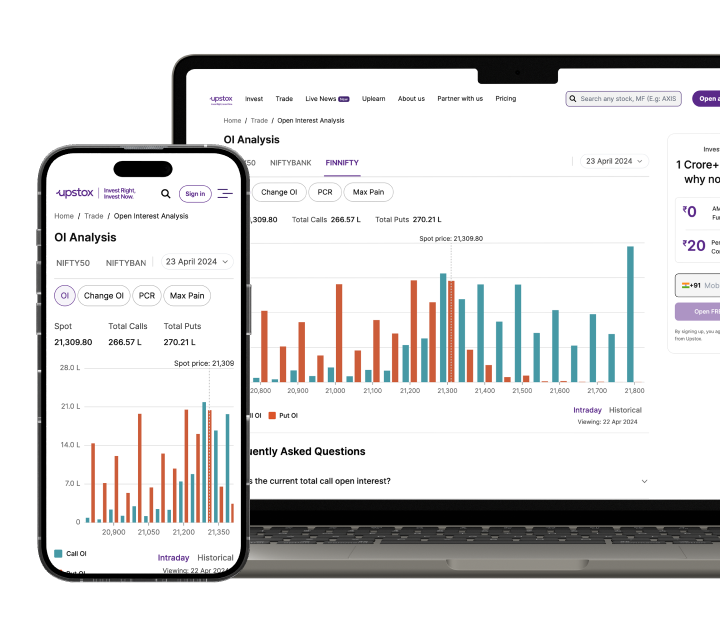

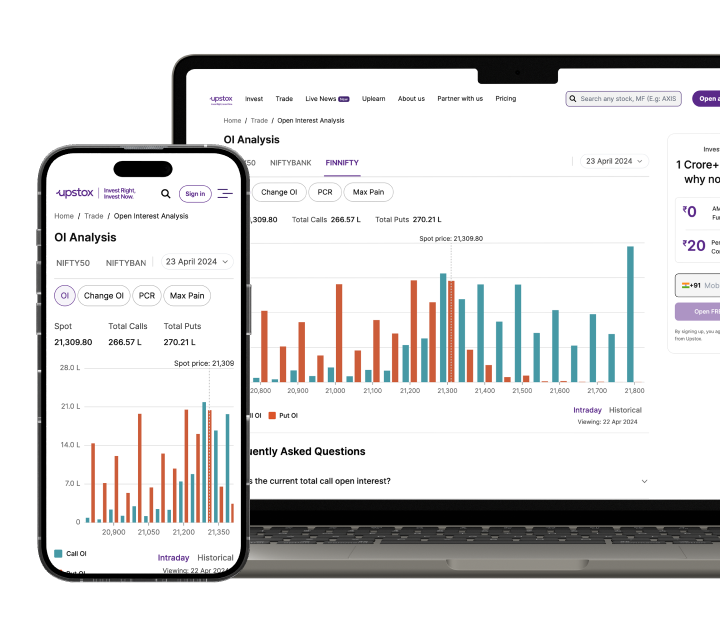

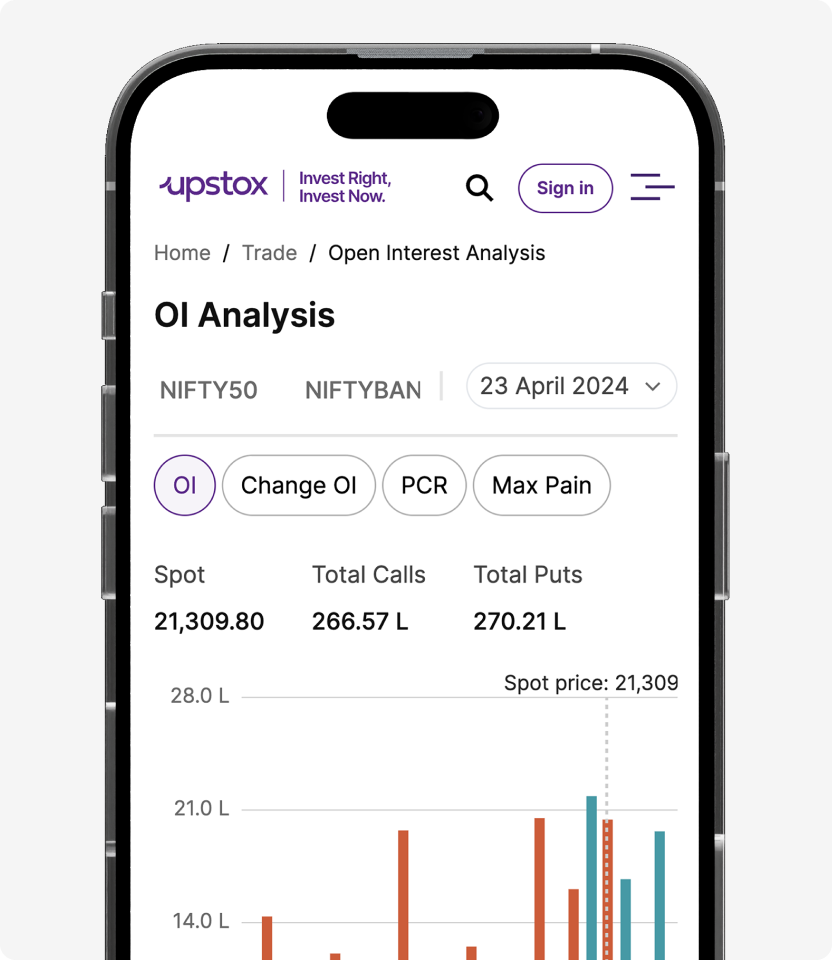

Explore OI Analysis for NIFTY 50, BANKNIFTY and FINNIFTY

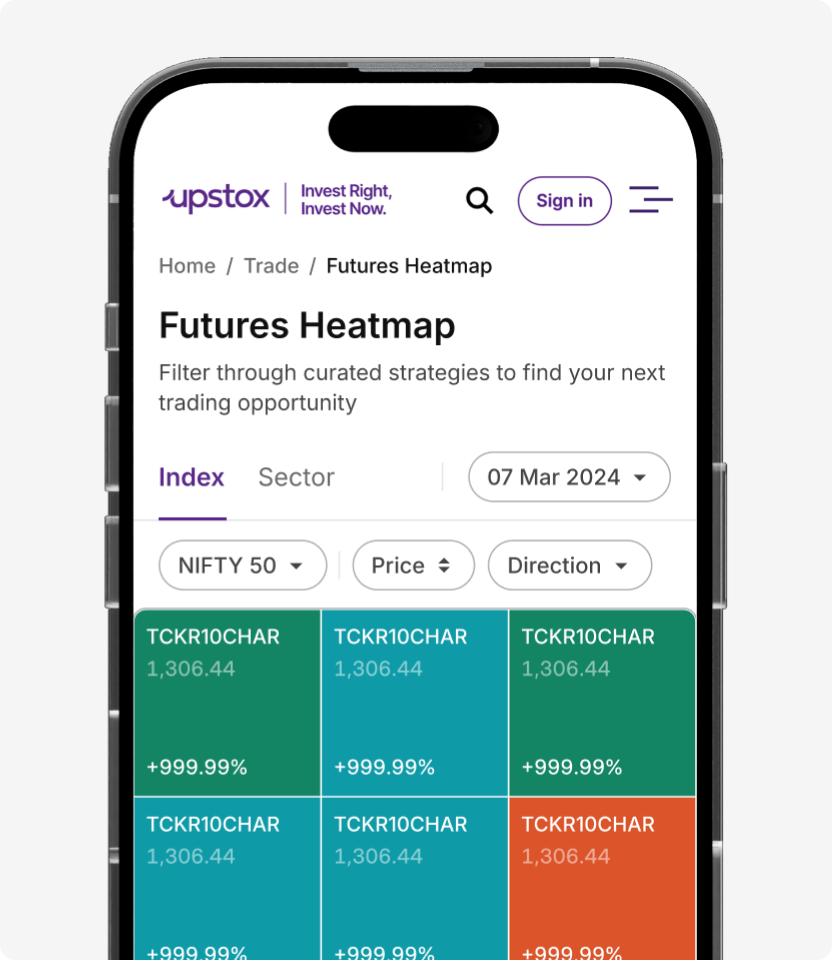

Visualize today’s price and open interest changes for the constituents of major indices

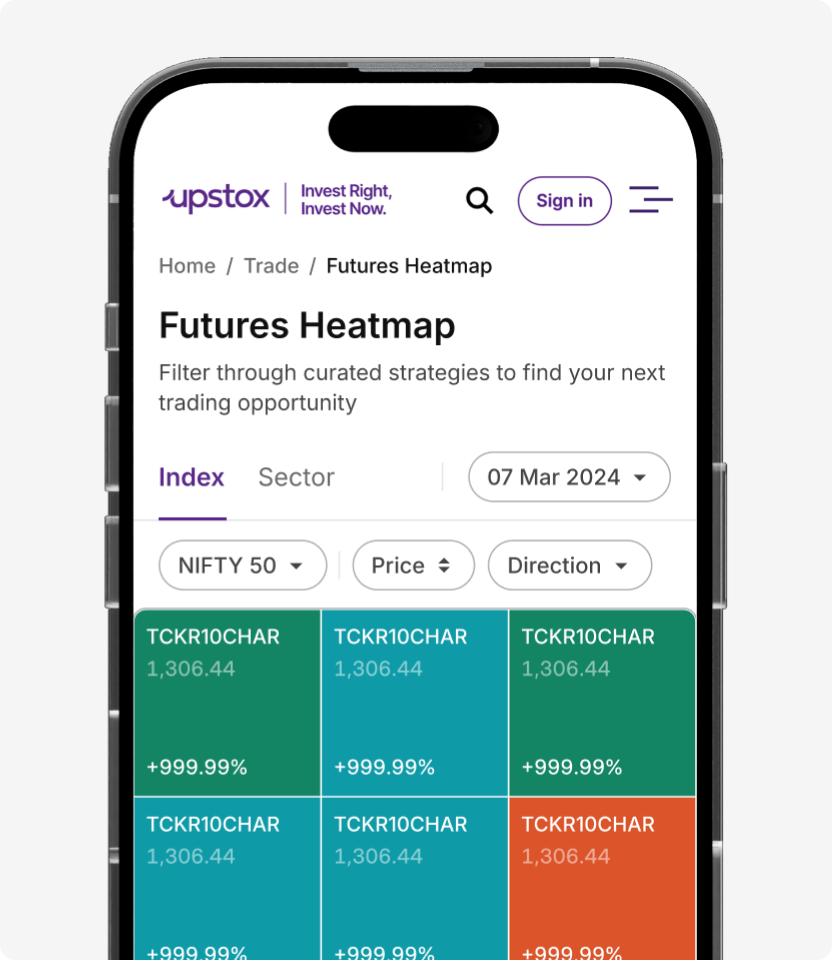

How do you read a futures heatmap? The Futures heatmap has a color coding based on whether the price is going up or down and if the open interest is going up or down. If the color is green, then there is a long build-up which is a bullish sentiment. If the color is orange, then a short build-up is occurring which indicates a downtrend. When it is blue, there is short covering happening which is when stocks are being pushed higher as short sellers close their positions. Lastly, if the color is yellow, it indicates long unwinding as bullish traders exit their trades.

In addition, traders can also see if an index’s movements are broad-based or limited to specific companies. For example, if the Nifty is down 2% today, you can use the Futures Heatmap to quickly see if all stocks are down or if there are a few sectors that are trending upwards against the prevailing downward movement.