- Home/

- IPO

42.94x

subscribed

Excelsoft Technologies IPO

42.94x

subscribed

Excelsoft Technologies Limited IPO Details

Excelsoft Technologies Limited IPO Overview

Excelsoft Technologies Limited IPO date

Excelsoft Technologies Limited IPO will open for subscription on November 19, 2025, and the closing date for the IPO is November 21, 2025. After this, investors are expected to be updated about the allotment status on November 24, 2025.

Investors who have been allotted shares can expect them to be credited to their demat account on November 25, 2025. The shares will be listed on the NSE and the BSE on Wednesday, November 26, 2025.

Excelsoft Technologies Limited IPO price band

The IPO includes a fresh issue and an offer for sale. The IPO price band has been set between ₹114 to ₹120 per share. Interested investors can choose a price within this band to apply for the IPO.

The IPO is a book-building issue, comprising a fresh issue of ₹180 crore and an offer for sale of ₹320 crore. Excelsoft Technologies Limited's IPO listing price will be determined on November 26, 2025. The listing price is the price at which a company’s shares debut on the stock exchanges.

Excelsoft Technologies Limited IPO lot size

Excelsoft Technologies Limited IPO details have been declared. The minimum lot size for an application is 125 shares, and the investor would have to apply for a minimum of 1 lot. Meanwhile, the IPO issue size is approximately ₹500 crore.

