What is a Short combination?

Written by Upstox Desk

Published on July 31, 2025 | 5 min read

The short combination option strategy is a two-legged option strategy which is deployed when the trader has a bearish outlook on the markets or on a particular underlying. This strategy is also known as a synthetic short strategy as it replicates a payoff similar to that of shorting the underlying asset. Although traders deploy this strategy instead of shorting the share in the cash market as the margin requirement is lower.

This strategy is easy to deploy as it involves buying an At-the-money put option and selling an At-the-money call option; having the same expiry and underlying asset.

However, some traders prefer to deploy this strategy using two different Out-of-the-money strikes.

The trader must remain vigilant when deploying this strategy as the loss potential is unlimited. The capital outlay of this spread is considerably economical as the premium earned from short call option position is used to subsidize the buying cost of the long put option position.

If the premium earned from the short call option position is more than the buying cost of the long put option position, the result is a net credit.

In these situations, the break-even point = strike price + net credit.

If the premium earned from the short call option position is less than the buying cost of the long put option position, the result is a net debit.

In these situations, the break-even point = strike price - net debit.

If either position is In-the-money at expiry, this will result in a short position. However the assignment risk associated with it lies with the short call option position, when it expires in-the-money.

Let's gain a better understanding of this with the help of an illustration:

The Nifty50 is at 18,000. The short combination option strategy is deployed by taking a short position in At-the-Money call option (strike price 18,000) for ₹87 and a long position in At-the-Money put option (strike price 18,000) for ₹107.

Strategy | Index | Action | Strike | Premium (₹) |

Short combination strategy | Nifty50 | Buy Put | 18,000 | -107 |

| Sell Call | 18,000 | 87 | ||

Net debit | 20 |

The spread generates a net debit and outflow of premium amounting to ₹20.

Break-even point = strike price - net debit =18,000 - 20 = 17,980.

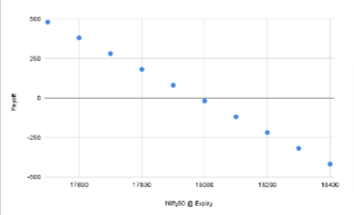

Payoff Schedule

Nifty50 @ Expiry | Net Payoff (₹) |

17,500 | 480 |

17,600 | 380 |

| 17,700 | 280 |

| 17,800 | 180 |

17,900 | 80 |

| 18,000 | -20 |

18,100 | -120 |

| 18,200 | -220 |

18,300 | -320 |

| 18,400 | -420 |

Payoff Chart

Scenario 1: Nifty50 expires at 17,500.

Here, Nifty50 is trading below the break-even point so the trade will be profitable. The short call position is Out-of-the-money and thus, has no intrinsic value whereas the long put position is In-the-money and has an intrinsic value of ₹500.

Profit = (break-even point - underlying price) x lot size = (17,980 - 17,500) x 50 = ₹24,000.

Therefore, the profit earned is ₹24,000.

Scenario 2: Nifty50 expires at 17,980.

Here, Nifty50 is trading at the break-even point so the trade will result in a no profit, no loss scenario. The short call position is just Out-of-the-money and thus has no intrinsic value whereas the long put position is In-the-money and has an intrinsic value of ₹20 which is used to recover the net debit.

Scenario 3: Nifty50 expires at 18,400.

Here, Nifty50 is trading above the break-even point so the trade will not be profitable and in fact, result in a loss. The short call position is In-the-money and thus, has an intrinsic value of ₹500 whereas the long put position is Out-of-the-money and has no intrinsic value.

Loss = (underlying price - break-even point) x lot size = (18400 - 17980) x 50 = ₹21,000. Therefore, the loss incurred is ₹21,000.

Conclusion

- As explained earlier, short combination strategy is an option strategy with a bearish outlook. The outcome leading to the decline in the price of the underlying can result in profit and in case of rise in prices, can result in loss.

- In this strategy, the short call option position can partly or fully cover the cost of the long put option. This invariably leads to reduction in cost of deploying the strategy.

- The strategy is easy to deploy but as one of the legs involves selling or writing options, it is important to exercise utmost caution while trading in this strategy.

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.