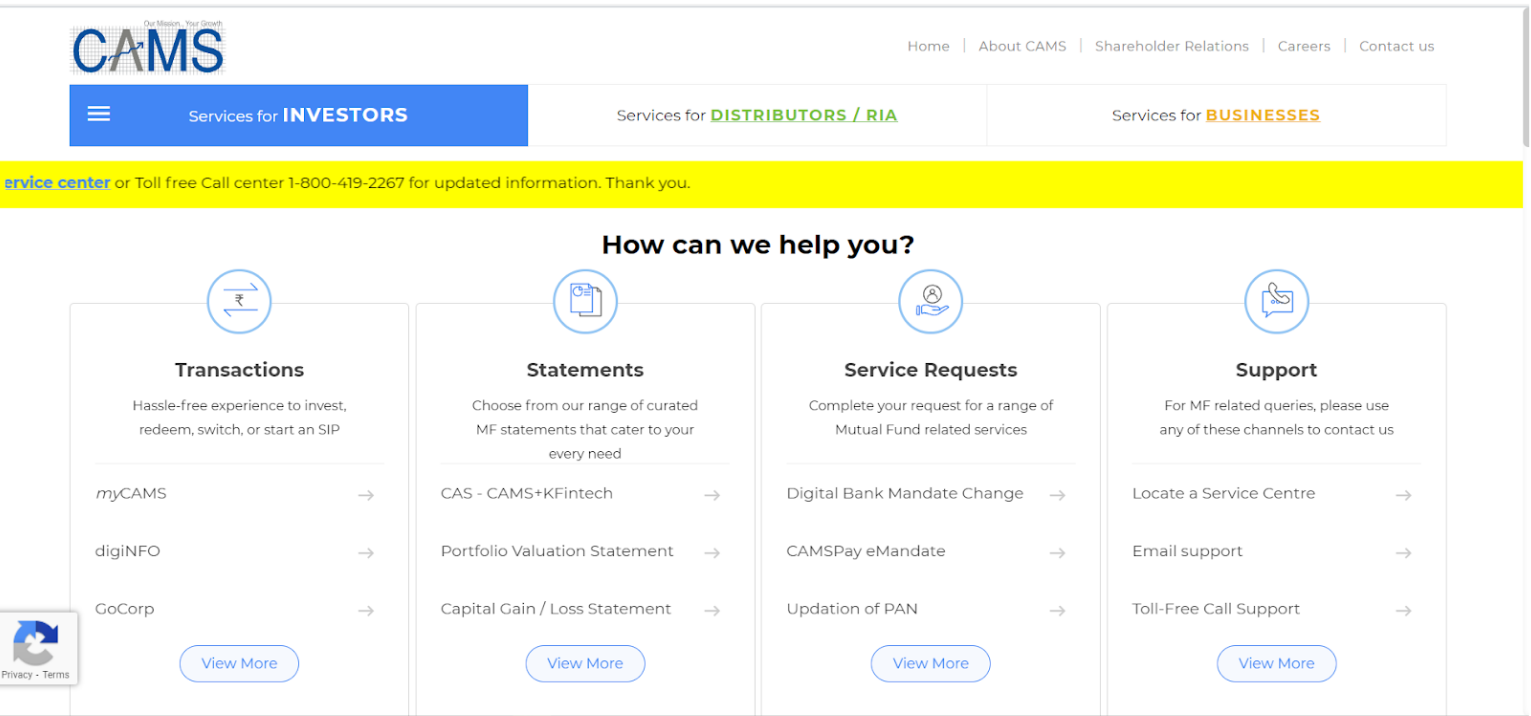

Step 1: Click here to visit the CAMS webpage. Accept the Terms and Conditions to proceed ahead.

Step 2: Under the ‘Statements’ option, go to ‘Capital Gain/ Loss Statement.’

