Identifying trends

Written by Upstox Desk

Published on October 01, 2025 | 6 min read

A common way to identify Stock Market trends is by using trendlines that connect a series of highs (uptrend) & lows (downtrend). Wondering how to use trendlines and when you should initiate a buy? Watch our engaging and easy-to-understand video from the #LearnWithUpstox series to find out.

Welcome back to a new blog of ‘Learn with Upstox’. Today, we will learn about Trend Lines. Trend lines is a tool that helps you identify trends. But first, what do you mean by trends?

There are 3 types of trends:

- Uptrend

- Downtrend

- Sideways trend

In this blog, we won’t talk about Sideways trends, instead we will concentrate on the other two. In theory, the uptrend market goes upwards, but when should you buy? Downtrend market goes down, so when should you short sell? Let’s find out, using Trend Lines.

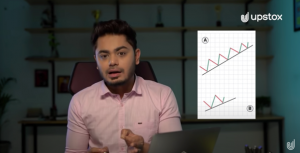

Let me ask you a question. There is one trend line named A and another named B. Both are uptrends. A has been touched at five points and B has two touch points of price and you have joined the line between the two touch points. Whenever the price is at a touchpoint with the trend line, you should initiate buy. This is very simple, no rocket science. So, you tell me which is better, A or B?

I know that most people would say A because the price has touched the trend line multiple times. This isn’t wrong, but wouldn’t you want the buy in before the trend line is already hit multiple times? Maybe at the third, fourth or fifth time. What happens is, if a trend line is touched multiple times, the trend line starts becoming weak. Yes, this is very practical, every time the point touches the trend line, it becomes weaker and the chances of it breaking are higher. Now, you would say that if the trend line breaks, I will short sell. Yes, you can short, but there is a trick that you will read about further down the blog.

The correct answer is, for a trader, short-term or mid-term, B is the better option. This is because, you will get an opportunity to buy when it touches the line the third time. A long-standing trend line can be detected by anyone, but the real deal is to identify it when it is still forming. Let me tell you a simple way to do this. When you see the price, you see the two points where it’s hitting, before it heads upwards again. Draw a line connecting these two points. An important question I get here is, do we connect it to the wicks or the body?

Let’s consider the two charts. One has a five-minute timeframe and the other has a one-day timeframe. Who looks at the one-day time frame? The one-day time frame is for a Swing trader or a Positional trader. An Intraday trader looks at the chart with a five-minute timeframe.

Looking at the chart below, you will see a point A and a point B. Now you will notice, we have used wick at point A and not body. The deal is, it is up to you. As you draw the line, sometimes you will have wick after wick, sometimes wick after body or vice versa and sometimes body after body. It could be anything once the line has been drawn.

Look at what seems to be the most logical. You will notice in our chart, that point B is touching the body while point C is wick again. In this trend line, we have only three hits. So, when the fourth one hits the line is when I would initiate the buy.

Now, looking at the daily timeframe given above, you’ll notice how much bigger it is than the five-minute one. Here you will see the downtrend forming from point A through B, C up till D. All these points show resistance. However, after point D, there is an upward charge, which we call breakout. As there is a breakout, the trend has changed. Our stock has gone into an aggressive uptrend. Every time there is a breakout, the trend will change, which is why these are called trend lines. Let’s look at Point E and F, from the trends earlier in the day. As soon as there is a breakout, the trend shifts to uptrend. You will notice the same thing at point G and H. When the stock becomes a bullish engulfing candle, a powerful candle, our downtrend ends and a strong uptrend begins.

Our last example, look at point I and J. When connected, this uptrend has a breakthrough as it continues. The breakthrough does take the stock price lower, but doesn’t turn the trend completely to the opposite downtrend. This is the most common occurrence in trend lines. This is called a retest. After breaking a trend line, the price generally moves back towards the trend line. To understand this better, let’s look at the horizontal line. If the market heads up to the trend line, it breaks through, instead of heading upwards consistently, it comes back down to test this level before heading into another upward climb. The same is true for trend lines.

Looking at the chart again, we see the breakthrough, the retest, and then the market stars falling. The horizontal line here tells you where to initiate your trade. The chart below is more zoomed in. After the first breakthrough, should one always wait for the retest? The answer to this question is – a Swing trader must always look out for the retest, and the retest should pass and not fail because sometimes after the retest, the stock may find support again and rise and this can mean loss whereas Intraday traders, playing on a shorter time frame shouldn’t wait because on a smaller time frame, it is possible to move .5% or 1%. But, you will notice that a daily timeline will not fall 5 – 7%. It is not possible. So, a daily trader should always wait for the retest, while an Intraday trader should move fast.

Similarly, in a downward trend, the price will touch, then breakout, an Intraday trader should make his move, while a Swing trader should wait for a retest before buying.

So, to conclude, a trend line is a technical tool that when connected from a lower price to a higher price shows an uptrend. Every time the price touches the line, we initiate a buy. When there is a breakout, an Intraday day trader should short sell immediately, whereas, hourly, daily or even weekly traders should wait for the retest because a market almost always moves in a zigzag pattern. You can short it post the retest and increase the possibility of success.

Hence, trend line is an important tool in technical analysis, which helps in finding support-resistance level. So, do your homework. My suggestion is, open a fifteen-minute timeframe, an hour timeframe and one-day timeframe. Do this for varied stocks on varied days, make trendlines, study them. It will definitely help forming informed choices when it comes to your stocks.

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.