Max Gain, Max Loss

When you enter into any trade, you may be thinking about how much could possibly make. Perhaps you are hoping for 10% or 20% return or maybe even several multiples of your investment. While it is nice to dream, you should be analytical when it comes to thinking about potential outcomes. The best-case scenario is known as the “max gain” of a trade. Alternatively, the worst-case scenario is known as the “max loss”. You should have a reasonable idea of what these two possibilities are prior to making the decision to deploy your capital.

There are two types of max gains: an unlimited gain and a fixed gain. Similarly, max losses can either be: an undefined (unlimited) risk or defined (fixed) risk. Let’s break this down by looking at max gains and losses for both stocks and options.

Max Gains: Stocks

How high is up? Whether you are looking at a price chart or looking at the sky, theoretically the highest something can go is infinite. The max gain when you buy a stock is unlimited. In reality, when was the last time you saw a stock go from ₹1 to ₹1,000 or ₹10,000 or ₹1,00,000? You probably haven’t seen this.

A stock may move up 10%, 20%, or could possibly even double in a year’s time. But could a stock double in a day or an hour? Not likely. When you think about max gains for stocks, you should consider: 1) what is the theoretical max gain and 2) what is the realistic max gain given your anticipated holding period. Each of these will be different answers. Let’s use TCS as an example. The theoretical max gain of any stock is unlimited. However, this isn’t going to happen in the near future. Even if you plan to hold the stock for several years, this won’t occur. The likely case is that you will trade this stock intraday, a few days, or possibly a few weeks. To get an idea about the realistic max gain, you can look to historical data to see how much TCS moves during your potential holding period.

Let’s assume you plan to only hold this stock for one day. If over the last several years, the most it has moved up in a day is +4.6%, you can use this as a potential benchmark. Perhaps, you can conclude that your realistic max gain while holding this stock is around 5%.

Illustration 1: Example Max Gain Table

| Theoretical Max Gain | Realistic Max Gain |

|---|---|

| Unlimited | 5% |

Something to remember is that this isn’t an exact science. You should also consider that past performance doesn’t equate to future performance. Despite this, using historical data can give you a reasonable benchmark to better set your expectations. If you don’t understand what you can possibly gain for a trade, then you will have no idea if it is worth it to risk your capital.

Max Gains: Options

We saw that the theoretical max gain for a stock is unlimited. When you buy a call option, which gives you the right to buy a stock, your max gain is also unlimited. However, a put option gives you the right to sell a stock. So, a put option will perform better if the underlying stock or index falls in value. The lowest a stock can fall is to 0. So, the put option’s theoretical max gain occurs when the stock drops from its current price to 0. The max gain of a put is the difference in the current price of the stock (or index) and 0.

Illustration 2: Example Theoretical Max Gain Table

| Theoretical Max Gain: Call | Theoretical Max Gain: Put |

|---|---|

| Unlimited | Current Stock Price – 0 |

To understand realistic max gains for options, you need to do a little further extrapolation and combine that with the profitability formula. The profitability formula for a call and put option are as follows:

- Call Option: Maximum (0, Underlying Price – Strike Price) – Option Cost

- Put Option: Maximum (0, Strike Price – Underlying Price) – Option Cost

You would use the same approach as with stocks where you used historical price movements to benchmark the potential gain. Assume you believe that a stock that is priced at 1000 could go up 5% in the next week and decide to buy a call option with a strike price of 1000. A 5% gain would place this stock at a price of 1050. Using the call option profit formula, you would calculate the following:

- Call Option Realistic Max Gain: Maximum (0, 1050 – 1000) – Option Cost

- Call Option Realistic Max Gain: 50 – Option Cost

For put options, you would take the same approach. The differences are that you would focus on how much the price of the stock could fall and you would use the put option profit formula. Keep in mind, this is for long options or options that you purchase. Short call and put options have different max gains. Since short options are a more advanced strategy, discussion about these strategies is beyond the scope of this lesson.

