- Home/

- IPO

43.07x

subscribed

L.K. Mehta Polymers IPO

Plastic Products

listed

43.07x

subscribed

₹1.14LMin. investment

L.K. Mehta Polymers Limited IPO Details

Issue size

₹7Cr

IPO type

SME

Market Cap

₹27.26CrLower than sector avg

Price range

₹71.00 – ₹71.00

Listing ExchangeBSE

RevenueApr 2023 - Mar 2024

₹18.16CrLower than sector avg

Lot size

1600 shares

Red Herring Prospectus

Read

Growth rate3Y CAGR

16.70%

SectorPlastic Products

Price range₹71.00 – ₹71.00

IPO type

SME

Lot size1600 shares

Issue size₹7Cr

Red Herring Prospectus

Read

Market Cap

₹27.26CrLower than sector avg

RevenueApr 2023 - Mar 2024

₹18.16CrLower than sector avg

Growth rate3Y CAGR

16.70%

Checklist

Quality analysis

Revenue growth

Company valuation

Earnings expansion

Risk analysis

Debt to Equity ratio

Promoter holdings

Shares pledged

The investment checklist helps you understand a company's financial

health at a glance and identify quality investment opportunities easily

Compare

Companies in this sectorObjectives

Working capital requirements

72.35%

General corporate purposes

0.18%

About L.K. Mehta Polymers Limited

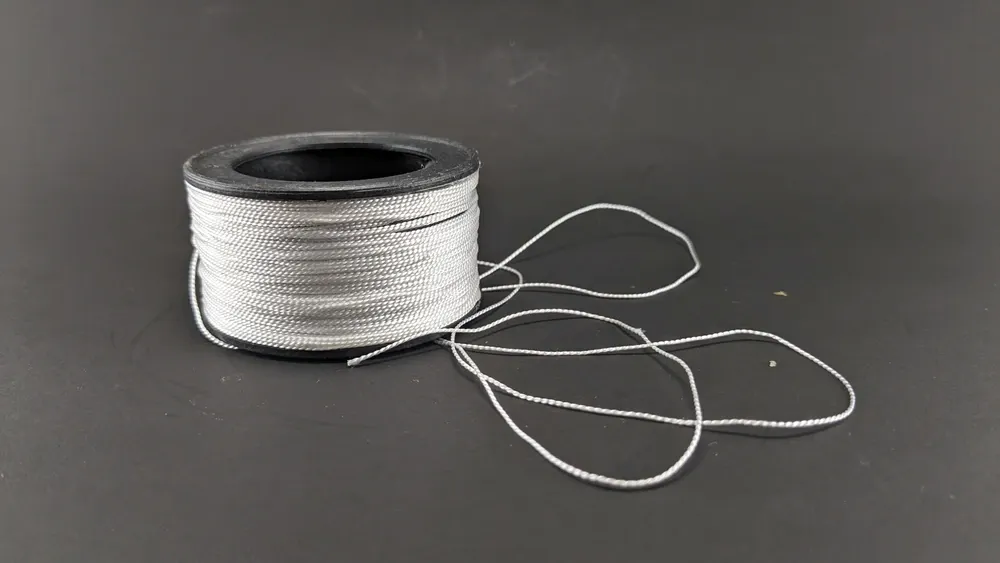

L.K. Mehta Polymers Limited is a leading manufacturer and trader of plastic products, specializing in ropes, twines, and raw materials like polypropylene and polyethylene granules. The company expanded in 2002 by establishing a production unit for woven sack bags and pipes, which operated until 2022. Known for its flagship brand "Super Pack," the company focuses on high-quality products and strong customer relationships. It sources raw materials from domestic and international suppliers, ensuring quality through reprocessing and continuous innovation.

L.K. Mehta Polymers IPO Subscription Status

Latest News on L.K. Mehta Polymers IPO

Bidding for the LK Mehta Polymers IPO opened today, February 13, and will close on February 17. The allotment of shares is expected to be finalised on February 18, Tuesday.

3 min read

LK Mehta Polymers IPO allotment: The ₹7.38-crore issue was open for subscription from February 13 to February 17. The IPO price was fixed at ₹71 per share. The listing date has been fixed as February 21.

4 min read

LK Mehta Polymers Ltd made a flat debut on the BSE SME platform, listing at ₹71.1, slightly above its IPO price. The stock hit a 5% lower circuit to trade at ₹67.54. The ₹7.38-crore IPO was subscribed 44.6 times. The company’s revenue for FY24 grew to ₹18.87 crore.

3 min read

Frequently asked questions

How to invest in the L.K. Mehta Polymers IPO ?

Investors can apply for the L.K. Mehta Polymers IPO through their Demat account via the stock exchange or through their broker.

What is the issue size of L.K. Mehta Polymers IPO ?

The issue size of the L.K. Mehta Polymers IPO is 7 Cr.

What is 'pre-apply' for L.K. Mehta Polymers IPO ?

Pre-applying for an IPO allows you to submit your application before the official subscription period begins.

Which exchanges will L.K. Mehta Polymers IPO shares list on?

The IPO shares will typically list on major stock exchanges such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), as specified in the IPO prospectus.