This past week, there has been continued volatility as the Nifty traded down 1.36%. For many options traders, movement in the Nifty – whether up or down – is welcome as it presents an opportunity to earn a profit.

The most common option strategies are where traders either buy calls if they are bullish or buy puts if they are bearish. These are known as ‘directional strategies’. To break-even and earn a positive return on these strategies, the Nifty needs to move enough to cover the cost of these strategies. So, when the Nifty isn’t moving forward significantly, traders may find it difficult to break-even and trading volume dries up.

When the Nifty moves down and up drastically in a short period of time, the Nifty VIX rises. If the Nifty moves up and down but does so by drifting over a long period of time, the Nifty VIX won’t be impacted as much. As the VIX moves higher, the cost to purchase options increases. If options cost more to purchase, then the Nifty needs to move even more in order to earn a favorable return.

Before the pullback over the last few weeks, the Nifty had been at all-time highs. Market highs can result in profit taking by investors and traders leading to short-term drops in market prices. However, it can be difficult to know when this profit taking will occur and there could be period’s type of continued market highs.

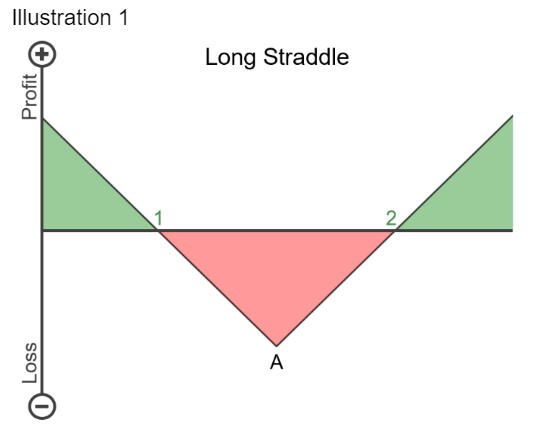

If an options trader is uncertain of the direction of the market or individual stock, they can place a ‘non-directional strategy’ like a straddle. A straddle is the simultaneous purchase of a call and put option with the same strike price and expiration date. A straddle is profitable for a trader if the underlying’s price moves significantly rather than staying flat. The more the underlying’s price moves, the greater the profit. A straddle is a debit strategy; a trader has to pay upfront to enter into the position. The drawback to this strategy is that you are buying both a call and a put so you are paying two premiums. In the diagram below, we plot the payoff diagram of a long straddle. This diagram shows a straddle centered on the strike price of ‘A’. The break-even points are above and below and denoted as ‘1’ and ‘2’. The first break-even point is the cost of the straddle minus the strike price. The second break-even point is the cost of the straddle plus the strike price.

Since straddles can be costly to purchase, the best opportunity is when volatility is lower – this is because if volatility is lower, then the options will be cheaper. The caveat is that you have to have an expectation that volatility will increase because if it doesn’t, then the underlying may not move enough to be profitable.

Now let’s think about the current market situation. While the market became volatile over the last month with the Nifty VIX rising to 14.82, the VIX is still relatively low. For reference, this is where the VIX has been over the last year.

| Friday (6 Jan) | 1 Week Ago | 1 Month Ago | 6 Months Ago | 1 Year Ago | |

| Nifty VIX | 14.82 | 14.87 | 14.08 | 18.37 | 17.60 |

With the VIX still low, straddles are relatively inexpensive. Straddles that expire at the end of the month with a strike price of 17850 would cost ₹440.05. To be profitable, the Nifty needs to drop to 17963 (-2.5%) or rise to 18290.05 (+2.5%). By comparison, a similar straddle purchased 6 months ago would have cost you ₹607.00. In order to break-even with a straddle purchase at this time, the Nifty would have needed to move +/- 3.8%.

There could be continued uncertainty as to the direction of the market. Historically, volatility is still low leading to relatively inexpensive options. With options being cheaper, it could present a trader opportunity to make bets on upcoming market movements.