Using Stop Losses

If you are just starting out, you may worry about suffering a large loss. Part of this worry comes from possibly experience a loss while you aren’t paying attention to the markets. You aren’t a full-time trader so you can’t constantly be keeping an eye on it. To make your life as a trader a little easier, you can use a stop loss order.

Stop loss orders are an essential tool for traders to manage risk and protect capital. These orders automatically close a position when the price reaches a predetermined level, limiting losses and preserving gains. To fully grasp stop loss orders, it’s important first to understand two foundational order types: market and limit orders. Each has unique advantages and drawbacks, and knowing when to use them is key to effective trading.

Market Orders

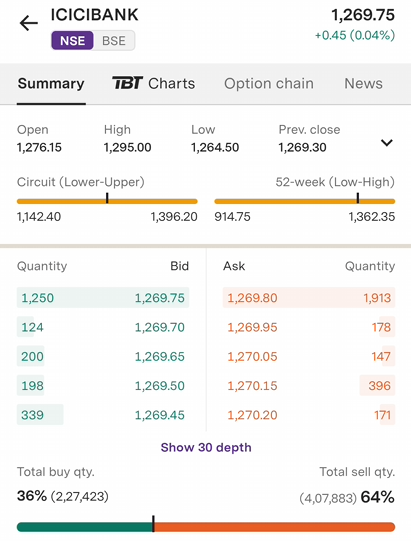

The most basic order is a market order. A market order is one where you are looking to execute a trade immediately at the best price that is currently available. This type of order works well when the markets are moving quickly and there is high liquidity. There is also the highest likelihood of trade execution with market orders. The problem with market orders is that you don’t know the exact price that you will pay. You aren’t the only trader in the market and other traders could place the order in front of you which could lead to a price change before your order gets filled. For example, you could place a market order for ICICI Bank. The current ask price is ₹1,269.80. However, there are only 1,913 shares available at that price. If someone buys 2,000 shares right as you are placing a market order, you won’t get the ₹1,269.80 price; you will likely receive a price of ₹1,269.96 or ₹1270.05.

Illustration 1

Source: Upstox

Source: UpstoxLimit Orders

A limit order allows you to set a specific price that you are willing to buy or sell at. Your order will only get executed if the market price reaches your price AND there is sufficient quantity available at that price. A limit order is useful to avoid overpaying when you are buying or underselling when you are selling. A drawback to this order type is that there is no guarantee of execution. If the market is moving rapidly or the security is illiquid, the market price may not reach your specified limit price or there may not be the volume to support executing your order.

Let’s go back to our ICICI Bank example. If you don’t want to pay any more than ₹1269.80 for this stock, you could set this as your limit price. If the 1913 quantity available is purchased by another trader just prior to you placing your limit order, your trade wouldn’t immediately get filled. This is because the ask price would rise to ₹1269.95 which is above your limit price. The only way for your order to then get filled would be for the price to fall back to ₹1269.80 or lower.

Illustration 2

Source: Upstox

Source: UpstoxStop Loss Orders

Stop loss orders combine elements of market and limit orders. They activate when the price of a security reaches a trigger price. You set this trigger price as part of your order and you also specify if you want your stop loss order to be treated as a market order or a limit order once triggered.

