- Home/

- IPO

1.24x

subscribed

Zinka Logistics Solutions IPO

Logistics

listed

1.24x

subscribed

₹13,986Min. investment

Zinka Logistics Solutions IPO Details

Issue size

₹1,114Cr

IPO type

Mainboard

Market Cap

₹4,817.81CrHigher than sector avg

Price range

₹259 – ₹273

RevenueApr 2023 - Mar 2024

₹296.92CrLower than sector avg

Lot size

54 shares

Red Herring Prospectus

Read

Growth rate3Y CAGR

35.00%Higher than sector avg

SectorLogistics

Price range₹259 – ₹273

IPO type

Regular

Lot size54 shares

Issue size₹1,114Cr

Red Herring Prospectus

Read

Market Cap

₹4,817.81CrHigher than sector avg

RevenueApr 2023 - Mar 2024

₹296.92CrLower than sector avg

Growth rate3Y CAGR

35.00%Higher than sector avg

Checklist

Quality analysis

Revenue growth

Company valuation

Earnings expansion

Risk analysis

Debt to Equity ratio

Promoter holdings

Shares pledged

The investment checklist helps you understand a company's financial

health at a glance and identify quality investment opportunities easily

Compare

Companies in this sectorObjectives

Company expansion

Funding of expenditure in relation to product developmentOffer for sale

Founders diluting their shares in the companyWorking capital requirements

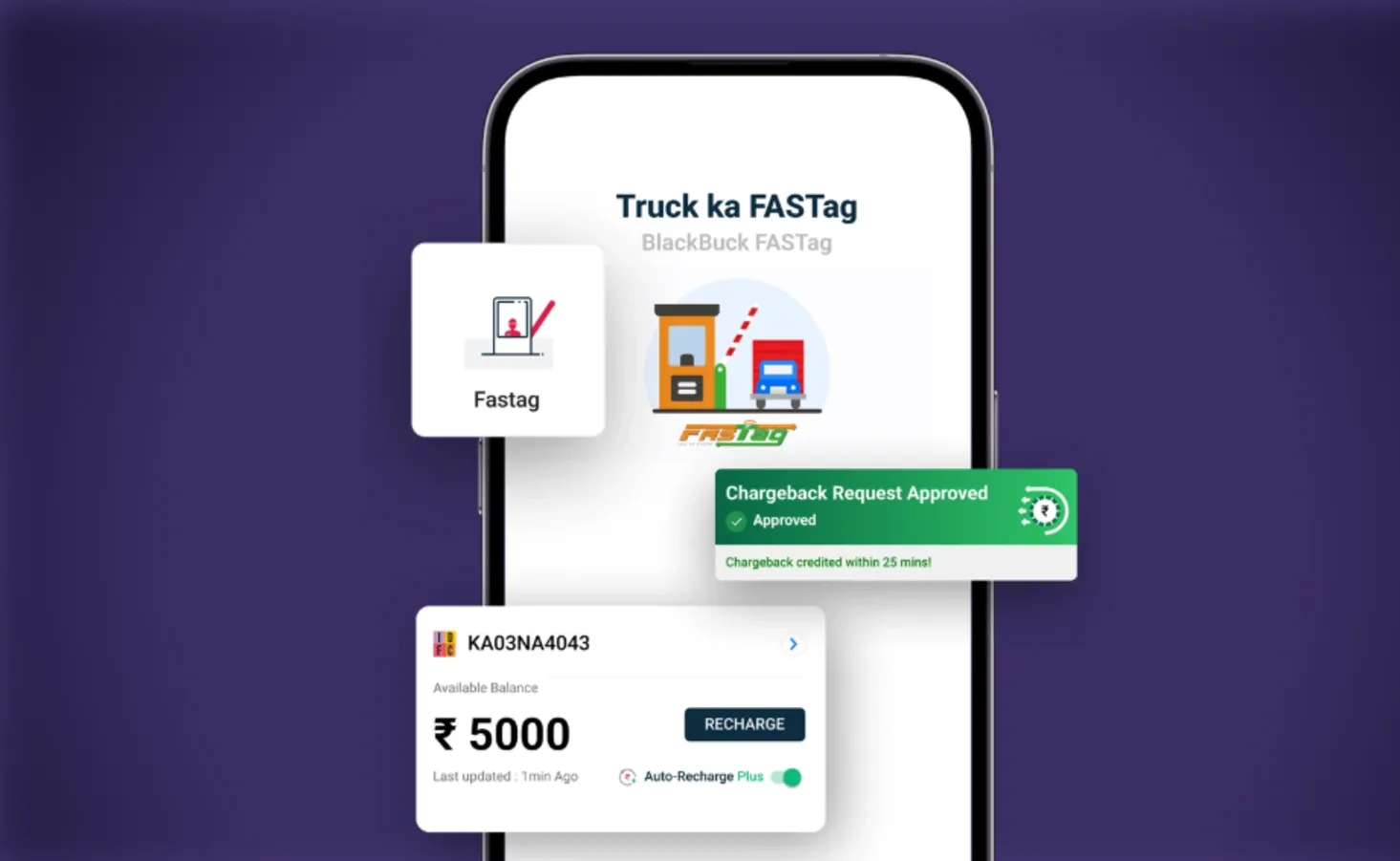

Funding towards sales and marketing costs, and investment in its NBFC.About Zinka Logistics Solutions

Zinka Logistics Solutions Limited is India’s largest digital platform for truck operators as of FY24. It comprises 27.52% of India’s truck operators, with 963,345 truck operators in the country transacting on its platform. It operates the BlackBuck app and offers payments, telematics, loads marketplace and vehicle financing services to truck operators. As of 30 June 2024, it had 390,088 average monthly active telematics devices, 0.71 million load postings which enabled 133,369 truck operators, and disbursed 5,109 loans amounting to ₹252 crore.