Checklist

Compare

Companies in this sectorObjectives

Strength and Weakness

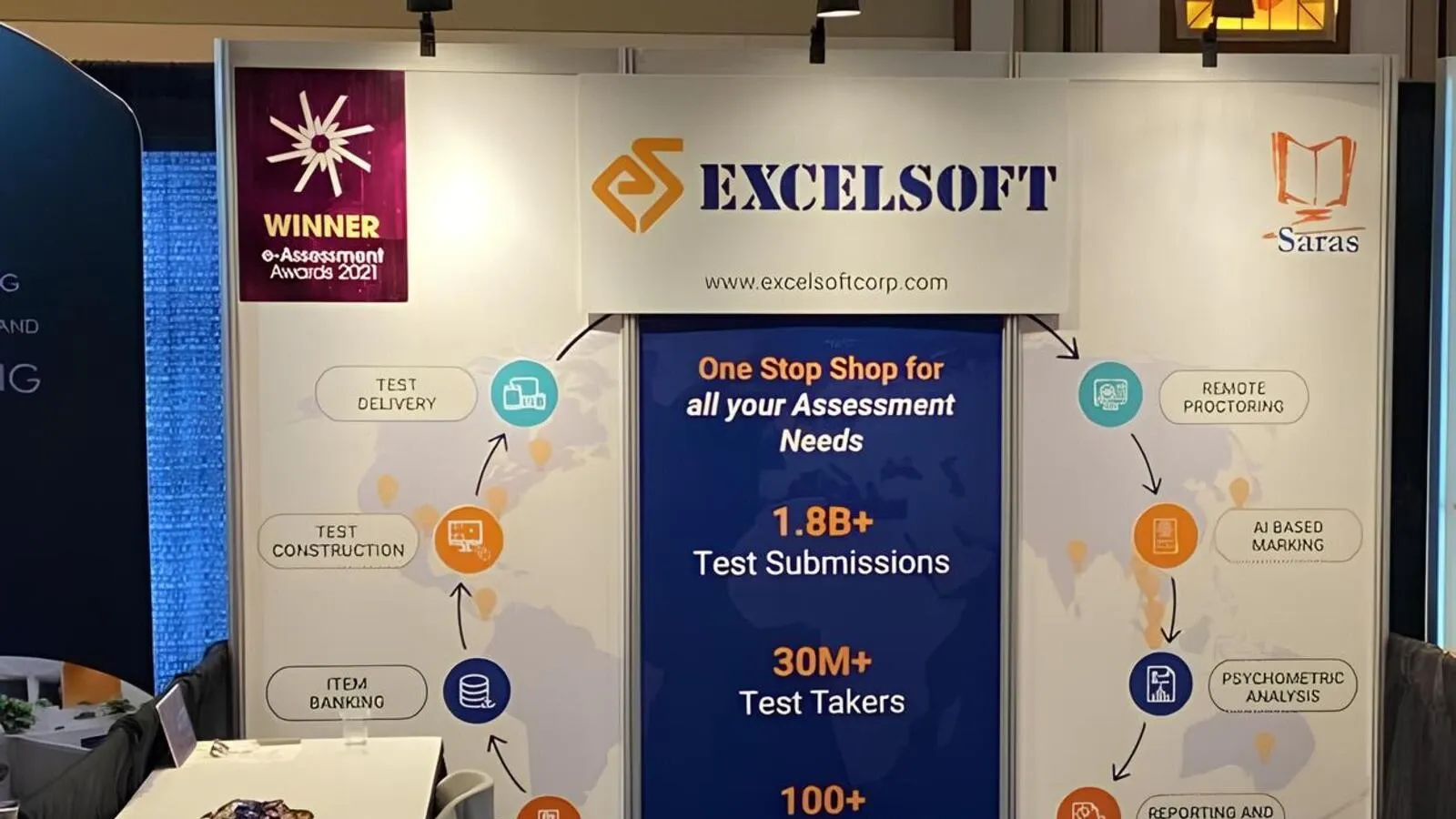

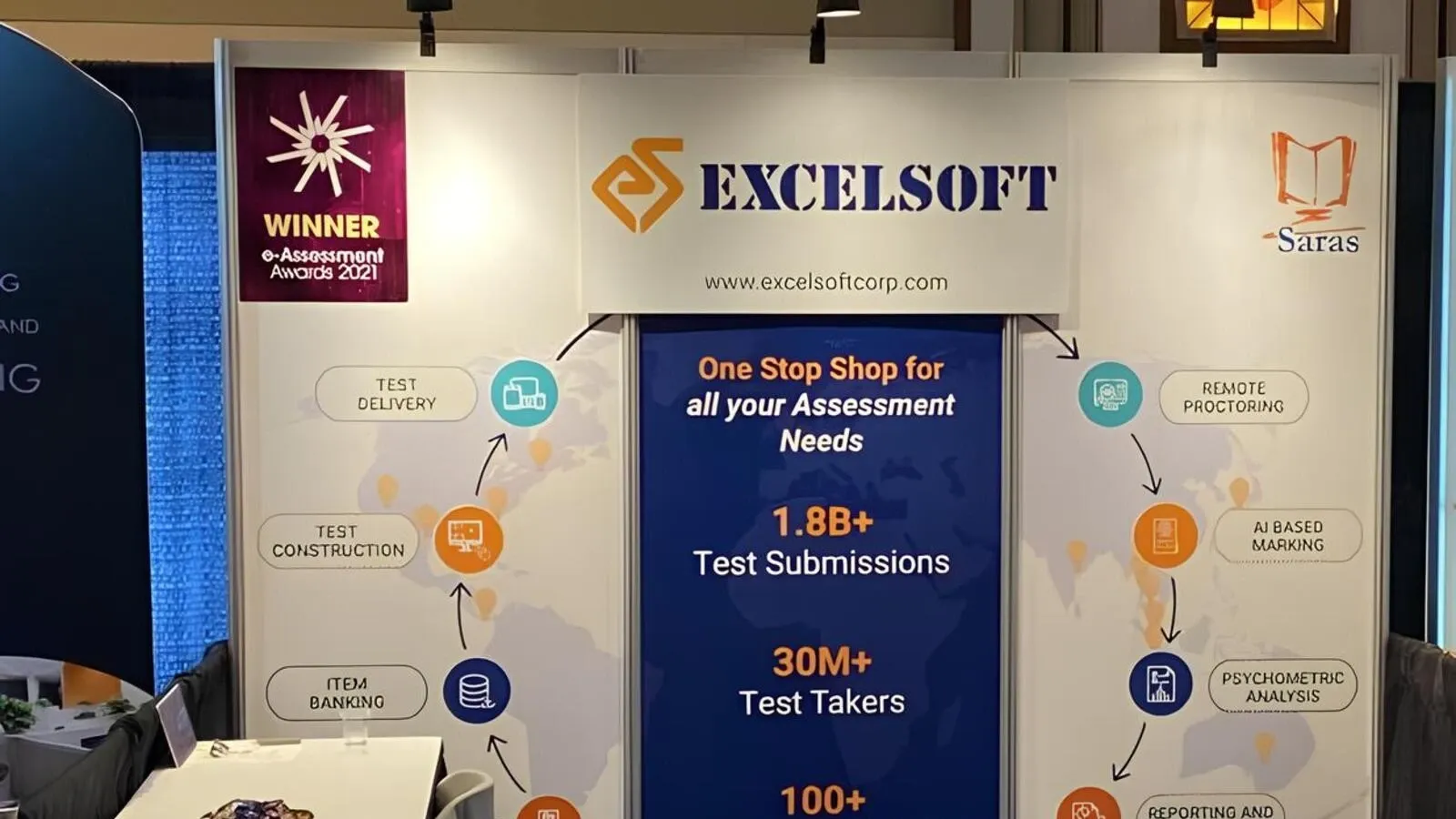

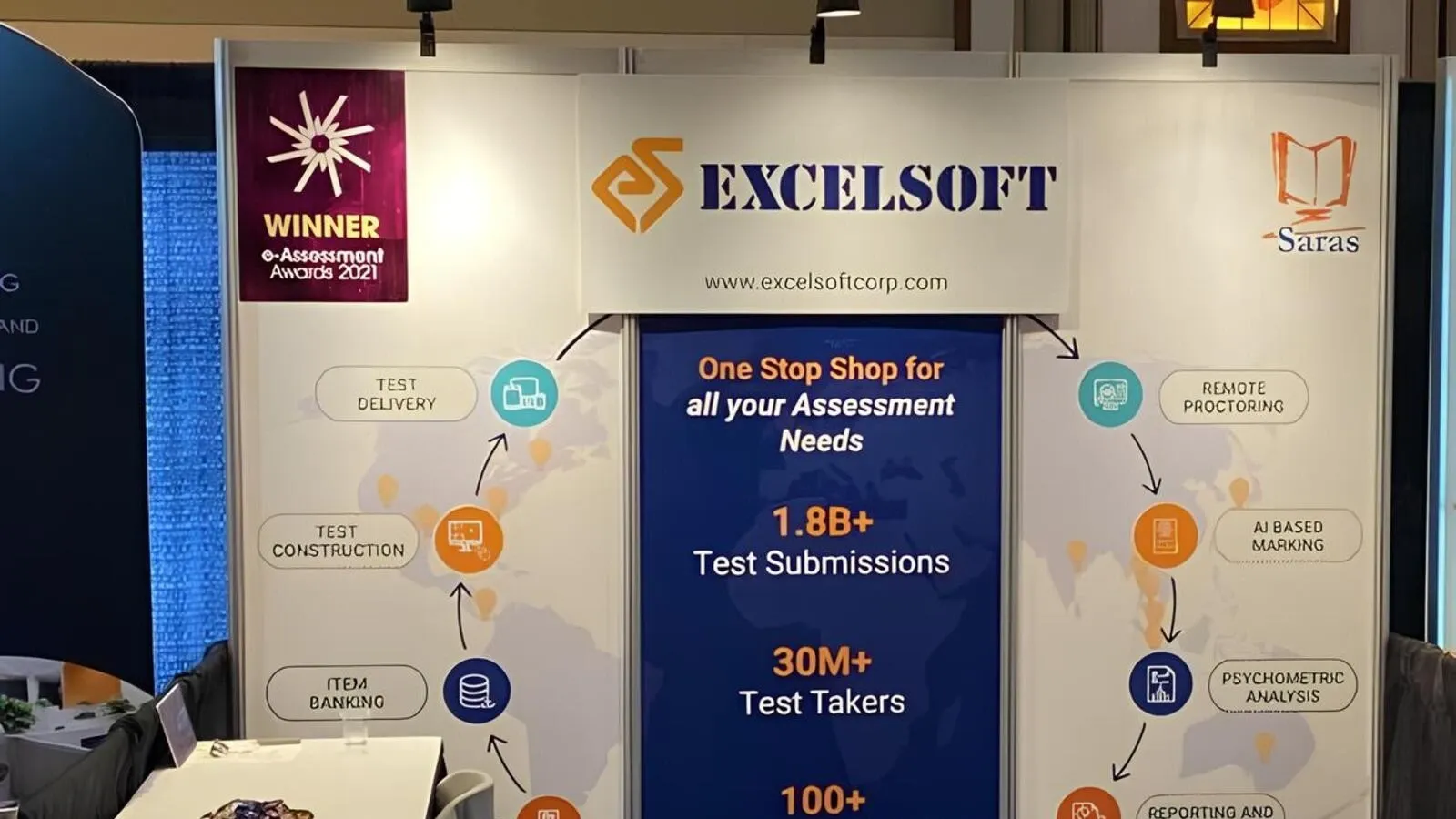

The company has established deep product engineering and implementation capabilities across the entire lifecycle of learning and assessment. Its solutions are built on scalable, secure, and cloud-based architectures, ensuring strong reliability and cost efficiency. Years of product development experience, combined with a user-centric design and adherence to global data privacy standards, make it a preferred technology partner for large educational institutions and enterprises.

The company served 101 clients as of June 2025, with 24 clients associated for over 10 years and 40 clients for 5–10 years, highlighting exceptional retention. This long-term loyalty provides stability, loyalty, competitive advantage, and growth potential, as well as serves as a barrier to entry for competitors.

The company has built a strong global presence with subsidiaries in the UK, USA, Singapore, and India, and operations in Dubai, serving clients across major international markets. As of June 2025, the company generated 60.69% of its revenue from North America and 24.53% from Europe & the UK, demonstrating strong diversification and scalability beyond India.

The company leverages multiple technology stacks and agile methodologies to deliver customised, scalable assessment and learning solutions across K–12, certification, and corporate segments. It continuously invests in innovation, spending ₹3.02 crore in FY25 on employee upskilling in advanced tools like AI and AR/VR and others in the form of training programs, webinars, bootcamps, workshops and master classes. This ensures that the company is not tied to a single technology stack and can offer optimised solutions for its clients.

The company operates with 1,118 employees, as of June 30, 2025, under a well-defined structure of standardised workflows, KPIs, and accountability systems to ensure operational consistency and scalability. These parameters support efficient resource utilisation, streamlined processes, and data-driven performance monitoring across business functions.

About Excelsoft Technologies Limited

IPO Analysis