What is a Diagonal Spread and How does it work

Written by Upstox Desk

Published on July 31, 2025 | 5 min read

A diagonal spread is a hybrid of a bull call spread or a bear put spread, combined with a calendar spread. The spread is known as diagonal spread as it combines to extreme points of two different strategies. The other pausible opinion about the naming of option strategy emerges from the fact that option chains are listed in columns and traders punching the orders would move diagonally between the two extreme columns, and therefore the name.

There are 4 types of diagonal spreads viz:;

- Diagonal Bull Call spread

- Diagonal Bear Call spread

- Diagonal Bull Put spread

- Diagonal Bear Put spread

Illustration

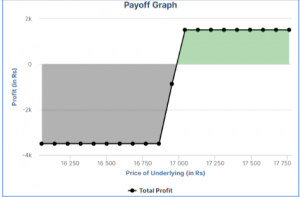

Diagonal Bull Call Spread

A diagonal bull call spread is initiated by selling an At-the-money call option in the near month and buying an In-the-Money call option in the next month. The spread is to be deployed when the outlook for the market is generally bullish, as the name implies. The Nifty50 is trading at 16,950.

Strategy | Index | Expiry | Action | Strike | Premium |

| Diagonal Bull Call spread | Nifty50 | 06 Oct 2022 | Sell Call | 17,000 (strike 1) | 202 |

| 27 Oct 2022 | Buy Call | 16,900 (strike 2) | -272 | ||

| Net Premium | -70 |

The spread incurs a debit, resulting in net premium payment of ₹ 70.

Breakeven point = strike 1 - net premium paid = 17,000 - 70 = 16,930

Limited loss = net premium paid * lot size = 70 * 50 = ₹ 3,500

Limited profit = (strike 1 - strike 2) - net premium paid * lot size = (100 - 70) * 50 = ₹ 1,500

The spread achieves limited profit when the price is above the short call option strike.

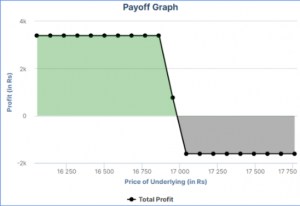

Diagonal Bear Put Spread

A diagonal bear put spread is deployed by buying the next month At-the-money put option and selling the near month Out-of-the-money put option. Just like Diagonal bull call spread, this spread also incurs a debit resulting in the premium outflow. As the name suggests, the spread is bearish in nature. The Nifty50 is currently trading at 16,950.

| Strategy | Index | Expiry | Action | Strike | Premium |

| Diagonal Bear Put spread | Nifty50 | 27 Oct 2022 | Buy Put | 17,000 (strike 1) | 118 |

| 06 Oct 2022 | Sell Put | 16,900 (strike 2) | -86 | ||

| Net Premium | 32 |

The spread incurs a net premium outflow of ₹ 32.

Breakeven Point = Strike 1 - net premium paid = 17,000 - 32 = 16,968

Limited profit = (Spread - net premium paid) * lot size = (100 - 32) * 50 = ₹ 3,400

Limited loss = net premium paid * lot size = 32 * 50 = ₹ 1,600

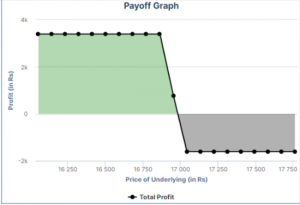

Diagonal Bear Call Spread The diagonal bear call spread, is another variation of diagonal call spreads. This is a spread created to earn credit i.e. it generates an upfront income in the form of premium received. The spread is deployed by selling a near term At-the-Money call option and buying the next month Out-of-the-Money call option. The Nifty50 is currently trading at 16,950.

| Strategy | Index | Expiry | Action | Strike | Premium |

| Diagonal Bear Call spread | Nifty50 | 06 Oct 2022 | Sell Call | 16,900 (strike 1) | 202 |

| 27 Oct 2022 | Buy Call | 17,000 (strike 2) | -144 | ||

| Net Premium | 58 |

The spread results in net inflow of premium of ₹ 58.

Breakeven point = strike 2 - net premium received = 17,100 - 58 = 17,042

Limited Profit = net premium received * lot size = 58 * 50 = ₹ 2,900

Limited Loss = (Spread - net premium received) * lot size = (100 - 58) * 50 = ₹ 2,100

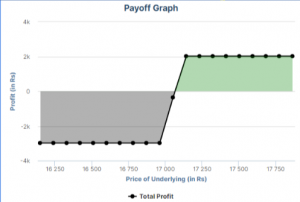

Diagonal Bull Put Spread The diagonal bull put spread is an option strategy with bullish outlook and is often deployed to generate net credit. The spread is initiated by selling near term In-the-Money put options and buying next month Out-of-the-Money put options. The Nifty50 is currently trading at 16,950.

| Strategy | Index | Expiry | Action | Strike | Premium |

| Diagonal Bull Put spread | Nifty50 | 06 Oct 2022 | Sell Put | 17,100 (strike 1) | 158 |

| 27 Oct 2022 | Buy Put | 17,000 (strike 2) | -118 | ||

| Net Premium | 40 |

The spread generates a credit and results in net premium inflow of ₹ 40.

Breakeven point = Strike 1 - net premium received = 17,100 - 40 = 17,060

Limited profit = net premium received * lot size = 40 * 50 = ₹ 2,000

Limited loss = (spread - net premium received) * lot size = (100 - 40) * 50 = ₹ 3,000

Conclusion:

- The diagonal option spread strategy may be easy to execute but tends to be very difficult in managing. The short option position shall always be vulnerable to sudden rise in implied volatility.

- But since this is a risk defined strategy, the drawdown and limits are already known.

- The strategy is not direction neutral therefore traders can take advantage of playing under a stronger trend by setting up credit spreads to minimize the cost of capital

- The credit spread generated is mostly due to selling of At-the-Money options, which have the highest extrinsic value. Therefore it is advisable to assume short positions in near month expiry.

- The spread can be deployed in any time series i.e. it can be between near and far month or near and next months. Also as portrayed in examples above the trades can be structures between weekly and monthly experies as well.

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.