Profitability of Profit

Probability of Profit is an options-specific metric that provides you with an estimated likelihood that you will turn a profit. While this exact concept is less important for stock trading, this is still an interesting topic to understand as it helps you more readily consider trade-level profitability.

Probability of profit, or PoP, considers all possible outcomes and their associated likelihoods, and is expressed as a percentage. The higher the probability of profit, the more likely it is that the trade will generate a profit. This metric doesn’t provide insight into how much profit will be made; the return could be +1,000% return or a return of +0.001%. Probability of profit is important to understand for trading because it helps you identify the likelihood that a particular trading strategy will be profitable in the long run.

When traders make decisions, they need to have an understanding of the underlying probability of success. This helps them make informed decisions and manage their risk. Often, trades with a high probability of profit will have lower max gains than trades that have lower probability of profit. If the trade doesn’t have a lower max gain but has a relatively high probability of profit, then the trade will likely have a less favorable risk/reward ratio. No strategy will have a high probability of profit, high max gain, and highly favorable risk/reward ratio. There will always be trade-offs and it is up to the trader to determine what is appropriate for them as well as how to manage the trade once deployed. It is also important to remember that no trading strategy is 100% successful, so understanding the probability of success is key to making profitable trading decisions.

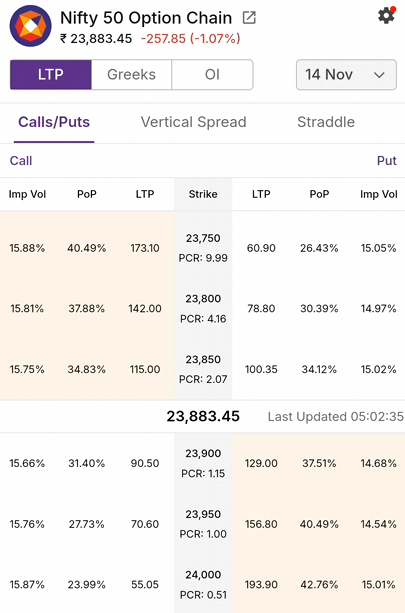

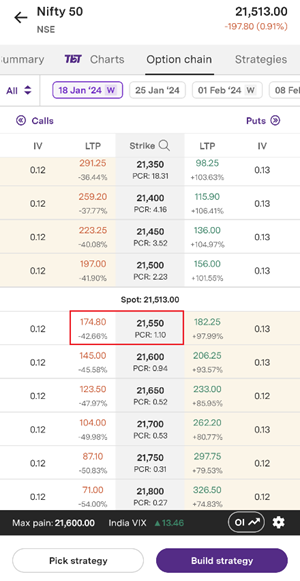

We will cover how to calculate this momentarily but the easiest way to find this is in our app and on our website. If you login to our website and search for an index or stock option chain, one of the data points you will see is PoP. In this example, we are showing the option chain for the Nifty50. We are displaying three data points for each strike price: LTP or Last Traded Price, PoP or Probability of Profit, and Imp Vol or Implied Volatility. If you look at the strike price of 23900, the PoP is 34.02% for the call option and 34.97% for the put option. This means that the market is estimating that this particular call option contract will have approximately a 34% chance of turning a profit. Again, this could be one rupee in profit, one thousand rupees, or more. Probability of profit does not inform you of the magnitude of the potential gain.

Illustration 1

Source: Upstox

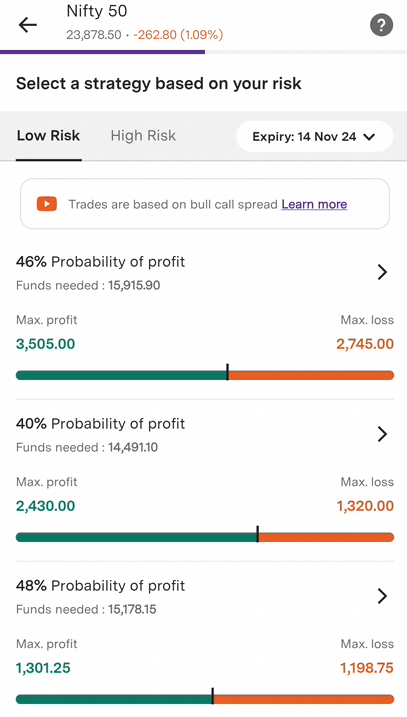

Source: UpstoxAnother way to find PoP is with our Ready-Made Option Strategies product. In the Upstox app, specifically the Pro side of the app, you will be able to find Ready-Made Option Strategies. This is a screenshot from this product.

