- Home/

- IPO

374.47x

subscribed

Modern Diagnostic & Research Centre

Hospital & Healthcare Services

listed

374.47x

subscribed

₹2.72LMin. investment

Modern Diagnostic & Research Centre IPO Details

Issue size

₹37Cr

IPO type

SME

Market Cap

₹135.89CrLower than sector avg

Price range

₹85.00 – ₹90.00

Listing ExchangeBSE

RevenueApr 2024 - Mar 2025

₹77.94CrLower than sector avg

Lot size

1600 shares

Draft Red Herring Prospectus

Read

Growth rate3Y CAGR

17.69%

SectorHospital & Healthcare Services

Price range₹85.00 – ₹90.00

IPO type

SME

Lot size1600 shares

Issue size₹37Cr

Draft Red Herring Prospectus

Read

Market Cap

₹135.89CrLower than sector avg

RevenueApr 2024 - Mar 2025

₹77.94CrLower than sector avg

Growth rate3Y CAGR

17.69%

Checklist

Quality analysis

Revenue growth

Company valuation

Earnings expansion

Risk analysis

Debt to Equity ratio

Promoter holdings

Shares pledged

The investment checklist helps you understand a company's financial

health at a glance and identify quality investment opportunities easily

Compare

Companies in this sectorObjectives

Capital expenditure

55.80%

Working capital

21.60%

General corporate purposes

19.90%

Repayment of borrowings

2.70%

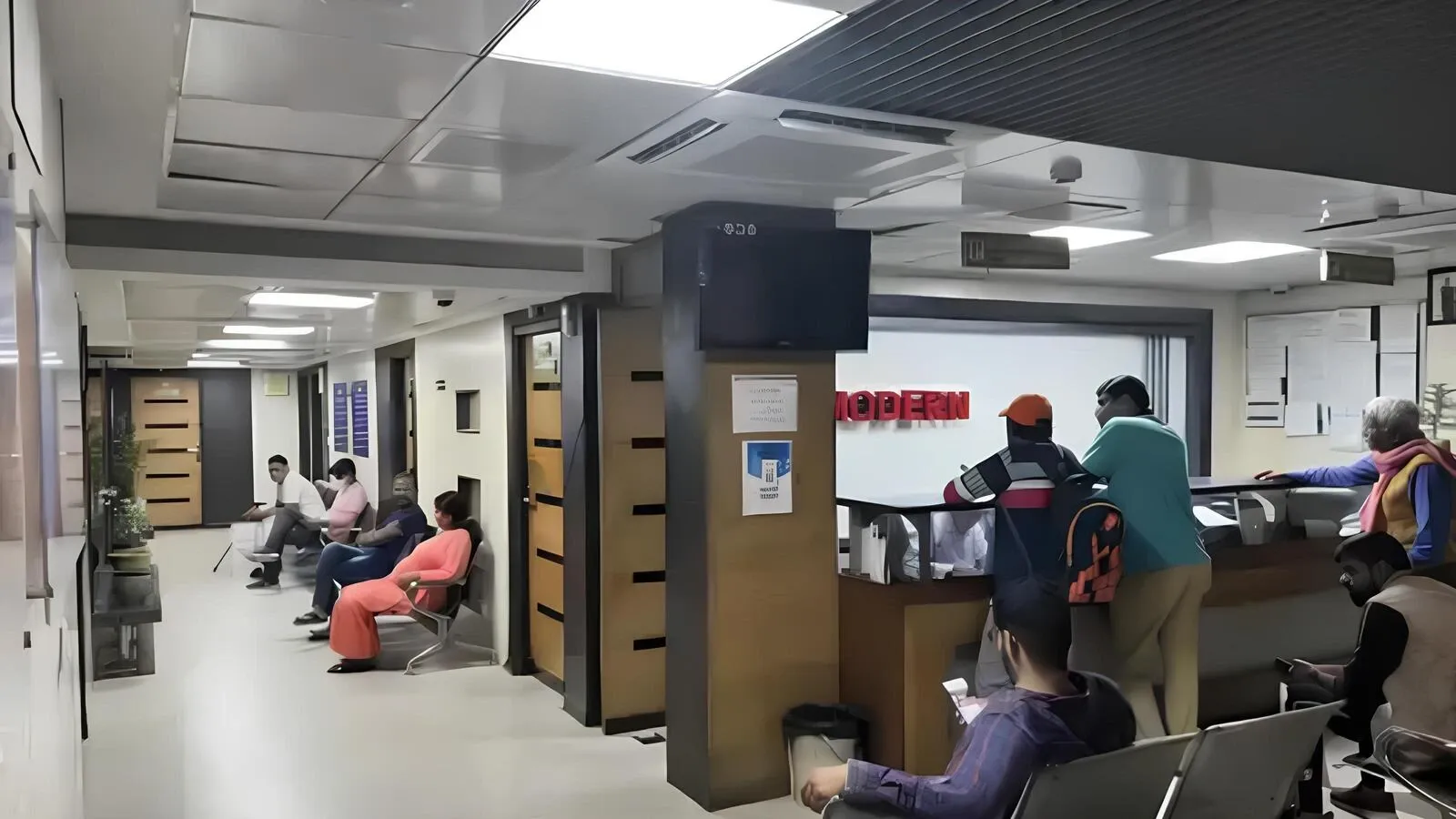

About Modern Diagnostic & Research Centre

Modern Diagnostic & Research Centre is a service provider in diagnostic and related healthcare tests in India. The company delivers diagnostic services that include core testing, disease diagnosis, prevention, and monitoring for individual patients, hospitals, healthcare providers, and corporate clients. The company offers services through pathology and clinical laboratories, as well as imaging services like ultrasound, colour Doppler, CT scan, MRI scan, digital X-ray, mammography, ECG, PFT, and other specialised diagnostic tests. Currently, it operates 21 centres, which consist of 18 laboratories and three diagnostic centres across 8 states with advanced tech like 3T MRI, 128-slice CT, NGS, and PACS for digital imaging. It also provides additional services, such as online access to test reports, home sample collection, and customised test packages for both individual and institutional clients.

As of June 30, 2025, Pathology made up 80.70% of revenue from operations, while radiology made up 19.30%. Domestic revenue was mainly from Haryana, which contributed 65.80%. India accounted for 96.70% of the revenue, and the remainder came from various countries such as Kenya, Nepal, Ethiopia, Uganda, and Dubai. In FY25, it conducted 3.24 crore tests for 13.69 lakh patients, with B2C revenues forming 48.66% and B2B 51.34%.

Modern Diagnostic & Research Centre Subscription Status

Latest News on Modern Diagnostic & Research Centre

Frequently asked questions

How to invest in the Modern Diagnostic & Research Centre ?

Investors can apply for the Modern Diagnostic & Research Centre through their Demat account via the stock exchange or through their broker.

What is the issue size of Modern Diagnostic & Research Centre ?

The issue size of the Modern Diagnostic & Research Centre is 37 Cr.

What is 'pre-apply' for Modern Diagnostic & Research Centre ?

Pre-applying for an IPO allows you to submit your application before the official subscription period begins.

Which exchanges will Modern Diagnostic & Research Centre shares list on?

The IPO shares will typically list on major stock exchanges such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), as specified in the IPO prospectus.