- Home/

- IPO

1.25x

subscribed

ATC Energies System IPO

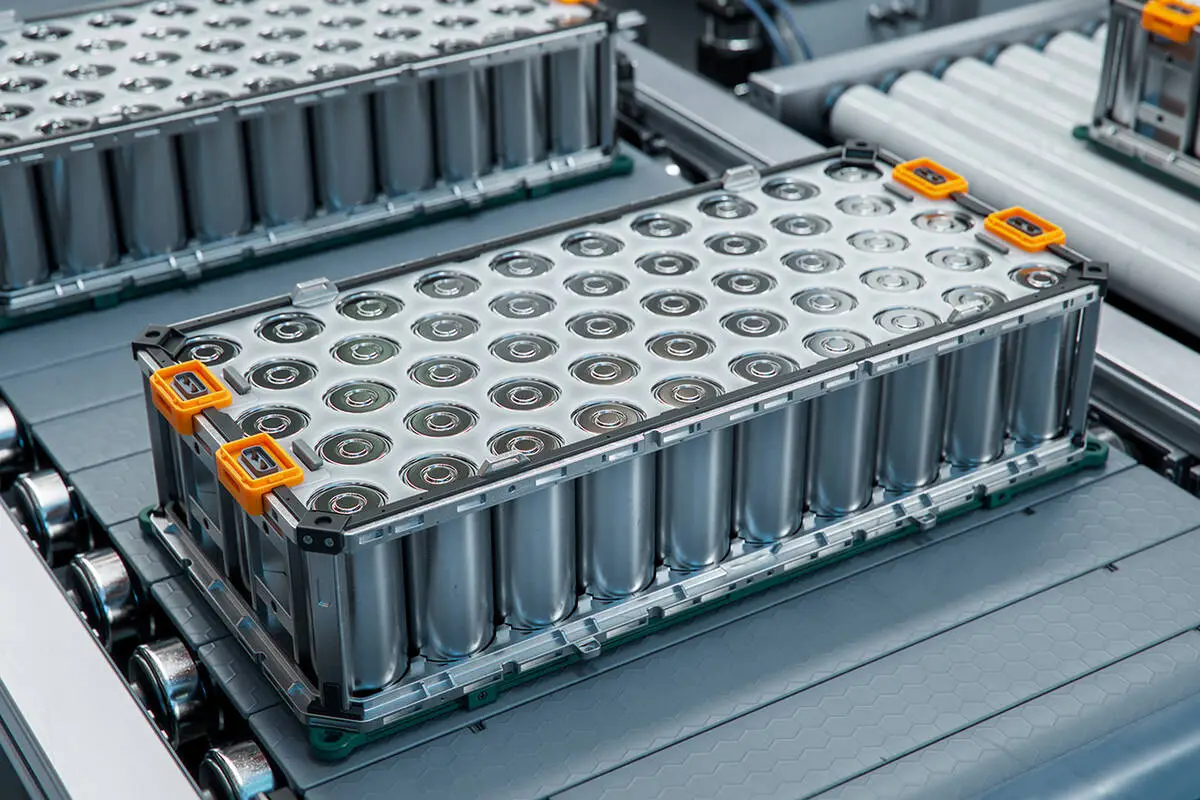

Batteries

listed

1.25x

subscribed

₹1.34LMin. investment

ATC Energies System Limited IPO Details

Issue size

₹63Cr

IPO type

SME

Market Cap

₹240.59CrLower than sector avg

Price range

₹112 – ₹118

Listing ExchangeNSE

RevenueApr 2023 - Mar 2024

₹51.2CrLower than sector avg

Lot size

1200 shares

Red Herring Prospectus

Read

Growth rate3Y CAGR

11.96%Higher than sector avg

SectorBatteries

Price range₹112 – ₹118

IPO type

SME

Lot size1200 shares

Issue size₹63Cr

Red Herring Prospectus

Read

Market Cap

₹240.59CrLower than sector avg

RevenueApr 2023 - Mar 2024

₹51.2CrLower than sector avg

Growth rate3Y CAGR

11.96%Higher than sector avg

Checklist

Quality analysis

Revenue growth

Company valuation

Earnings expansion

Risk analysis

Debt to Equity ratio

Promoter holdings

Shares pledged

The investment checklist helps you understand a company's financial

health at a glance and identify quality investment opportunities easily

Compare

Companies in this sectorObjectives

Repayment or prepayment of borrowings

18.65%

Working capital requirements

18.62%

Capital expenditure towards IT upgradation

14.62%

Capital expenditure towards civil and upgradation works

13.17%

General corporate purposes

Not assigned

About ATC Energies System Limited

ATC Energies produces cost-effective lithium-ion batteries for various industries, including banking, automobiles, agriculture, and medical equipment. With manufacturing facilities in Vasai, Thane, and Noida, the company offers customized and standardized batteries in various sizes. Founded by an entrepreneur with 25+ years of experience, ATC Energies focuses on eco-friendly, high-quality products. The company aims to lead the growing demand for renewable energy storage and contribute to India's low-carbon economy.

ATC Energies System IPO Subscription Status

Latest News on ATC Energies System IPO

Frequently asked questions

How to invest in the ATC Energies System IPO ?

Investors can apply for the ATC Energies System IPO through their Demat account via the stock exchange or through their broker.

What is the issue size of ATC Energies System IPO ?

The issue size of the ATC Energies System IPO is 63 Cr.

What is 'pre-apply' for ATC Energies System IPO ?

Pre-applying for an IPO allows you to submit your application before the official subscription period begins.

Which exchanges will ATC Energies System IPO shares list on?

The IPO shares will typically list on major stock exchanges such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), as specified in the IPO prospectus.