- Home/

- IPO

1.59x

subscribed

Pace Digitek IPO

1.59x

subscribed

Pace Digitek Limited IPO Details

Pace Digitek Limited IPO Overview

Pace Digitek IPO date

Pace Digitek Ltd. IPO will open for subscription on September 26, 2025, and the closing date for the IPO is September 30, 2025. After this, investors are expected to be updated about the allotment status on October 01, 2025.

Investors who have been allotted shares can expect them to be credited to their demat account on October 03, 2025. The shares will be listed on the NSE and the BSE on Monday, October 06, 2025.

Pace Digitek IPO price band

The IPO includes a fresh issue. The IPO price band has been set between ₹208 to ₹219 per share. Interested investors can choose a price within this band to apply for the IPO.

The IPO is a book-building issue, comprising an issue of ₹819.15 crore.

Pace Digitek IPO listing price will be determined on October 06, 2025. The listing price is the price at which a company’s shares debut on the stock exchanges.

Pace Digitek IPO lot size

Pace Digitek Ltd. IPO details have been declared. The minimum lot size for an application is 68 shares, and the investor would have to apply for a minimum of 1 lot. Meanwhile, the IPO issue size is approximately ₹819.15 crore.

Checklist

Compare

Companies in this sectorObjectives

Strength and Weakness

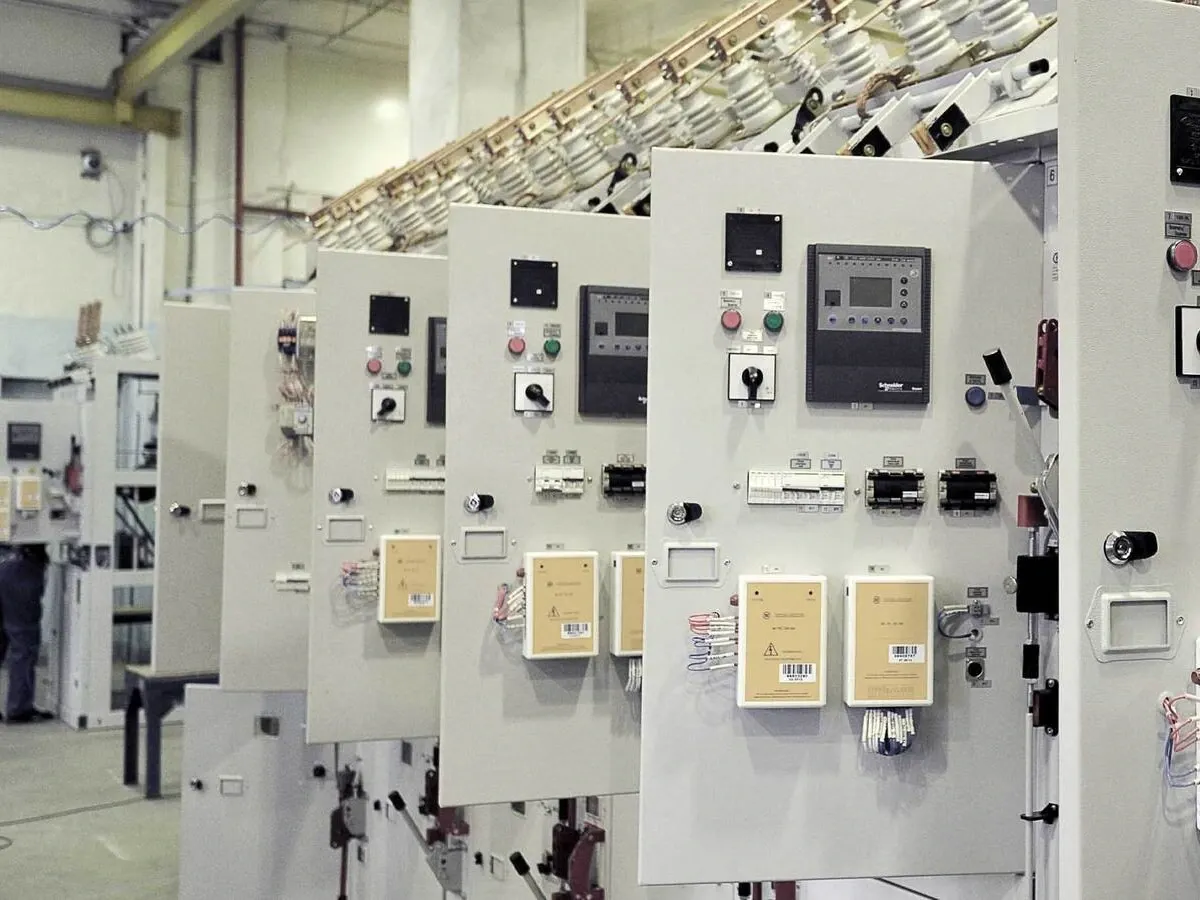

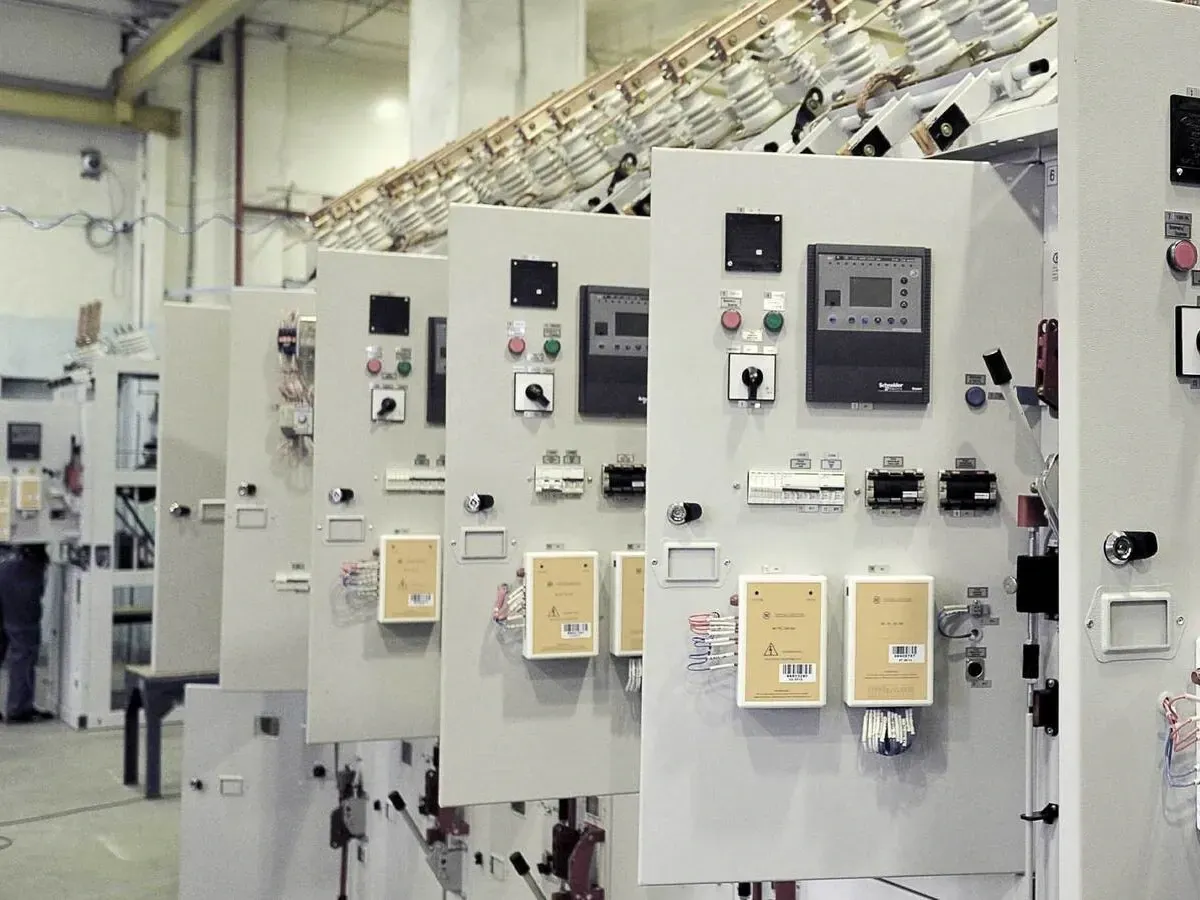