###### Image source: [https://www.camsonline.com/](https://www.camsonline.com/)

###### Image source: [https://www.camsonline.com/](https://www.camsonline.com/)

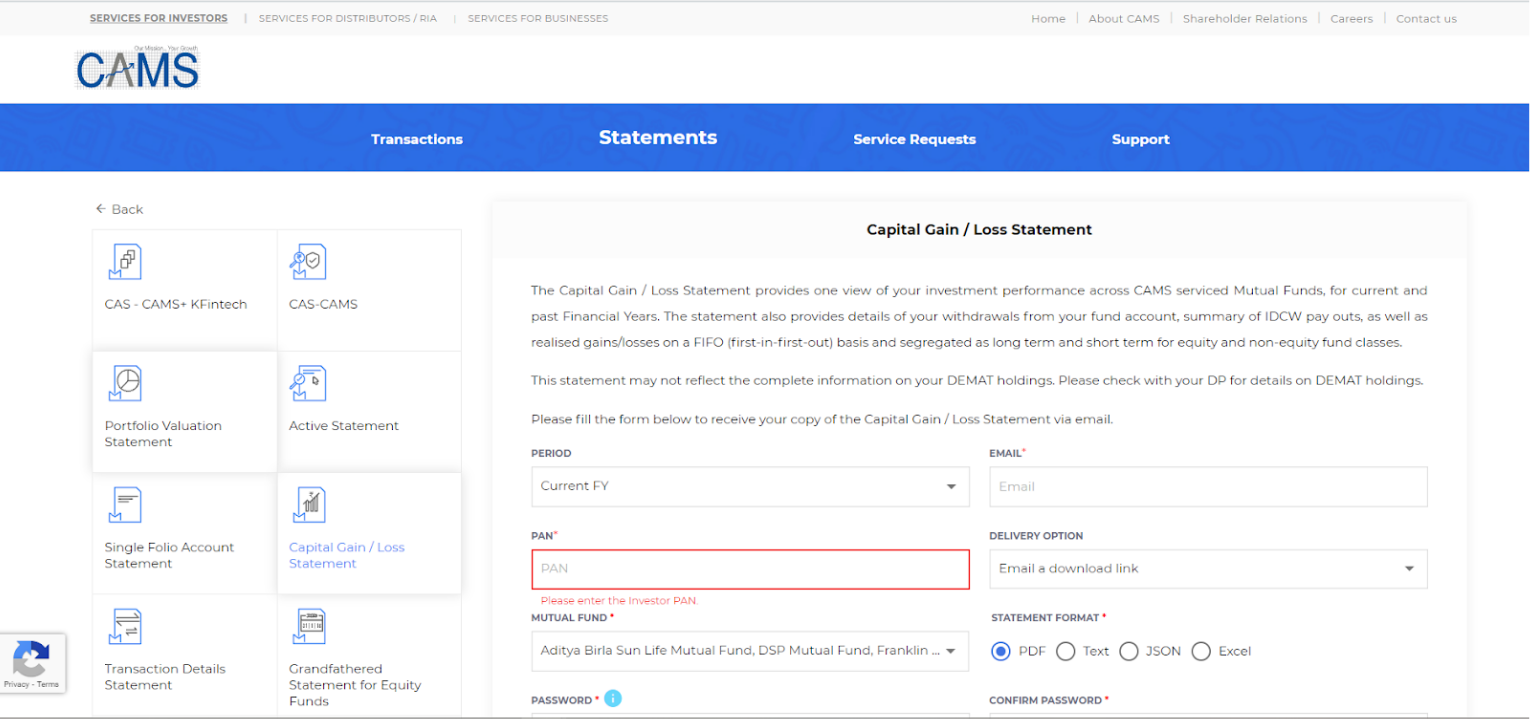

Step 3: Enter the required details.

As you would want to know the capital gains of the previous financial year, select the previous FY from the drop-down list of the ‘period’ section.

###### Image source: [https://www.camsonline.com/](https://www.camsonline.com/)

###### Image source: [https://www.camsonline.com/](https://www.camsonline.com/)

Enter your email ID that is registered with your investment folios.

Select ‘All Funds’ from the drop-down list of the mutual fund category. Enter your PAN.

Select ‘Email an encrypted attachment’ as the delivery option. Then you need to set a password that you will need to open the document.

