- Home/

- IPO

4.31x

subscribed

CLN Energy IPO

Batteries

listed

4.31x

subscribed

₹1.41LMin. investment

CLN Energy Limited IPO Details

Issue size

₹72Cr

IPO type

SME

Market Cap

₹263.83CrLower than sector avg

Price range

₹235 – ₹250

Listing ExchangeBSE

RevenueApr 2023 - Mar 2024

₹132.7CrLower than sector avg

Lot size

600 shares

Red Herring Prospectus

Read

Growth rate3Y CAGR

2.93%Higher than sector avg

SectorBatteries

Price range₹235 – ₹250

IPO type

SME

Lot size600 shares

Issue size₹72Cr

Red Herring Prospectus

Read

Market Cap

₹263.83CrLower than sector avg

RevenueApr 2023 - Mar 2024

₹132.7CrLower than sector avg

Growth rate3Y CAGR

2.93%Higher than sector avg

Checklist

Quality analysis

Revenue growth

Company valuation

Earnings expansion

The investment checklist helps you understand a company's financial

health at a glance and identify quality investment opportunities easily

Compare

Companies in this sectorObjectives

Working capital requirements

40.22%

Purchase of machinery and equipment

13.43%

General corporate purposes

Not assigned

About CLN Energy Limited

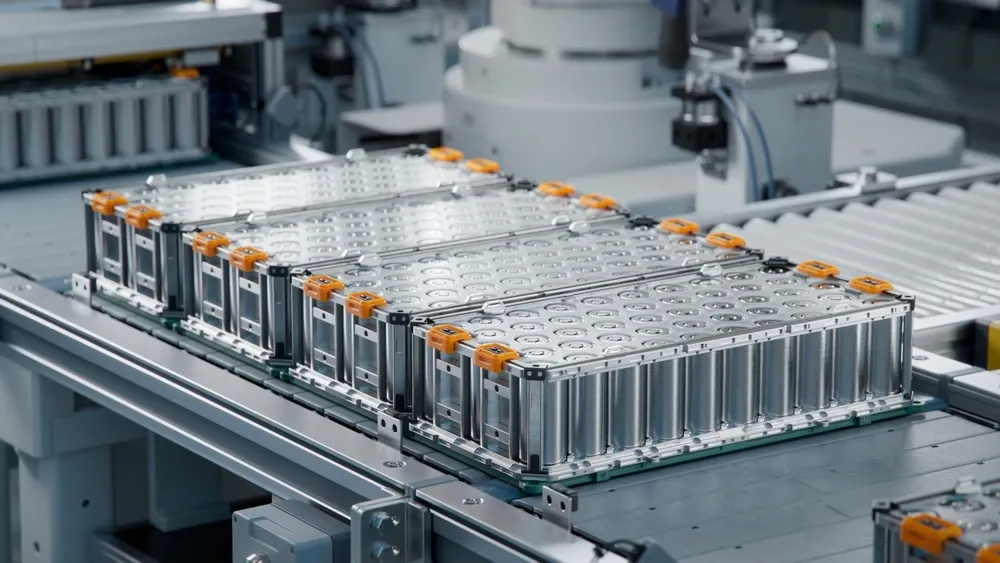

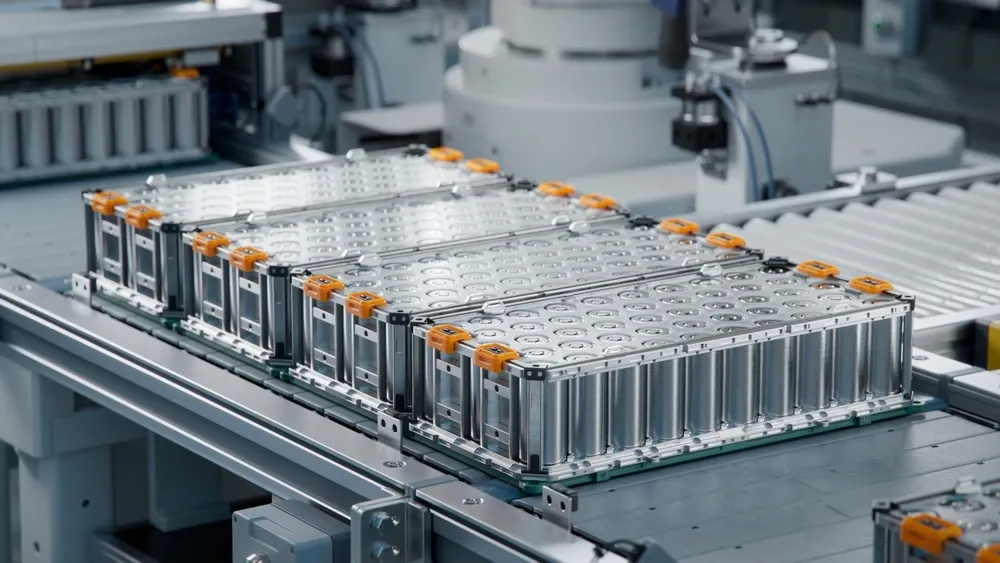

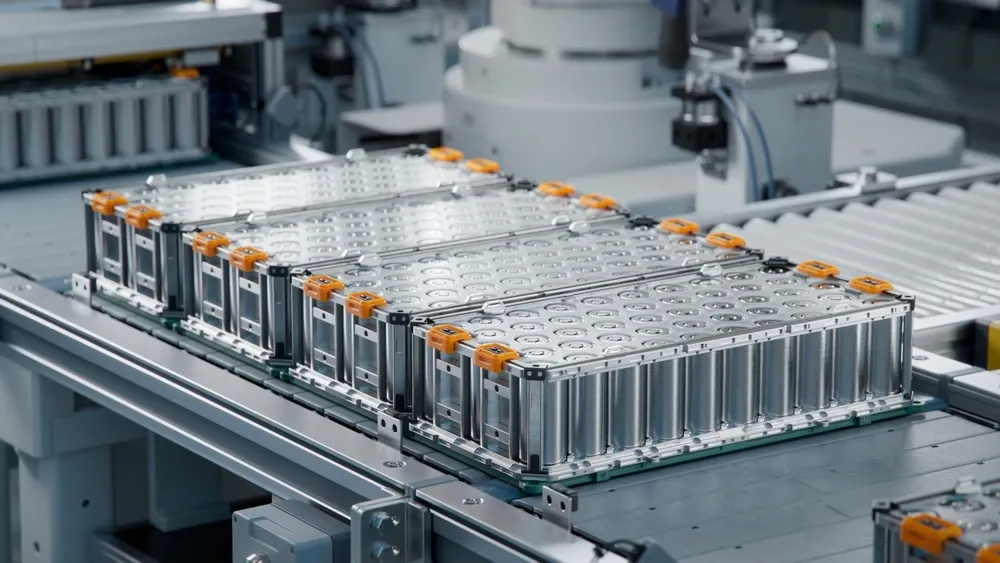

CLN Energy Limited, founded in 2019, specializes in sustainable products, including lithium-ion batteries, motors, and powertrain components for electric vehicles (EVs) and energy storage solutions. With two advanced manufacturing plants in Noida and Pune, the company produces high volumes of batteries and motors for EVs and stationary applications. CLN Energy also focuses on R&D to provide tailored, efficient solutions, positioning itself as a leader in the renewable energy and EV sectors.

