Go Fashion IPO: All you need to know

Established in 2010, Go Fashion is a women’s bottom-wear brand in India that not only designs but also retails its products. In fact, the company claims that it is among the few apparel companies in India to have identified the market opportunity in women’s bottom-wear and have acted as a ‘category creator’ for bottom-wear. Its products are sold under the brand, ‘Go Colors’.

This apparel maker and retailer is now launching its public issue. Here’s all you need to know about this IPO

Offer detailsIPO Size:₹1,014 crore

Fresh Issue:₹125 crore O ffer for sale:**₹889 crore

Price band:₹655-₹690 per share

Fresh Issue:₹125 crore O ffer for sale:**₹889 crore

Price band:₹655-₹690 per share

IPO TimelineStart Date: 17 Nov 2021

End Date: 22 Nov 2021

Tentative Allotment Date: 25 Nov 2021

Tentative Refund Credit: 26 Nov 2021

**Tentative Share Credit in Demat:**29 Nov 2021

Expected Listing Date: 30 Nov 2021

End Date: 22 Nov 2021

Tentative Allotment Date: 25 Nov 2021

Tentative Refund Credit: 26 Nov 2021

**Tentative Share Credit in Demat:**29 Nov 2021

Expected Listing Date: 30 Nov 2021

Registrar Information (RTA)

Registrar Name – KFin Technologies Private Limited

Contact – Gayathri Venkatesan

Contact Number

Contact – Gayathri Venkatesan

Contact Number

- +91 44 4211 1777

Key Highlights

-

Go Fashion, under its brand ‘Go Colors’, was the first company to launch a brand exclusively dedicated to the women's bottom-wear category.

-

It held about 8% market share in the branded women’s bottom-wear market as on FY20.

-

The company has a universal portfolio with over 50 styles of bottom-wear in more than 120 colours. Go Colors has a network of 450+ exclusive brand outlets (EBOs) in 23 states and union territories in India. Further it also sells through 1,270 large format retail stores including Reliance Retail, Globus Stores and Spencer’s Retail, among others.

-

The company has sourcing and manufacturing network of 120 suppliers and job-workers across India.

-

Indian women’s apparel market was worth ₹1.6 lakh crore in 2020 and is expected to grow at a CAGR of 9.2% till 2025.

-

Further, the share of organized retail is expected to rise from 27% in 2020 to 42% in 2025 indicating bigger opportunity for organized players such as Go Fashion.

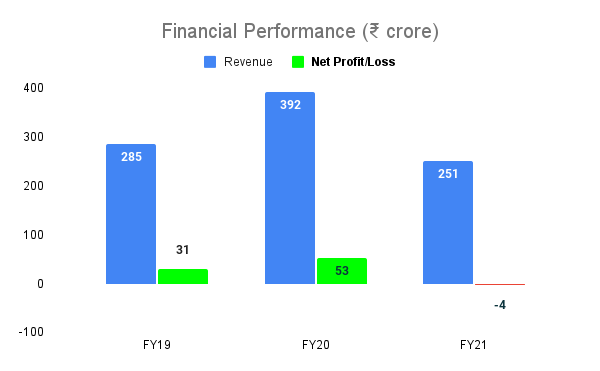

Financial Information

Here are the revenue and profit earned by Go Fashion (India) for the last three years:

The company’s performance in FY21 was impacted by the pandemic.

Strengths

-

Amongst its competitors, Go Fashions has amongst the highest number of SKUs in the women's bottom-wear category at 728 units thus providing the widest choice to its customers.

-

Its brand is present across retail formats viz. exclusive brand outlets, large store formats, multi-brand outlets and even online.

-

It has had amongst the fastest roll-out of EBO compared to its competitors. Its store count rose from 70 outlets in 2015 to 450 outlets 2021 indicating aggressive rollout and wider outreach.

-

The average selling price of Go Colors of about ₹ 600 per piece helps it cater across income segments and penetrate deeper in Tier 3 and 4 towns.

-

The company has implemented end-to-end automation for inventory operation. This has the company to avoid stock out and ensure sufficient supply at our stores. Further, the lack of seasonality in the company’s products helps it to tide over the risks of changing fashion trends.

-

Demonstrated strong track record of financial performance. In the FY20, the company’s ROCE was the highest among all major retail led women’s apparel brands in India

Risks

-

The company relies on a single brand and product strategy.

-

The continuing impact of the pandemic is one of the risks for the company. Go Fashion (India) had to shut down, both temporarily and permanently, many of its Go Color stores and kiosks at different locations.

-

The inability to expand or manage its network. For instance, current locations of its exclusive brand outlets may become unattractive, and suitable new locations may not be available at a reasonable price.

-

Its six trademarks are still pending for registration and a lack of protection could mean third-party infringement.

-

Fashion trends change rapidly. A sudden deviation in consumer preferences could make the business redundant.

-

Go Fashion does not own any manufacturing facilities and depends on suppliers and job workers to produce its products, a majority of whom are located in Tamil Nadu. Any disruption in their work could impact the output of the business.

-

Rapid growth of online retail players could impact the company’s business which is largely EBO dependent and also its pricing advantage.

Opportunities

-

While the overall women’s bottom-wear market is expected to grow at about 12%, organized market is expected to grow at a faster clip of 24% CAGR between 2020 and 2025.

-

The size of organized women bottom-wear market is expected to reach ₹9,200 crore by 2025

-

Leveraging its own online platform and e-commerce channels can help the company grow its customer base further.

How to apply

Select the IPO you want to apply for from the list of open issues. Enter your correct UPI ID and select the investor type. The quantity should be a multiple of the lot size. If you wish to apply at the cut-off price, simply click on the checkbox next to ‘Cut-off price’. You will receive an SMS from the NPCI confirming your bid and requesting you to accept the mandate on your UPI app. We have noticed a significant delay in UPI payment SMS/notifications from NPCI. Request you to be patient. Please ignore this message if you’ve accepted the mandate.

How to check your IPO allocation

Go Fashion allotment status will be available on or around 25 November 2021. The allotted shares will be credited to the demat account by 29 November 2021. We will provide you with the link to check the allocation’s status as soon as the registrar makes it live. This may happen after the IPO is closed (after 23 November 2021).