Debut stocks steal the show as markets storm to new highs

NIFTY50 crossed the 20,000 mark for the first time since September and closed the week at 20,267.

-

Market cap of Adani Group stocks surged over ₹1 lakh crore in a single trading session on November 28.

-

BSE-listed companies surpassed $4 trillion market capitalisation for the first time.Tata Technologies shares surged 180% on the first day of trade on November 29.

Hello, we are back again with another wrap of the financial markets through an eventful week.

The stock markets rallied to new highs this week amid a positive sentiment fuelled by multiple domestic and global factors. With a stellar debut of Tata Technologies and IREDA, investors could have not asked for more in a bullish market.

Key benchmark indices surged to lifetime highs. The NIFTY50 crossed the 20,000 mark for the first time since September and hit its all-time high on Friday.

Overall, NIFTY50 soared nearly 400 points, or 2.3%, this week.

NIFTY50's journey in recent months

| Rally in 2023 | Closing |

| --

| --

- | --

- |

| December 1 | 20,267 |

| September 15 | 20,222 |

| July 19 | 19,829 |

The benchmark Sensex also piled on gains to approach its lifetime high levels. It rallied more than 1,500 points to touch an 11-week high at Friday’s close.

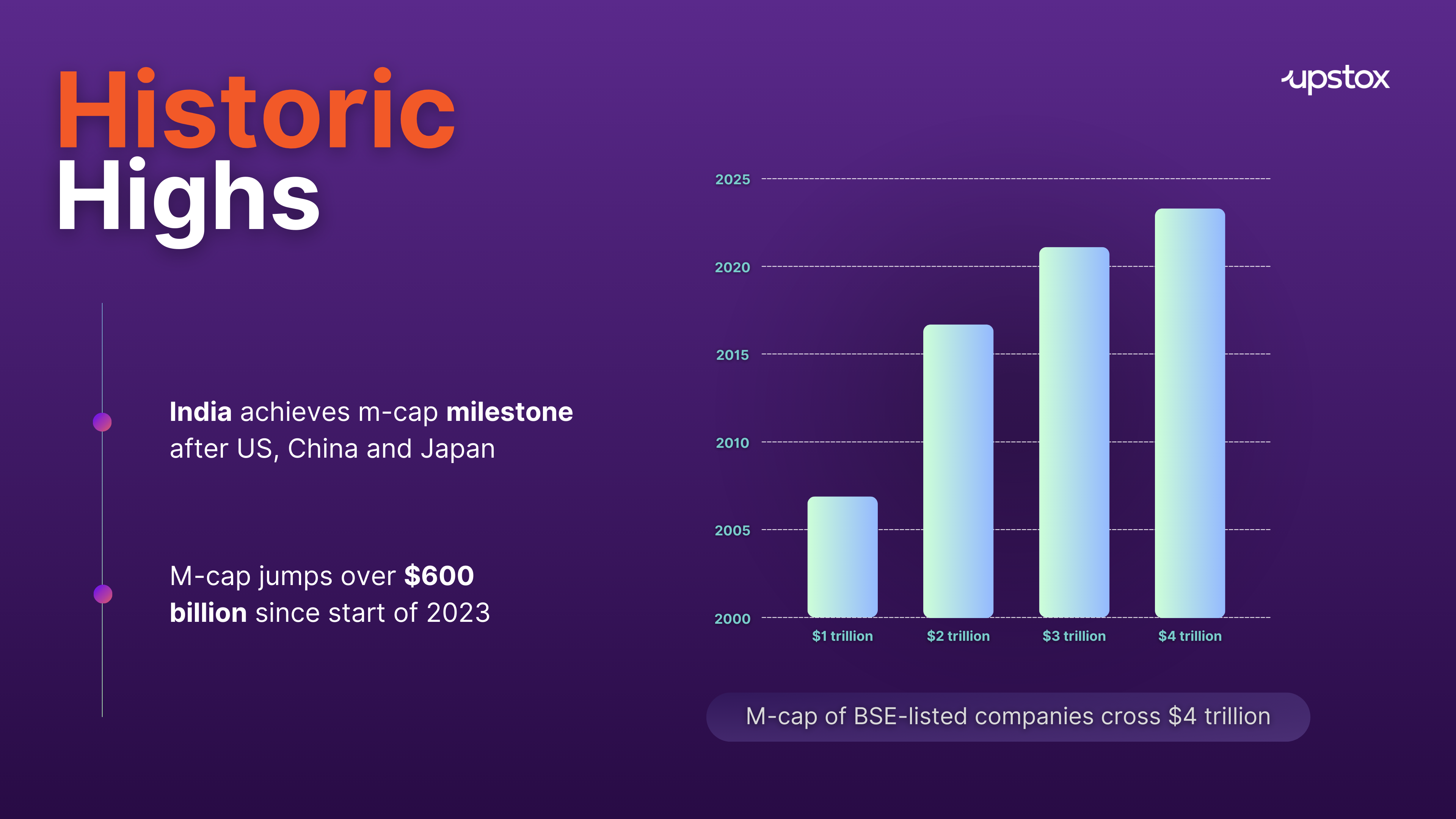

The week also saw a remarkable feat by the Indian stocks with the combined market capitalisation of BSE-listed companies surpassing $4 trillion for the first time ever.

What propelled the stock market rally?

Listing of new IPOs such as Tata Technologies and IREDA as well as relief upswing in Adani Group stocks helped stocks reach record valuations.

Easing concerns about interest rates, fuelled by dovish remarks from the US Federal Reserve, also played a significant role. US bond yields retreated after reaching multi-year highs, attracting foreign portfolio investors (FPIs) back to emerging markets.

FPI buying was a major catalyst for the market rally. Expectations of further FPI inflows propelled index heavyweights such as ICICI Bank, Reliance Industries, HDFC Bank and TCS higher.