As you can see, the product has curated three potential option trades. These trades have a 46%, 40%, and 48% probability of profit respectively. You don’t need to do the calculations for this metric – we do them for you! There is also another interesting point. We are also displaying the max profit and max loss for each of these strategies. This will let you balance the tradeoff between the likelihood of success, how much you can potentially make, and what you are risking.

Illustration 2

Source: Upstox

Source: UpstoxNow, you may be wondering: does the probability of profit accurately predict the future? No, it simply a forecast based on current market data and an options pricing model – the Black-Scholes Pricing formula. When trading or investing, there is never a guarantee of future results. The probability of profit is a percentage and there is always the chance that the other side could occur. For example, you may have an 80% probability of profit but the 20% could be what is observed by you. An analogy to this is a weather forecast. A meteorologist may forecast a 20% chance of rain in your area but you may still observe rain despite the chance of rain being relatively low. In addition to this, market conditions can change. When you enter into the trade, the probability of profit may be at a certain level but it can change based on events like a change in interest rates, news about inflation, geopolitical instability, or earnings announcements. Any new information could subtly or dramatically change the probability of profit.

Manually Calculating the Probability of Profit

Assume that you are interested in calculating this metric for yourself. Perhaps you are building out your own algorithmic trading strategy or you just want to know more. To do this, you need to have the following values:

- Underlying Price (S0)

- Breakeven Point (B)

- Volatility (σ)

- Interest rate

(r) - Dividend Yield (q)

- Days to Expiration (t)

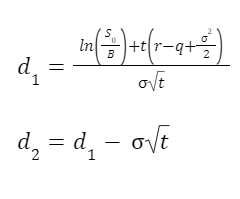

Once you have that, you use these two formulas for call options and put options to calculate the PoP.

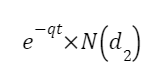

- Call Option PoP formula:

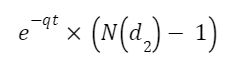

- Put Option PoP formula:

The breakeven point (B) value will vary by option strategy. For example, a long call option has a breakeven point of the strike price plus the premium paid to enter the strategy. A bull call spread has a breakeven point of the lower strike price plus the net premium paid to enter the strategy.

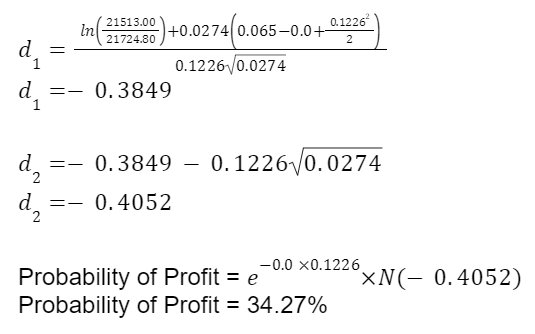

Since these are pretty archaic formulas, let’s walkthrough an example with some actual data. Assume that you want to estimate the probability of profit for a call option on the Nifty. The underlying is trading at 21513.00 and the strike you are interested in is the 21550 that is just slightly out-of-the-money. The expiration is 10-days from now and is priced at 174.80.

Illustration 3

Source: Upstox

Source: UpstoxThe implied volatility is 12.26%, interest rate is 6.5%, and dividend yield is 0.0%. You can calculate the breakeven point by adding the call price of 174.80 to the strike price of 21550. The time until expiration on an annual basis is 0.0274 (10 / 365).

Conclusion

The Probability of Profit is a metric that is associated with option’s trading. You can either directly calculate the value or you can simply look to Upstox to get this value. It is not a prediction of the future and there are no guarantees in trading. However, it can be used as a gauge so that you will have a general idea if there is a high, medium, or low chance of having the trade be profitable. By balancing this against what you could potentially earn or loss on a trade, you can have a better-informed trading plan.

Is this chapter helpful?

- Home/

- Profitability of Profit