Long Call Condor Option Strategy

Written by Upstox Desk

Published on July 31, 2025 | 5 min read

The Long Call Condor is a multi-leg option strategy that is neutral on market direction but bearish on volatility. Since it is a risk defined strategy, the profit and loss are limited. The strategy resembles the long butterfly strategy, except that the pair of sold options are not the same strike but are two different strikes. The spread is created by taking a long position in the call option on lower strike, selling one call option on lower middle strike, selling call option on higher middle strike and buying a call option on the higher strike.

Basically, there are four different strikes and involves buying and selling of put and call options. It is important to remember that the options are based on the same underlying and have the same expiration date. In terms of moneyness of strikes, the spread is initiated by selling ITM and OTM call options and buying further ITM and OTM call options.

Illustration:

The Nifty is currently trading at 18,050.

Strategy | Index | Action | Strike | Premium (₹) |

Long Call Condor | Nifty50 | Buy call | 17,900 (strike 1) | -220 |

Sell Call | 18,000 (strike 2) | 140 | ||

| Sell Call | 18,100 (strike 3) | 85 | ||

| Buy Call | 18,200 (strike 4) | -45 | ||

| Net Premium | -40 |

This is a debit spread as there is a net premium outflow of ₹40. The spread is able to achieve maximum profit when the prices trade between the pair of sold call options. The maximum loss is limited to the premium paid. Just like Butterfly Option Spread, this strategy also comes with two breakeven points.

Lower breakeven point = (Strike 1 + net premium paid) = 17,900 + 40 = 17,940 Upper breakeven point = (Strike 4 – net premium paid) = 18,200 – 40 = 18,160

Max potential loss = (Net premium paid * lot size) = ₹40 * 50 = ₹2,000

Max potential profit = (Strike 2 – Strike 1 – net premium paid) * lot size = (18,000 – 17,900 – ₹40) * 50 = ₹60 * 50 = ₹3,000

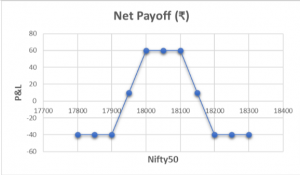

Payoff Schedule

Nifty50 @ Expiry | Net Payoff (₹) |

17800 | -40 |

17850 | -40 |

| 17900 | -40 |

17950 | 10 |

18000 | 60 |

| 18050 | 60 |

18100 | 60 |

| 18150 | 10 |

| 18200 | -40 |

| 18250 | -40 |

| 18300 | -40 |

Payoff chart

Impact of Greeks

- Theta is positive for this strategy; it is at its highest point when spread is between two middle strikes.

- Delta is near zero at initiation, it doesn’t increase or decrease much even when the price moves outside middle strikes because of the way spread is structured.

- Gamma is negative and the slow Delta keeps it that way, it only spikes a bit when options spread moves beyond breakeven point.

Vega is negative and at its lowest point when the spread is between the middle strikes. When implied volatility increases, Vega expands and hurts the profitable position. When Vega turns positive the spread incurs loss.

Conclusion:

- A Long Call Condor is a range bound strategy, wherein the trader would expect the price of underlying security to consolidate between two middle strikes.

- Any increase in time till expiry directly correlates to increase in implied volatility and thereby adds momentum to prices. The spread is explicitly designed to take advantage of decrease in implied volatility.

- It is not necessary to hold the strikes at equal spacing. Depending on the market momentum or directional bias of the trader, the spread between short call options or between long and short call options can be altered.

- Maximum profit occurs when the prices consolidate between two sold call option strikes. Losses occur when the prices breach lower or upper barriers. In both the scenarios, the loss is limited to the extent of premium paid upfront during the initiation of the options strategy.

- Compared to Long Butterfly spread, the profit zone of Long Call Condor is much wider and provides valuable breathing space to the spread.

- Because the strategy involves selling two options, the SPAN margin deployment will be higher.

- The payoff is very similar to Short Iron Condor.

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.