who trust us for

Trading & Investing

4.5+

Avg. app rating- Backed by the Best

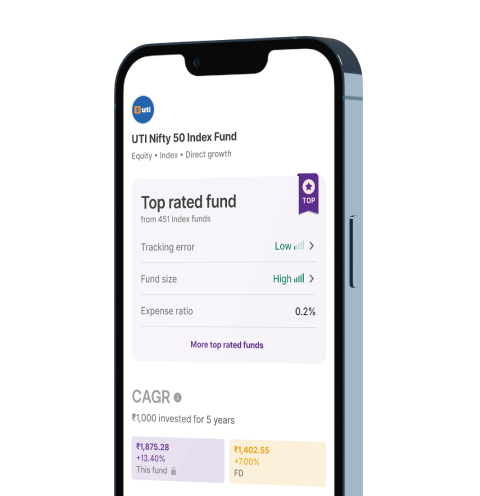

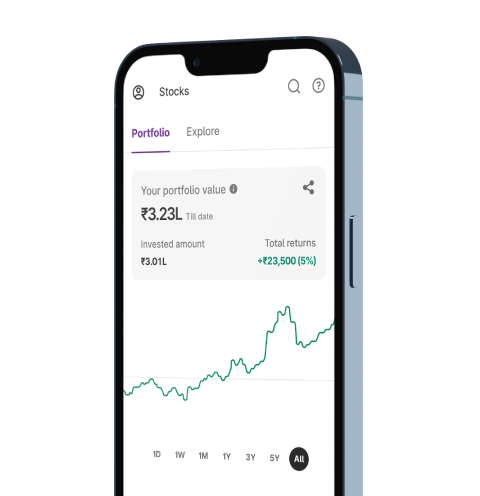

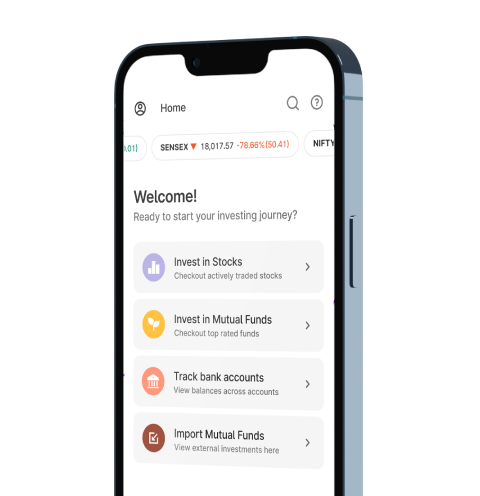

Upstox for Investors

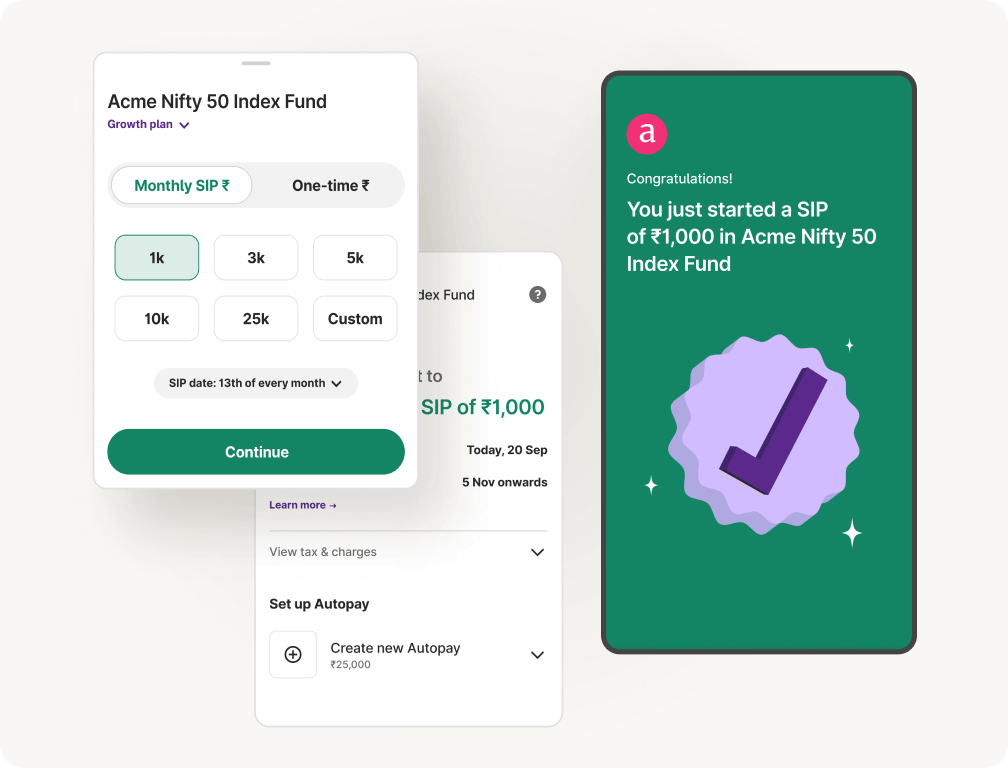

Invest Right, Invest Now in Stocks, Mutual Funds, and IPOs

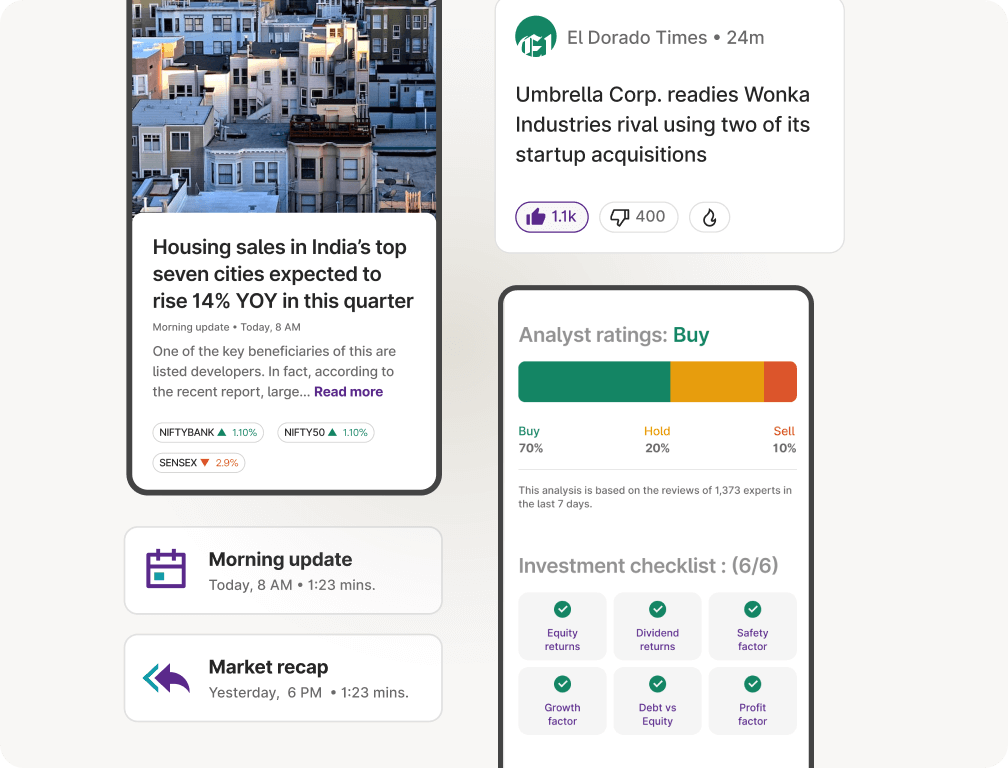

Investment Ideas

News & Insights

Order Placement

Top rated Funds | Best for Beginners | Top 30 actively traded Stocks

Analyst ratings | Investment checklist | Risk & return related info

Open 24/7 | Pay via UPI | SIP mode for Stocks & Mutual Funds

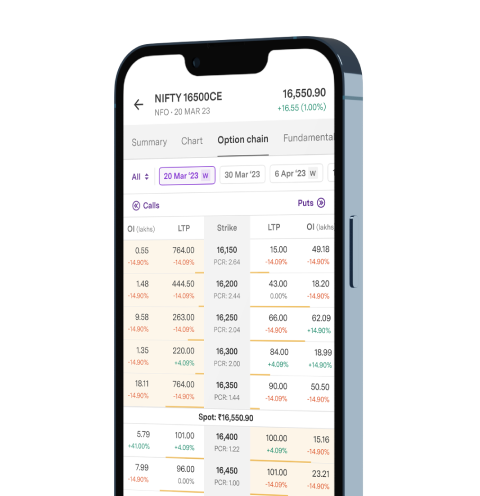

Upstox Pro for Traders

Powerful trading in Equities, Futures, Options, Commodities and Currencies made simple

