- Home/

- IPO

821.97x

subscribed

Gabion Technologies India IPO

Engineering

listed

821.97x

subscribed

₹2.43LMin. investment

Gabion Technologies India Limited IPO Details

Issue size

₹29Cr

IPO type

SME

Market Cap

₹109.96CrLower than sector avg

Price range

₹76.00 – ₹81.00

Listing ExchangeBSE

RevenueApr 2024 - Mar 2025

₹100.36CrLower than sector avg

Lot size

1600 shares

Draft Red Herring Prospectus

Read

Growth rate3Y CAGR

12.88%Higher than sector avg

SectorEngineering

Price range₹76.00 – ₹81.00

IPO type

SME

Lot size1600 shares

Issue size₹29Cr

Draft Red Herring Prospectus

Read

Market Cap

₹109.96CrLower than sector avg

RevenueApr 2024 - Mar 2025

₹100.36CrLower than sector avg

Growth rate3Y CAGR

12.88%Higher than sector avg

Checklist

Quality analysis

Revenue growth

Company valuation

Earnings expansion

Risk analysis

Debt to Equity ratio

Promoter holdings

Shares pledged

The investment checklist helps you understand a company's financial

health at a glance and identify quality investment opportunities easily

Compare

Companies in this sectorObjectives

Working capital

76.24%

General corporate purposes

20.10%

Capital expenditure

3.66%

About Gabion Technologies India Limited

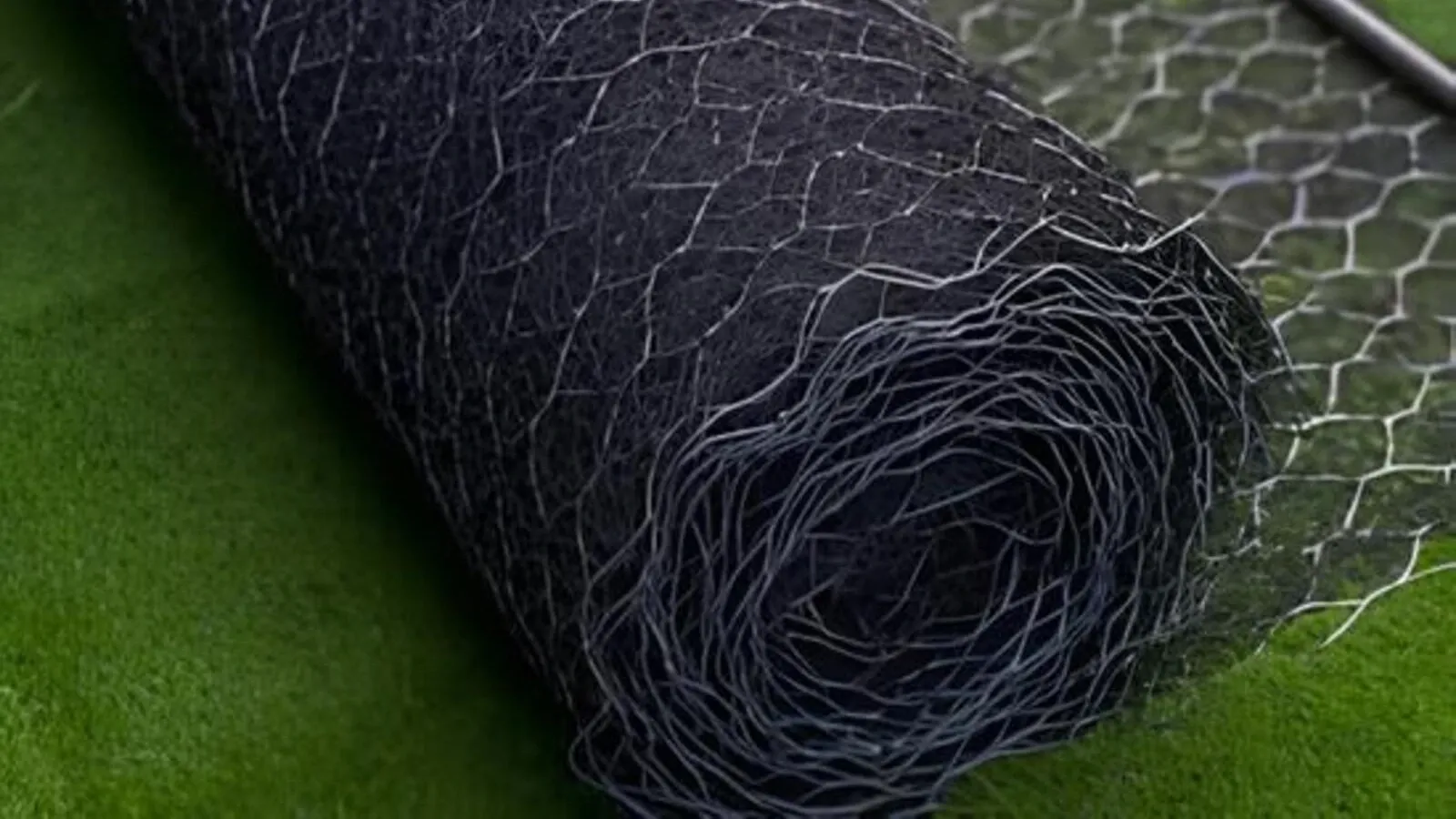

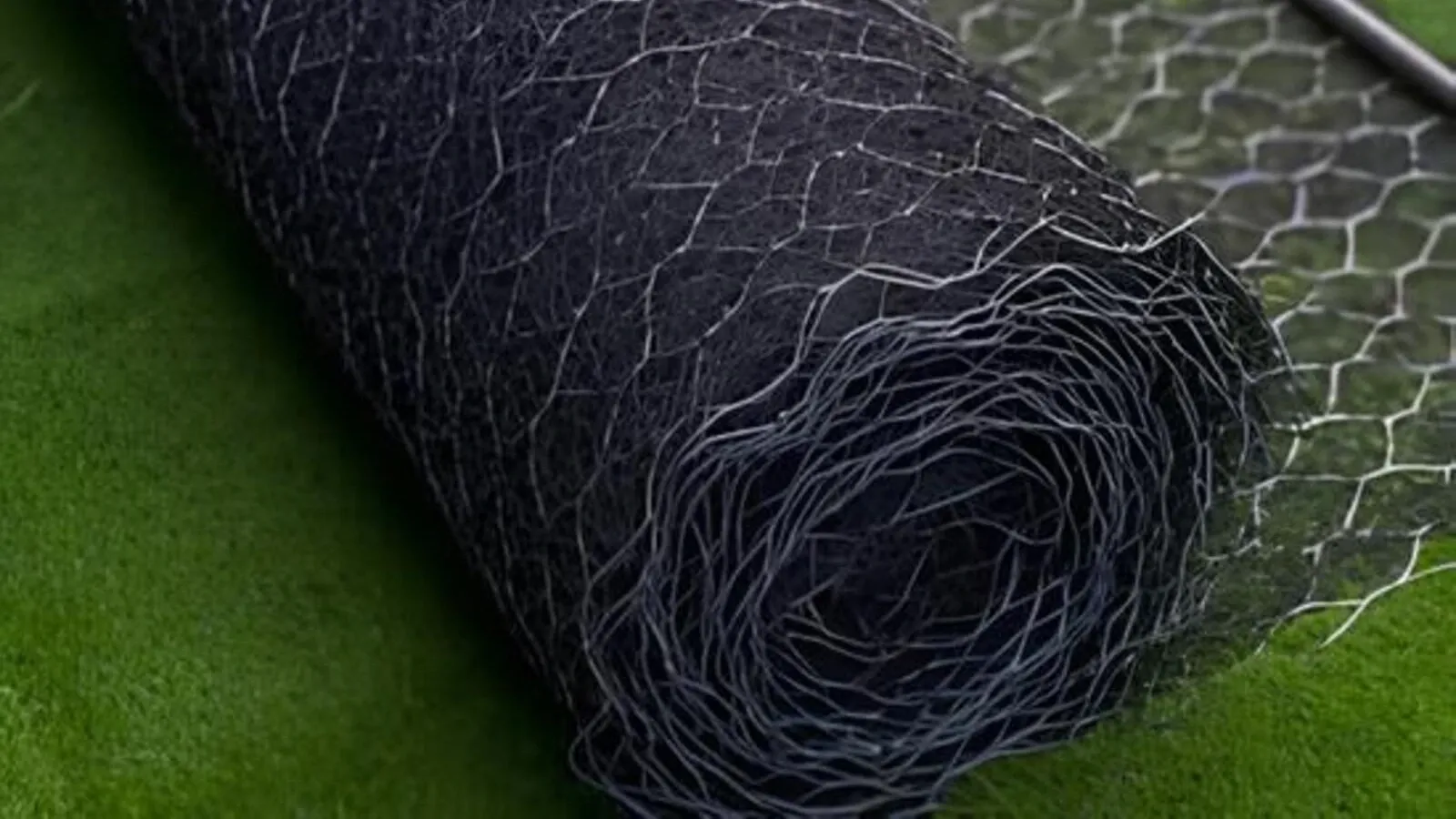

