Emcure Pharma IPO: All you need to know

Founded in 1983, Emcure Pharmaceuticals manufactures and globally markets a wide variety of pharmaceutical products. It has filed its draft red herring prospectus (DRHP) with the Securities Exchange Board of India (SEBI) to raise funds through an IPO (initial public offering). The company is aiming to raise ₹4,000 crore through this IPO.

The Pune-based company is the 12th largest pharmaceutical company in India. As per the CRISIL report FY21, Emcure Pharmaceutical Limited is a leader (as per sales numbers) in three therapeutic areas: gynaecology, blood-related and HIV antivirals.

The company is acknowledged for its diverse product portfolio, including injectables, orals and biologics. The company also has a Messenger RNA (mRNA) platform, which is currently developing a COVID-19 vaccine.

With a globally diversified empire, including 19 subsidiaries, 500 scientists and 11,000 employees, the pharma giant IPO aims to encash the growing potential of the pharmaceutical sector.

Here is everything you should know about the Emcure Pharmaceuticals IPO:

Offer details

-

IPO Size: ₹4,000-₹5,000 crore

-

Fresh issue: ₹ 1,100 crore

-

Offer for sale: ₹ 1.82 crore

-

Dates: Not announced

-

Price band: Not announced

-

Lot size: Not announced

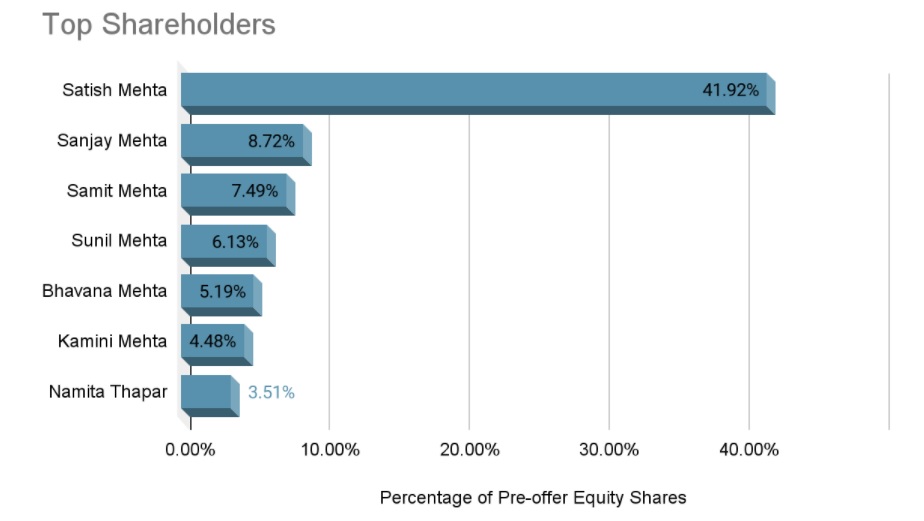

Reportedly, the offer for sale shares will include shares of existing shareholders, promoters, promoter group and other investors. Promoters, namely Satish Mehta and Sunil Mehta, who cumulatively currently own a 48.5% stake in the company, will sell 20.30 lakh and 2.5 lakh shares, respectively. Private equity investor Bain Capital, which holds a 13.09% stake in the company, will sell 99.5 lakh shares. Other shareholders are likely to sell 22 lakh shares.

The company shares will be listed at BSE (Bombay Stock Exchange) and NSE (National Stock Exchange).

Investor category-wise break-up

| QIB | NIB | Retail |

| --

| --

- | --

- | --

- |

| 50% | 15% | 35% |

Reasons for going public and objective of the IPO

Emcure Pharmaceutical aims to utilise its IPO proceeds for:

-

Repaying, either whole or part of the borrowings, which stood at ₹ 1,712 crore as of 31 March 2021.