GDP numbers raise hopes

Besides, domestic growth factors also did not disappoint. The Indian economy grew by 7.6% in the July-September quarter, raising hopes of beating the RBI growth estimate of 6.5% for the entire fiscal.

BSE companies scale $4 trillion milestone

Fuelled by a surge in equity prices, the total market value of companies listed on the BSE surpassed $4 trillion mark on November 29 for the first time.

This year, the Sensex has gained nearly 11% while the market capitalisation of all listed firms on the exchange has increased by around ₹50.81 lakh crore.

The m-cap gains this year are primarily due to a rise in mid-cap and small-cap stocks in the broader market. Stocks outside the top 100 now account for 40% of the country's market cap, up from 35% at the start of FY24.

Tata Tech, IREDA listings fire up market rally

Besides a rally in the broader market, premium listing of companies such as Tata Technologies and IREDA also uplifted the market sentiment.

After a superb IPO, Tata Technologies shares zoomed 180% on the first day of trade on November 29, making it the most successful listing of the year.

Indian Renewable Energy Development Agency (IREDA) also made a remarkable stock market debut on the same day. It ended with a premium of 87.5% against the issue price of ₹32.

Gandhar Oil Refinery (India) Ltd followed suit and was listed with a bang on November 30. It rallied more than 78% on the first day against the issue price of ₹169.

Adani Group shares zoom

A resurgence in Adani Group's share prices contributed to the positive sentiment.

The collective market capitalisation of Adani Group stocks witnessed a surge of more than ₹1 lakh crore in a single trading session on November 28.

The market capitalisation of Adani Group stocks climbed to nearly ₹11.31 lakh crore on Tuesday from around ₹10.27 lakh crore in the preceding session.

The week ahead

Amid the bullish scenario, experts advise caution. The Assembly election results in Madhya Pradesh, Rajasthan, Telangana, Chhattisgarh and Mizoram on Sunday could affect the market sentiment.