One Percent Rule

It may be easy to simply state “don’t risk more than you can afford to lose” but how do you put this into practice. If you are making multiple trades per day, some of these trades may have a higher risk of loss than others. Perhaps the ones with a higher risk of loss have the potential for significant upside. This can make it confusing to know how much to allocate on a single trade. There is a rule of thumb to help you out with this: the one percent rule.

The 1% Rule

This rule is as simple as it sounds: don’t risk more than 1% of your capital on a single trade. Keep in mind, this is for active trading. If you are buying and holding individual stocks, mutual funds, or ETFs, you don’t need to follow this rule.

What this rule essentially means is that if you have a balance of 50,000 as your trading capital, then the most you should risk is ₹500 or 1% x 50,000. The intent is to minimize the impact to your portfolio if you were to suffer a dramatic loss. When you trade options, it is quite possible to lose the entire premium. This is a screenshot from the Upstox app – specifically, the Ready-Made Option Strategies product. This shows a call option on the Nifty50 which will cost you ₹3,952.50 to purchase. A call option has unlimited downside but if the underlying index or stock doesn’t move far enough in your favor, you could potentially lose the entire premium. In this case, if the Nifty closes below 23800, or moves down -0.03%, by expiry, you will lose the entire ₹3,952.50.

Assuming that you only had ₹50,000 in capital, this trade would be approximately 8% of your portfolio. So, there is the potential to lose 8% of your capital in a few days – that is a substantial hit! This is why the 1% rule is important.

Illustration 1

Source: Upstox

Source: UpstoxIf you instead had ₹4L in capital, this trade would be slightly less than one percent. If this trade is unsuccessful, the worst-case scenario is that you only lose the one percent. While not a preferred outcome, losing one percent over a few days on a trade won’t impact your long-run success.

A Practical Approach

Whether you are just starting your journey in the markets or have been active for several years, you need to maintain flexibility. Keep in mind: flexibility does not mean lack of discipline. The markets continually evolve and asset classes, sectors, and individual securities will fall in and out of favor over time. If you are too rigid in your approach, you could end up missing out on opportunities. We also recognize that capital could be a limitation. In our option example, the one percent rule would require you to have substantial capital to place these trades. The intent of the one percent limit is to ensure your long-term trading viability assuming catastrophic losses such as 50% or 100%. If you are diligent to ensure that you exit trades before suffering losses of this size, then you could consider being flexible and going as high as 3% to 5% of capital per trade.

This is even more true if you don’t trade options because the likelihood of losing this amount of capital – as long as you are focused on stocks with higher liquidity – is exceptionally low. If you are trading stocks, you should feel be able to also trade at a higher amount of capital than the one percent rule suggests. Ultimately, the decision to be flexible is based on potential upside and potential downside.

Assume you are running a simple options strategy where you purchase call options on the Nifty each week systematically with no other insights or analysis. What if you do historical research on the price returns of the Nifty following the Union Budget and come to the conclusion that the markets generally do really well following this event? You could be completely inflexible and continue to trade at the one percent limit. Or, you could have some flexibility, while still be financially prudent, and perhaps increase the limit for these select trades. You should be able to do this if you have higher conviction with certain ideas. Similarly, you should feel free to reduce the limit if you think that there could be a potential for higher risk during a certain time period.

Illustration 2

Source: Upstox

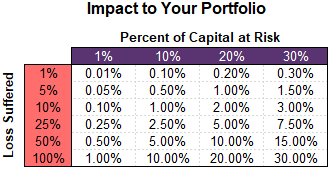

Source: UpstoxFor reference, if you are trading large or mid cap stocks intraday, the large loss could be -10%. Of course, there is always the potential for a larger loss but for many stocks, this size of loss is far more realistic than a loss of 50% or 100%. In this table, if you allocate one percent to an equity trade and it goes down 10%, the impact to your portfolio is only -0.10%: a negligible amount. Conversely, if you only allocated one percent to this trade and it goes up 10%, then your portfolio will only rise by +0.10%. So, for stock trades, you should feel comfortable with being flexible with the one percent rule.

Conclusion

In summary, the one percent rule is a good starting point to determine how much you should allocate to a particular trade. It shouldn’t be strictly followed because it doesn’t account for your confidence in a specific trade, the potential upside, or the varying loss potential per trade. Ultimately, the intent of this rule is to get you to think about long-term trading success and how a loss could impact your portfolio.

Is this chapter helpful?

- Home/

- One Percent Rule