-

General corporate purposes

Company fundamentals

If you are eyeing the Emcure Pharmaceutical Limited IPO, understand the company’s fundamentals:

Largest shareholders of Emcure

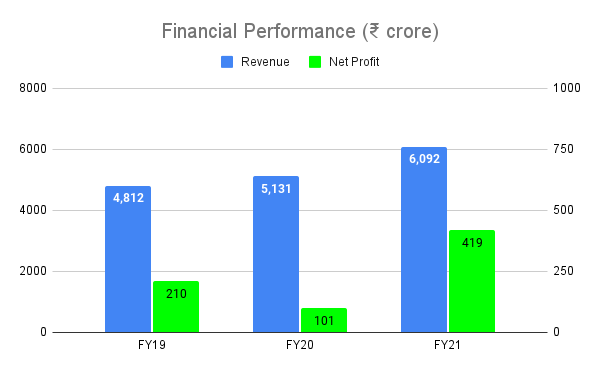

Financial information

The company has been profitable for the last three years: FY21, FY20 and FY19. Between FY19 and FY21, the net profit rose by a CAGR of 41%. The total revenue was up 12.5% during the same period.

Overview of business

Emcure Pharmaceuticals is one of the leading pharmaceutical companies in India. Since its inception in 1981, the company has targeted to provide quality healthcare solutions by leveraging advanced scientific strengths.

Emcure has a presence in over 70 countries, including India, Canada, and the US. The major therapeutic areas where the company develops, manufactures, and markets its pharmaceutical products are as follows:

-

Gynaecology

-

Neurology

-

Oncology

-

Cardiology

-

Blood-related

-

Pain management and analgesics

-

Oncology

-

Respiratory

-

HIV

Strengths

-

A broad range of pharmaceutical products with sales across the globe, including India

-

Global existence in over 70 countries with a robust foothold in Europe and Canada

-

Recognised and trusted name in the pharma sector with seven brands in the top 300 as per AIOCD

-

Intense research and development backed by a team of 500+ scientists

-

Sound financial position, including profitable growth over the last three years

-

Leader in therapeutic areas like oncology, blood-related and HIV

-

An established name in COVID care and post-COVID care products

-

Manufacturers of first India’s first homegrown mRNA vaccine (currently in the trial phase)

Industry outlook

Owing to the recent pandemic-induced focus on healthcare and related products, the pharmaceutical industry in India is booming. There is high investor interest, and companies have been deploying consistent efforts to ride on the sector boom.

Further, the sedentary lifestyle, growing threat of critical ailments, ageing population and new product launches have tremendously contributed to the growth of the pharmaceutical sector in India and across the globe.

Opportunities

-

The growing pharmaceutical sector can create opportunities for a differentiated product array.

-

Substantial investments in tech-driven projects can help the company to create a differentiated product portfolio in its target therapeutic areas.

-

An increase in drug usage and new drug discovery methods can prove fruitful for the company Emcure.

-

Demonstrated research and development capabilities coupled with a strong global presence will likely benefit the company to expand its revenue base and presence across more geographies.

-

Tailwinds to the API market and the much-hyped China plus one strategy (with India in focus) can benefit the leaders (such as Emcure) in the pharmaceutical sector.

Threats

-

Cut-throat competition from domestic and global pharma giants, such as Abbott India, Biocon Limited, Cipla, Dr Reddy’s Laboratories, Torrent Pharmaceuticals and Alkem Laboratories.

-

Multiple pharma companies (including Supriya Lifesciences, Vijaya Diagnostic Centre, and more) launching their IPO during the same time could hurt Emcure.

-

Change in healthcare regulations

-

Uncertainty clouding the treatment for different COVID-19 phases treatment could cause the failure of some COVID care and post-COVID care products.

Risks

-

With pharma stocks in the limelight since the pandemic and the BSE healthcare index ruling its all-time highs, a market correction can cause a financial setback.

-

Competitors like Windlas Biotech Limited, one of the leading pharma formulations contract development and manufacturer (CDMO), could potentially affect the company’s sales in the future.

-

Failure to thrive on innovation-driven growth could affect the company’s performance.

-

Consistently changing international pharmaceutical and related regulations could affect the company because a large share of the revenue is through sales in global markets.

With solid financials and interesting future product launches, Emcure Pharma IPO is a much-awaited one. However, with five other pharmaceutical companies launching their IPO this year, the competition in the stock market is likely to intensify.