CLN Energy IPO Subscription Status

Latest News on CLN Energy IPO

The components manufacturer for electric vehicles (EVs) aims to raise ₹72.3 crore from investors through the IPO. CLN Energy IPO is open for bidding till Monday, January 27. The company has fixed the price band at ₹235 to ₹250 per share for the IPO.

4 min read

CLN Energy IPO investors can check the IPO share allotment status on the websites of the BSE and the issue registrar, Bigshare Services Pvt Ltd. The listing date has been tentatively fixed as January 30. The company's shares will be listed on the BSE SME platform.

4 min read

At the listing price of ₹256 per share, the value of a single lot of shares bagged by investors in the IPO share allotment stood at ₹1,53,600 (₹256x600). Investors would have made gains of ₹3,600 per lot as the minimum investment in a single lot was ₹1,50,000 (₹250x600).

3 min read

Frequently asked questions

How to invest in the CLN Energy IPO ?

Investors can apply for the CLN Energy IPO through their Demat account via the stock exchange or through their broker.

What is the issue size of CLN Energy IPO ?

The issue size of the CLN Energy IPO is 72 Cr.

What is 'pre-apply' for CLN Energy IPO ?

Pre-applying for an IPO allows you to submit your application before the official subscription period begins.

Which exchanges will CLN Energy IPO shares list on?

The IPO shares will typically list on major stock exchanges such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), as specified in the IPO prospectus.