How to check allotment status of Sigachi Industries IPO

Sigachi Industries is expected to list on the exchanges on 15 November 2021. You can check whether you have been allotted shares by following these steps on the Upstox app. If the shares are allotted, then they will be credited to your demat account on 12 November 2021.

Key dates

-

Allotment date: 10 November 2021

-

Initiation of refunds: 11 November 2021

-

Credit of shares to demat account: 12 November 2021

-

Expected listing date: 15 November 2021

If you’re using an older version of the Upstox app, read this.

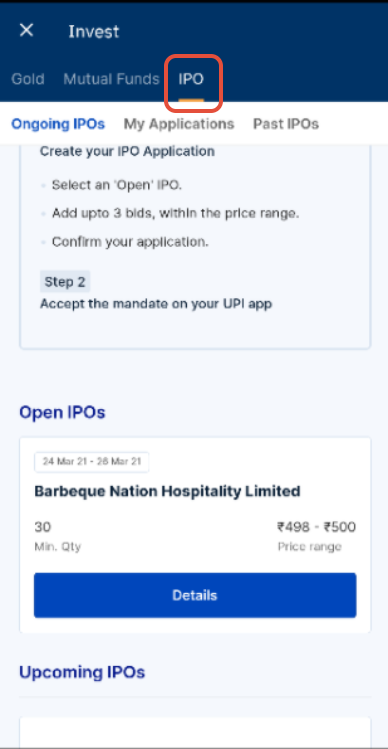

- Using Upstox App, click on the IPO section of the Invest tab.

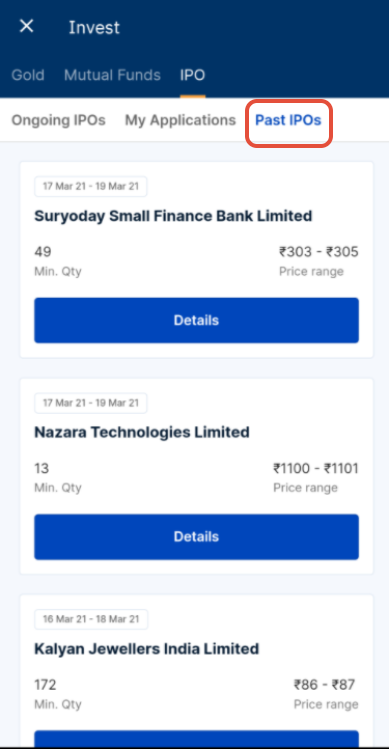

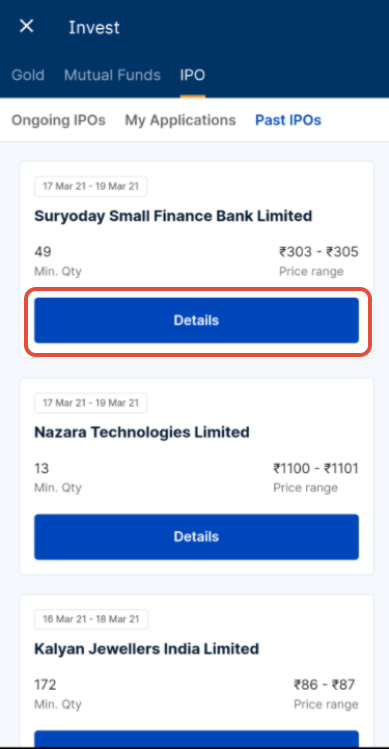

- Click on the ‘Past IPO’ tab.

- Click on the details of the IPO whose status you want to check.

- Scroll below to see the allotment dates.

On successful allocation, the shares will be credited in your demat account on 12 November 2021. If you don’t get the allotment for Sigachi Industries’ IPO then your money will be unblocked and you will be able to utilise it.

If you’re using the updated version of the Upstox app, read this.

Login to the Upstox app using your 6-digit Pin or Biometrics.

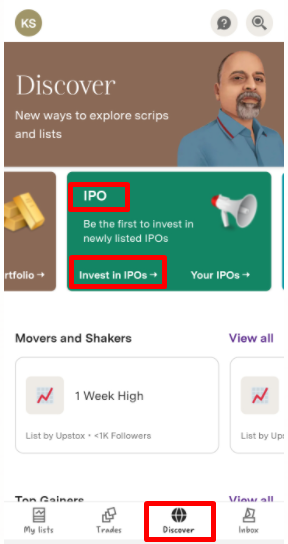

- Using Upstox App, click on the ‘Discover’ tab from the bottom navigation bar and click on ‘Invest in IPOs’ from the IPO section.

- Once you click on Invest in IPOs you will be directed to the invest.upstox.com where the IPO section has three categories

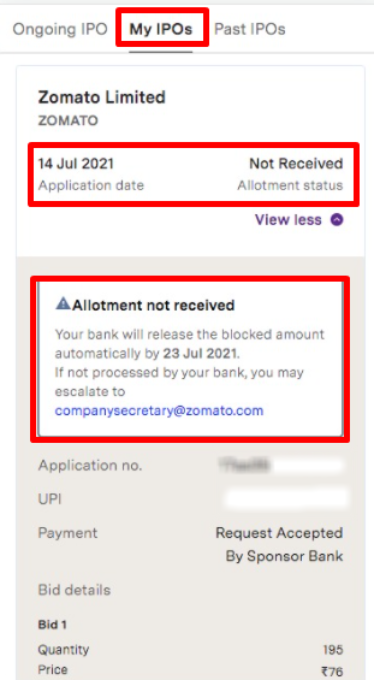

- Ongoing IPOs, My IPOs, and Past IPOs. So click on the ‘My IPOs’ tab here you will see your allotment status i.e. received or not received. Here you can click on view more and see details about the IPO.

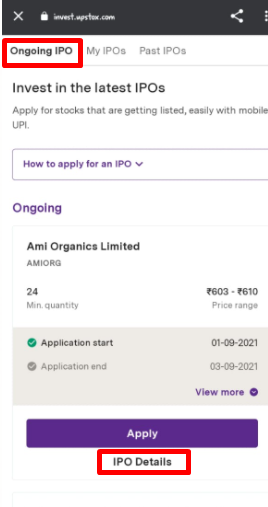

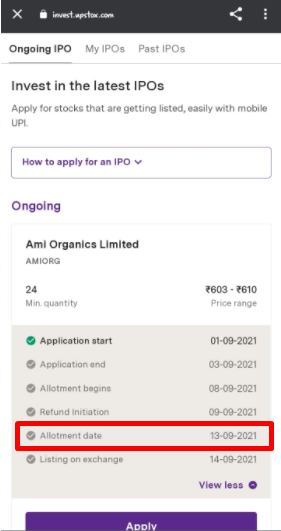

- To see the allotment dates click on Ongoing IPOs and under that IPO details. Here you will see the IPO timeline.

On successful allocation, the shares will be credited in your demat account on 12 November 2021. If you don’t get the allotment for Sigachi Industries’ IPO then your money will be unblocked and you will be able to utilise it.

Keep in mind: Certain banks may wait till the end date of mandate to complete revocation. You may raise a request with your bank to release funds anytime post allotment date in case you have not received an allotment of shares.

What happens if an IPO is oversubscribed?

Also, if the IPO is oversubscribed, the allocation of shares will be done through a lucky draw. And only a few investors will get their hands on the IPO.