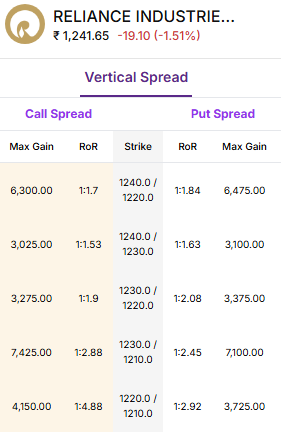

We’ve discussed theoretical and realistic max gains. There is also a fixed max gain also known as a fixed payoff. You will see that whenever you trade options; specifically, when you are trading combinations of long and short options. One such option strategy is a vertical spread which involves buying a call and selling a call or buying a put and selling a corresponding put. The details of the strategy are beyond the scope of this lesson but this screenshot from the Upstox website provides this information.

Illustration 3

Source: Upstox

Source: UpstoxIf you look at the first line, there is a max gain of ₹6,300 listed for this particular strategy that involves buying a 1220 call and selling a 1240 call on Reliance. If you continue to the next line, the max gain is different. It is ₹3,025 for this strategy. For each of these strategies, these numbers represent the absolute most you can gain by entering into this option strategy. It is not theoretical max gain or a realistic max gain that you calculate. It is defined by the strategy deployed and known ahead of time.

Max Losses: Stocks

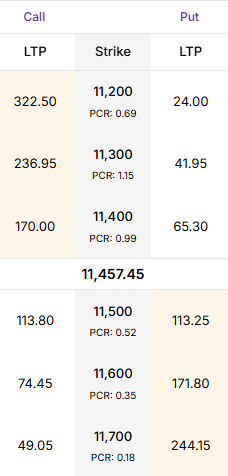

When you enter into a trade, you should always understand: what is the worst that could happen? That is the max loss – the most amount that you could lose. Similar to max gains, there is a theoretical and realistic max loss. In this illustration, we are showing the stock price of Ultratech Cement. On this date, it was trading at ₹11,457.45. If you were to buy a share of this stock and the value of the stock fell to zero, you would lose ₹11,457.45. This is the worst-case scenario; the max loss.

Illustration 4

Source: Upstox

Source: UpstoxFor stocks, the theoretical max loss is the price of the stock. Of course, the likelihood of this happening is extremely small. The company would have to go bankrupt in order for the price to reach zero. Even then, you would likely know in advance if a company is in financial trouble prior to it becoming completely insolvent. A more realistic max loss is one that could occur due to a substantial market decline rather than the company failing. Think back to the global financial crisis of 2008 or the start of the pandemic where the market indices and individual stocks fell 40%, 50%, or more in some cases. Events like this are unpredictable and if you happen to be holding a position when this occurs, you could be susceptible to a loss.

You can look to historical data, either from the specific stock or broader index, to see how large of a drawdown has occurred. If you see the worst daily loss is -15% and you only plan to keep this trade for one day, you can make the assumption that the realistic max loss is -15%. Likewise, if you intend to hold a position for a week and the worst historical loss for a week is -25%, you can assume this is the realistic max loss.

Illustration 5: Example Max Loss Table

| Theoretical Max Loss | Realistic Max Loss |

|---|---|

| Unlimited | -25% |

Max Losses: Options

When you purchase options, your max loss is defined. In fact, the max loss is limited to the price of what you paid for the option. This is regardless of how much the stock moves up or down in price. This is a sample option chain for Ultratech Cement. If you were to purchase a call option with the strike price of 11500, this would cost you ₹113.80. This is the max loss for this trade. Similarly, if you purchase the 11300-strike price put option, the max loss is ₹41.95.

Illustration 6

Source: Upstox

Source: UpstoxIllustration 7: Option Max Loss Table

| Max Loss: Long Call | Max Loss: Long Put |

|---|---|

| Premium Paid | Premium Paid |

One thing to note is that the max loss for a short option is different than the max loss for a long option. Short call and put options require more trading expertise and discussion about these strategies is outside the scope of this lesson.

Conclusion

As you develop your trading plan, you need to understand your upside and downside. While you won’t always attain the max gain or loss each time you trade, you should be aware of them. This will help you better understand your risk-reward trade-offs. Ultimately, this will help you in determining whether or not you should place this trade or if you consider certain risk management measures to better align the risk-reward with your end goals.

Is this chapter helpful?

- Home/

- Max Gain, Max Loss