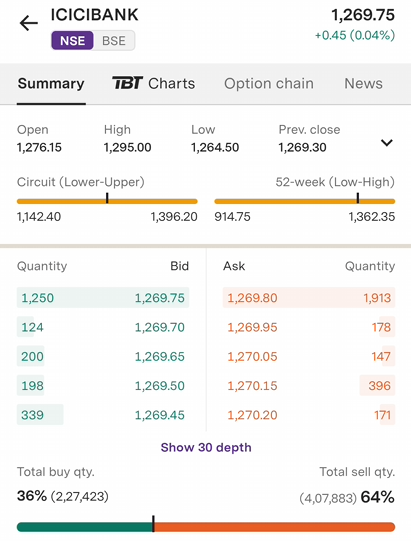

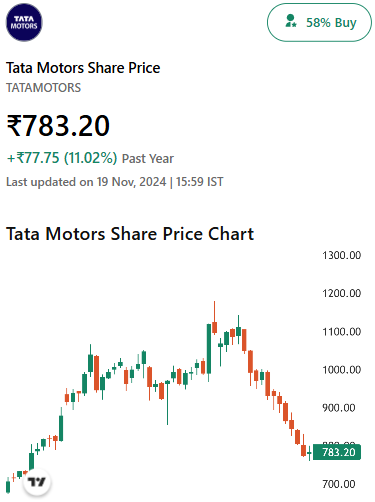

A stop loss order, or stop loss-market order, will place a market order once the security price reaches your trigger point. Assume that you own shares in Tata Motors. It is currently on a downward price trend and while you would like to keep owning it, you are worried about it falling further. You decide that if the price falls below ₹780, you are no longer interested in holding this stock. So, you set a stop loss-market order with a trigger of ₹780. If Tata Motors falls to a price of ₹780, then your market order to sell will be sent to the exchange. Keep in mind, this does not mean that ₹780 is the price that you are selling at!

Illustration 3

Source: Upstox

Source: UpstoxIf the market is fast moving, there is a chance that you could get a market price that is well below the price of ₹780. As with normal market orders, you are paying for fast execution and not a specific price point. Of course, fast execution won’t give you that much of an advantage if the markets are also moving fast.

There is also something known as “gap risk”. Stop loss orders don’t get triggered at the exact price; the trigger price is treated as a boundary. Let’s look at another example. Assume you own shares in the Indian Oil Corporation and you set a stop loss order for ₹177. You do this while the price is currently trading at ₹180. As you can see in this chart, the price went from ₹180 and gapped over ₹177 and opened around ₹173 before trading back up to around ₹175. Your stop loss order will get triggered because the price is below the target price of ₹177. Since the market price will be ₹173, this is what you will get filled at. This is far below your stop loss trigger price of ₹177.

Illustration 4

Source: Upstox

Source: UpstoxThere is also a stop limit order or stop loss-limit order. With this stop loss type, you still set a trigger price for the stop loss order to go into effect. However, you will also set a limit price for your order to be executed at. For example, if you own shares in Bharti Airtel and want to protect yourself against further downside price movement. It is currently trading at ₹1525.50 and you set a stop limit order with a trigger price of ₹1525 and limit price of ₹1524. This means that if Bharti Airtel falls to ₹1525, a limit order to sell your shares at a price of ₹1524 will be sent to the exchange. If the stock slides down to ₹1525 and then to ₹1524.95, you will likely get filled at ₹1524.95. This is because ₹1524.95 is a better selling price than ₹1524.

Illustration 5

Source: Upstox

Source: UpstoxSimilar to stop loss orders discussed previously, there is a gap risk. With the market order version of stop losses, you could potentially get filled at a far worse price than anticipated if the stock gaps in the wrong direction. With stop limit orders, you may not get filled at all! What would happen in our example if the stock trades to ₹1525, then gaps down to ₹1523, and continues sliding down. Your limit order would get triggered at ₹1525 but the next available price of ₹1523 is worse than your limit price. Therefore, your order won’t get filled. You may think that you are protected by the stop limit order but you weren’t because of the price action.

Conclusion

Each type of order has its place in trading strategies. Market orders are best for simple execution where speed and high-priority exits are critical. Limit orders help you make precise entry and exits which is beneficial if your strategy relies on capitalizing on small price discrepancies.

Stop loss orders can be essential for risk management with stop loss-market orders helping you gain an edge in execution speed and stop limit orders providing additional price control. Even though there are some drawbacks to stop loss orders, particularly associated with price gaps, the benefits usually outweigh the risks.

Is this chapter helpful?

- Home/

- Using Stop Losses