Introduction to the Option Greek – Rho

Introduction to the Option Greek – Rho

What if you were in the market to purchase a new house. You were shopping around for home loans and two banks had different fixed rate mortgages. One bank offered you a home loan at 8% interest and another offered you a home loan at 9% interest. We don’t even need to do the math to know that the loan offered at a 9% interest rate will have a higher monthly payment than the one at 8% interest. This is analogous to our final primary option Greek: Rho.

What is Rho?

Rho is one of the option Greeks and is a measure that shows the impact of changes in interest rates on option prices. Specifically it shows the approximate change in the option’s price for a one percentage point change in interest rates. Options with higher Rho values are more sensitive to changes in interest rates while options with lower Rho values are less affected. Rho is generally regarded as one of the least impactful Greeks because it rarely changes significantly. Large moves in interest rates typically 25-50 basis points are a result of monetary policy changes and not day-to-day market fluctuations. The risk-free rate will likely only change a few times a year at most. Because of this the values of Rho are smaller with less time to expiration because there is less of a chance that a change in rates will occur. Option contracts with a large amount of time to expiry possibly several months will have higher values for Rho and their option prices will be more sensitive to interest rate changes.

What is an example of using Rho?

So why do interest rates impact option prices? When you buy an option you pay a premium. With call options you have the right to purchase the underlying on expiry at the value of the strike price. If you purchase the underlying there will be a cash outflow. Since this potential cash outflow happens in the future time value of money comes into account. A higher discount rate results in a lower present value of that potential cash outflow. This means to exercise the option in the future the cash you need to have on-hand today is less due to the higher interest rate.

For example if your strike price is ₹100 and over the 1-month period that you hold the option perhaps you currently earn ₹1 in interest on your capital. Therefore you only need ₹99 today to exercise the 100-strike. If interest rates are higher you need even less today to exercise the 100-strike. This makes the option more valuable.

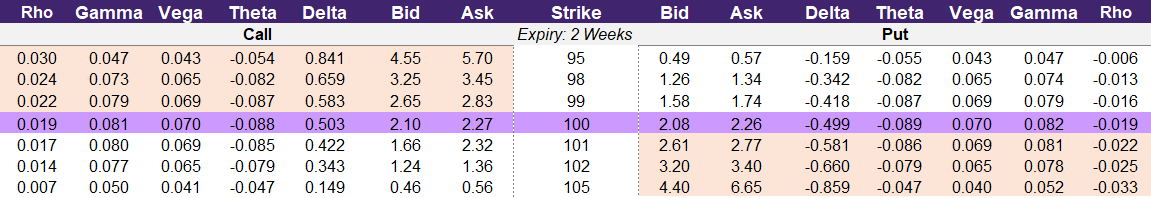

Illustration 1 is the option chain for a hypothetical stock that is trading at ₹100. Assume you buy the 95-strike call option trading at ₹5.70. The rho for this contract is currently 0.030. If interest rates were to rise by 1% perhaps from 8% to 9% then the value of this option contract will rise by 0.03 to ₹5.73.

Illustration 1

Source: Upstox

Source: UpstoxHow does Rho vary between calls and puts?

A long call option has positive rho and a long put option has negative rho. If interest rates rise and you are holding a long call option the value of the option will increase. Conversely if you are holding a put option and interest rates increase then the value of the contract will decrease.

Currently many banks around the world are watching the US Federal Reserve and are generally matching their monetary policy. If the US Fed decides to cut interest rates there is a reasonable chance that the RBI will similarly cut interest rates. If this happens then the value of any long call options will decrease while long put options will increase. Short options behave in the opposite manner to the corresponding option type. Short call options have negative rho and act like long put options while short put options behave like long call options. Illustration 2 below summarizes these relationships.

Illustration 2

| Strategy | Rho | Up | Down |

|---|---|---|---|

| Long Call | Positive | Option Price ↑ | Option Price ↓ |

| Long Put | Negative | Option Price ↓ | Option Price ↑ |

| Short Call | Negative | Option Price ↓ | Option Price ↑ |

| Short Put | Positive | Option Price ↑ | Option Price ↓ |

How does Rho vary by moneyness for long call and long put options?