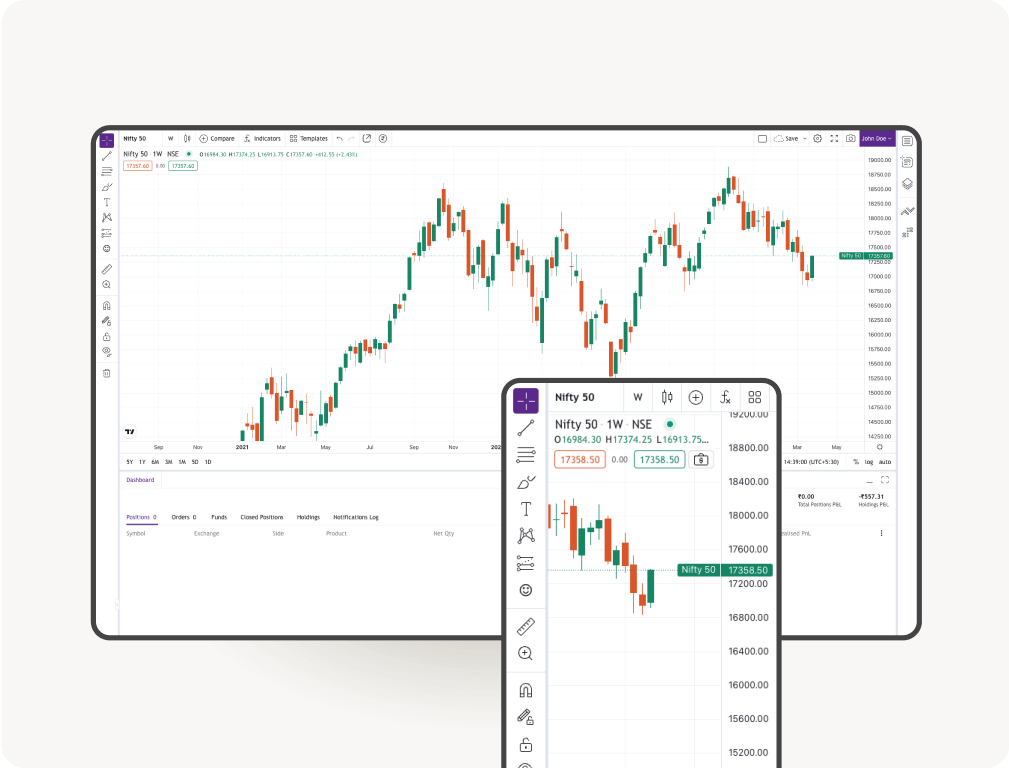

Powerful Charting

Powerful Discovery

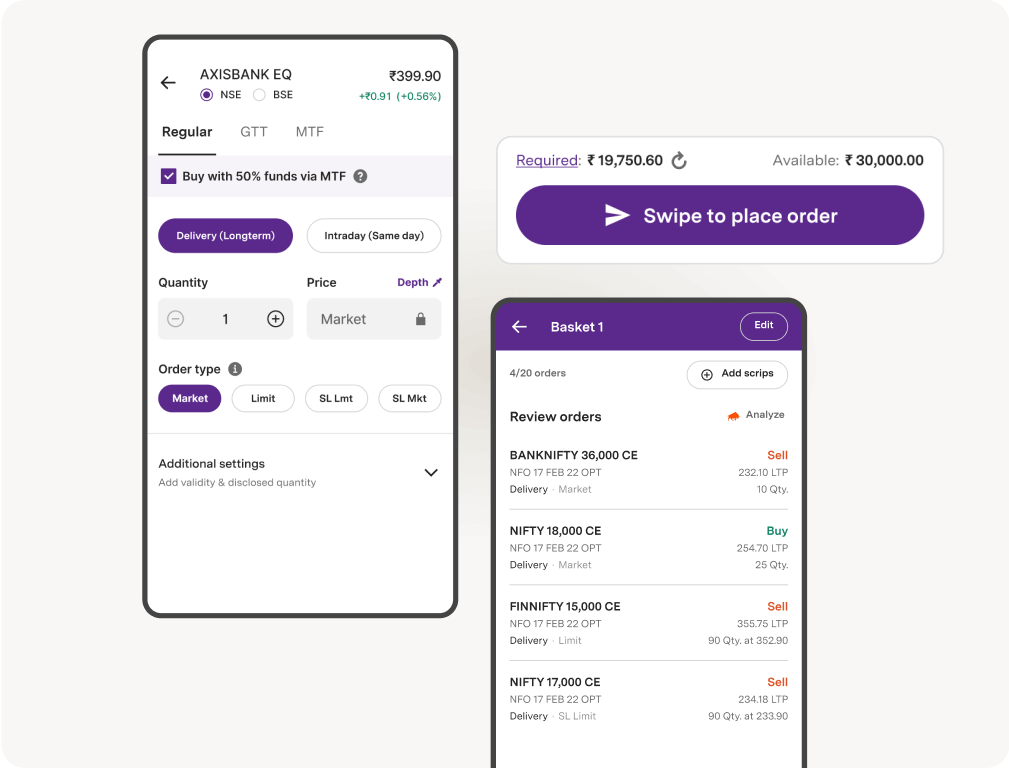

Powerful Execution

TradingView | 8 charts at once | 100+ indicators | 80+ Drawing tools

OI analysis | Option chain with greeks | FII & DII data | F&O smartlists

GTT | Basket orders up to 10 legs | 2X margin via Margin Pledge on 450+ stocks

Learn all about the Stock Market

With our jargon-free and expert-led Courses, Webinars, Events and self-help Videos

Transparent pricing.

No hidden charges.

*ZERO AMC is applicable for newly onboarded customers in the first year

Account Opening

Demat + Trading Account Charges

AMC*

Account Maintenance Charges

Commissions

For Mutual Funds and IPOs

Brokerage*

For Equity, F&O, Commodity and Currency Trades

Calculate Brokerage & Margin Easily With These

Explore All Calculators

Latest News

Get the Latest Market News at Your Fingertips

Don't take our word for it