Gabion Technologies India is engaged in manufacturing, designing, trading and installation of services required by the civil engineering, infrastructure development, and environmental protection projects. The company operates across 3 business verticals- (i) manufacturing and supply of geosynthetic and geotechnical products such as, defence gabions, steel gabions, rockfall protection systems, geomats and geogrids, (ii) engineering, design and construction services and (iii) trading in auxiliary products that are required by its customers.

The company provides services to government bodies, PSUs, contractors, and private clients in various infrastructure sectors like roads, railways, irrigation, energy, mining, defence, and real estate. Its products find application in retaining walls, slope protection, rockfall barriers, river training, flood protection, ground improvement, and ash pond development, among others. The company takes up turnkey EPC projects and is prequalified to bid independently for government tenders, having bid for projects up to ₹2,558.79 lakh.

Product wise, manufacturing contributed 57.03% of the company’s FY25 revenue, trading 9.4% and services 33.50%. Sector wise, private sector accounted for 64.3%, while the government sector accounted for 35.6%. Domestic revenue was led by states such as Odisha, Himachal Pradesh and Karnataka while exports constituted of exports to Bhutan and Nepal.

Gabion Technologies India IPO Subscription Status

Latest News on Gabion Technologies India IPO

Gabion Technologies IPO: The ₹29.16-crore initial public offering, which will conclude on January 8, is solely a fresh issuance of 36 lakh shares. The price band has been fixed at ₹76 to ₹81 per share.

3 min read

Gabion Technologies IPO: The ₹29.16-crore initial share sale, with a price band of ₹76 to ₹81 per share, is a fresh issuance of 36 lakh shares.

3 min read

Gabion Technologies IPO allotment finalised: The initial share sale was entirely a fresh issuance of 36 lakh shares worth ₹29.16 crore, with no offer for sale (OFS) component.

3 min read

Frequently asked questions

How to invest in the Gabion Technologies India IPO ?

Investors can apply for the Gabion Technologies India IPO through their Demat account via the stock exchange or through their broker.

What is the issue size of Gabion Technologies India IPO ?

The issue size of the Gabion Technologies India IPO is 29 Cr.

What is 'pre-apply' for Gabion Technologies India IPO ?

Pre-applying for an IPO allows you to submit your application before the official subscription period begins.

Which exchanges will Gabion Technologies India IPO shares list on?

The IPO shares will typically list on major stock exchanges such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), as specified in the IPO prospectus.