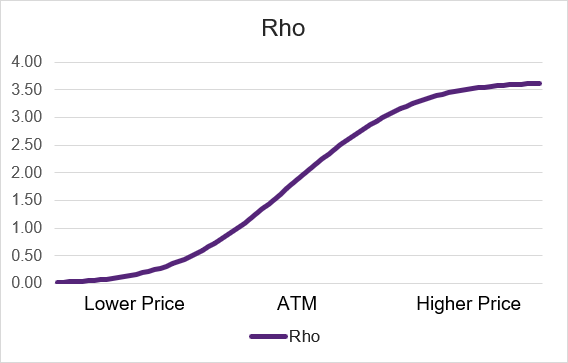

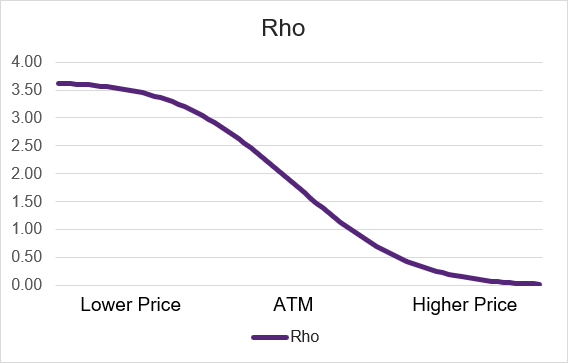

Rho is a positive value for long call but is negative for long puts. If you purchase a long call option and if interest rates rise then the option price will rise. This effect isn’t even across all levels of moneyness. If the underlying price falls and the option becomes out-of-the-money (“lower price” in illustration 3 below) then the impact of rho will be minimal. If on the other hand the underlying price rises then the option will become in-the-money (“higher price” in illustration 3 below). Long call options that are in-the-money will have higher levels of rho than at-the-money or out-of-the-money options.

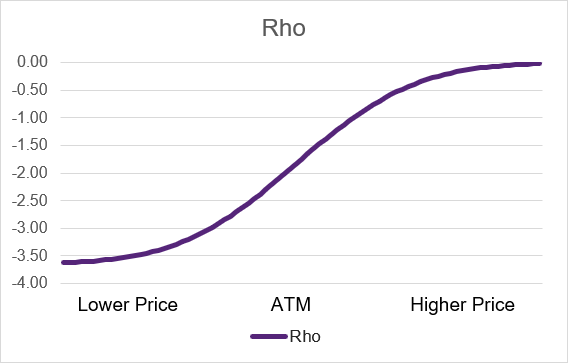

Long put options behave similarly in terms of moneyness but have a negative rho value. If you purchase a put option and the price of the underlying falls then the option will become in-the-money. In-the-money put options will have a more negative rho than at-the-money or out-of-the-money put options. If you are long an in-the-money put option and an out-of-the-money put option and interest rates rise the in-the-money put option will lose more value than the out-of-the-money put option.

Illustration 3: Long Call Rho by moneyness

Source: Upstox

Source: UpstoxIllustration 4: Long Put Rho by moneyness

Source: Upstox

Source: UpstoxHow does Rho vary by moneyness for short call and short put options?

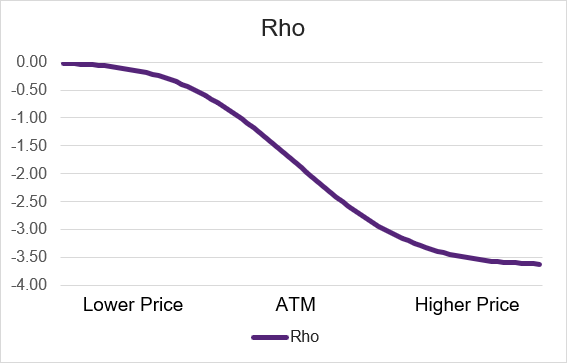

Short call options have a negative rho. While this is the same as long put options the amount of rho as a result of the underlying price is different. With long put options in-the-money put options – due to the underlying being below the strike price – have the more negative rho. Short call options however require the underlying price to be above the strike price to have the more negative rho. So in-the-money short call options have more negative rho than at-the-money or out-of-the-money short call options.

Short put options have positive rho. If the underlying is below the strike price (in-the-money) which is to the left side of the chart in illustration 6 then the contract will have a higher rho. Alternatively if the underlying is above the strike price (out-of-the-money) then the short put contract will have a lower rho value.

Illustration 5: Short Call Rho by moneyness

Source: Upstox

Source: UpstoxIllustration 6: Short Put Rho by moneyness

Source: Upstox

Source: UpstoxSummary

- Rho is the sensitivity to option prices based on a 1% unit change in interest rates.

- Rho is one of the main, or primary, option Greeks but is the least important due to the low frequency of interest rate changes as well as the typical size of the change in the risk-free rate.

- Rho will be positive for long calls and short puts. Rho will be negative for long puts and short calls.

- The more in-the-money that an option contract is, the more interest rate sensitive (higher rho value) that the option price will be.

- Rho has more impact to option prices the further away from expiry that the contract is.

Is this chapter helpful?

- Home/

- Introduction to the Option Greek – Rho