Step 4: Use the password you have set to get the capital gains statement on your email id. You will not receive any attached document if you have not redeemed your mutual fund investment during the selected financial year.

How to Download Consolidated Capital Gains Statement from Karvy

Follow these steps to download the consolidated gains statement of the mutual funds serviced by Karvy.

Step 1: Go to https://mfs.kfintech.com/mfs/

Step 2: Click on Mutual Fund Investors.

###### Image source: [https://mfs.kfintech.com/mfs/](https://mfs.kfintech.com/mfs/)

###### Image source: [https://mfs.kfintech.com/mfs/](https://mfs.kfintech.com/mfs/)

Step 3: You can easily set up an account with Karvy if you do not have an account.

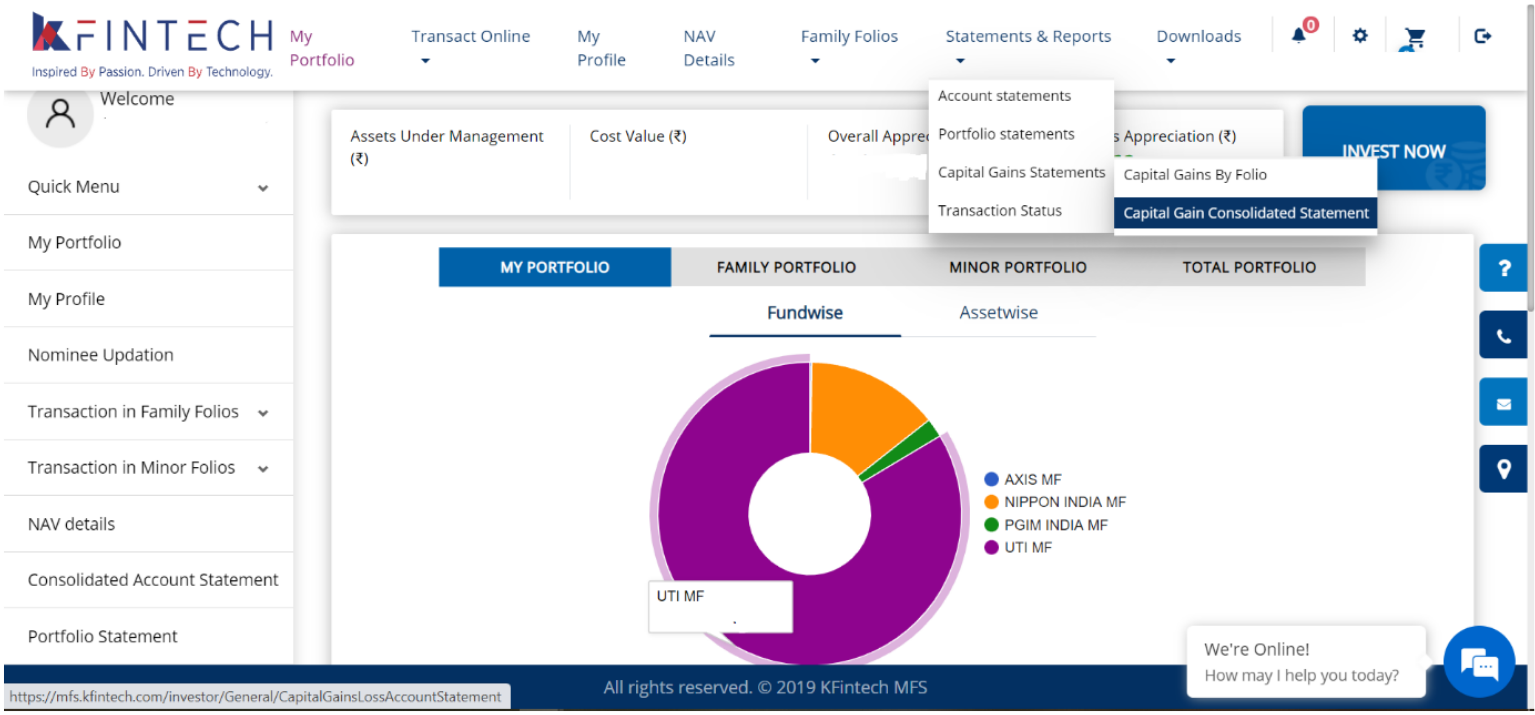

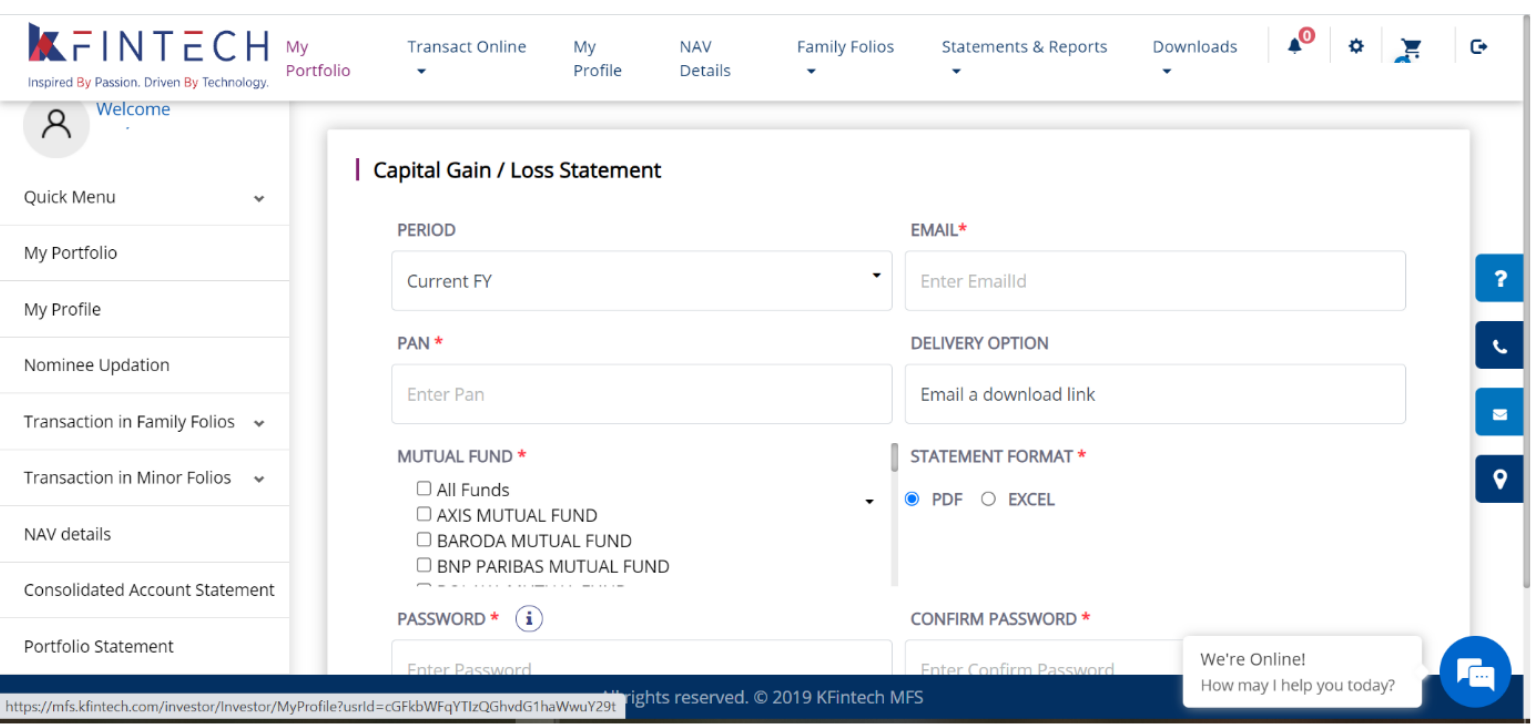

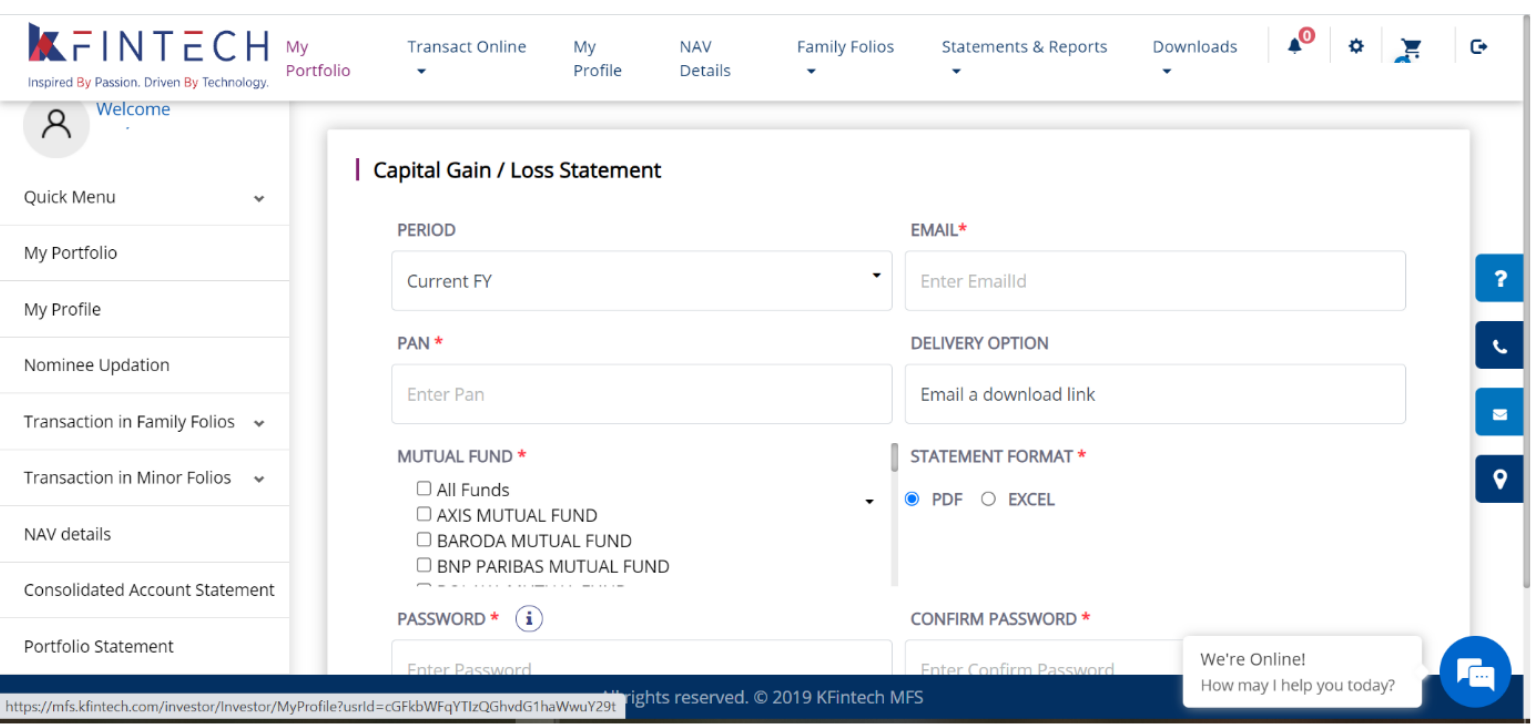

Step 4: You will see your investment details on the dashboard. Go to Statements & Reports > Capital Gains Statements > Capital Gains Consolidated Statement.

###### Image source: [https://mfs.kfintech.com/mfs/](https://mfs.kfintech.com/mfs/)

###### Image source: [https://mfs.kfintech.com/mfs/](https://mfs.kfintech.com/mfs/)

Step 5:

Fill up the required details. Select ‘Previous FY’, ‘All Funds’ from the drop list of the period and mutual fund category, respectively. Enter your email id, PAN, and password.

Image source: https://mfs.kfintech.com/mfs/

You will receive your capital gains statement on your email id and use the password to open the file.

As you can see, it is extremely easy to get your capital gains statement for your mutual fund investments.