It delivers fully integrated solutions in the telecom tower sector, handling everything from manufacturing and supplying power management systems. Its product division manufactures power management solutions such as SMPS, intelligent power management units (IPMU), integrated power management systems (IPMS), and battery and power cabinets.

As of March 31, 2025, the company's strong and diverse order book totalled ₹7,633.6 crore across verticals, with major contributions from telecom towers (₹3,570.00 crore), energy projects (₹4,063.6 crore), and ICT, reflecting robust demand and business diversification.

Over the years, the company has expanded the telecom Infra operations to comprise products, projects, O&M, services and solutions. With the acquisition of the business of GE Power Electronics India and rights over the ‘Lineage Power’ brand in FY14, the company commenced ‘end-to-end’ manufacturing of direct current systems, which are tailored for telecom tower companies and operators and has helped it enhance its market position in the energy management solutions.

It operates three advanced manufacturing facilities in Bengaluru through its subsidiary Lineage Power Private Limited, covering telecom passive infrastructure, lithium-ion battery systems, and battery energy storage systems (BESS). The newest BESS plant in Bidadi has an annual production capacity of 2.5 GWh, extendable to another 2.5 GWh, featuring a fully automated cell-to-pack assembly line that supports energy storage from renewables with high efficiency. These facilities span 200,000 sq. ft. and hold multiple certifications.

About Pace Digitek Limited

IPO Analysis