IPO Analysis

IPO REVIEW

Zinka Logistics Solutions IPO

Should you apply?

View Video

Latest News on Zinka Logistics Solutions IPO

Zinka Logistics filed a draft red herring prospectus with SEBI, outlining six key risks. 📌Negative Cash Flow in Past 📌Highly Dependent on Business Partners 📌Highly Dependent on Business Partners 📌Limited Experience in Vehicle Financing 📌Legal Proceedings Pending Against Zinka Logistics and Directors 📌Legal Proceedings Pending Against Zinka Logistics and Directors.

Zinka Logistics IPO allotment status: The ₹1,114.72 crore initial share sale of Zinka Logistics Solutions Ltd (BlackBuck IPO), with a price range of ₹259-₹273 apiece, consisted of a fresh issue of equity shares valued at ₹550 crore and an offer-for-sale of 2.06 crore shares worth ₹565 crore.

3 min read

📌Open the website of Kfin Technologies and hover on the ‘Products’. Now, in the drop-down menu go to the investors section and click on the IPO allotment status or click on Kfin Technologies.

📌Fill in all your details – the company’s name, Application number/ Demat account/ or PAN number.

📌Enter the captcha and hit the search button. After that, a screen will pop up with the status.

Frequently asked questions

How to invest in the Zinka Logistics Solutions IPO ?

Investors can apply for the Zinka Logistics Solutions IPO through their Demat account via the stock exchange or through their broker.

What is the issue size of Zinka Logistics Solutions IPO ?

The issue size of the Zinka Logistics Solutions IPO is 1114 Cr.

What is 'pre-apply' for Zinka Logistics Solutions IPO ?

Pre-applying for an IPO allows you to submit your application before the official subscription period begins.

Which exchanges will Zinka Logistics Solutions IPO shares list on?

The IPO shares will typically list on major stock exchanges such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), as specified in the IPO prospectus.