Low Risk or Low Correlation Trades

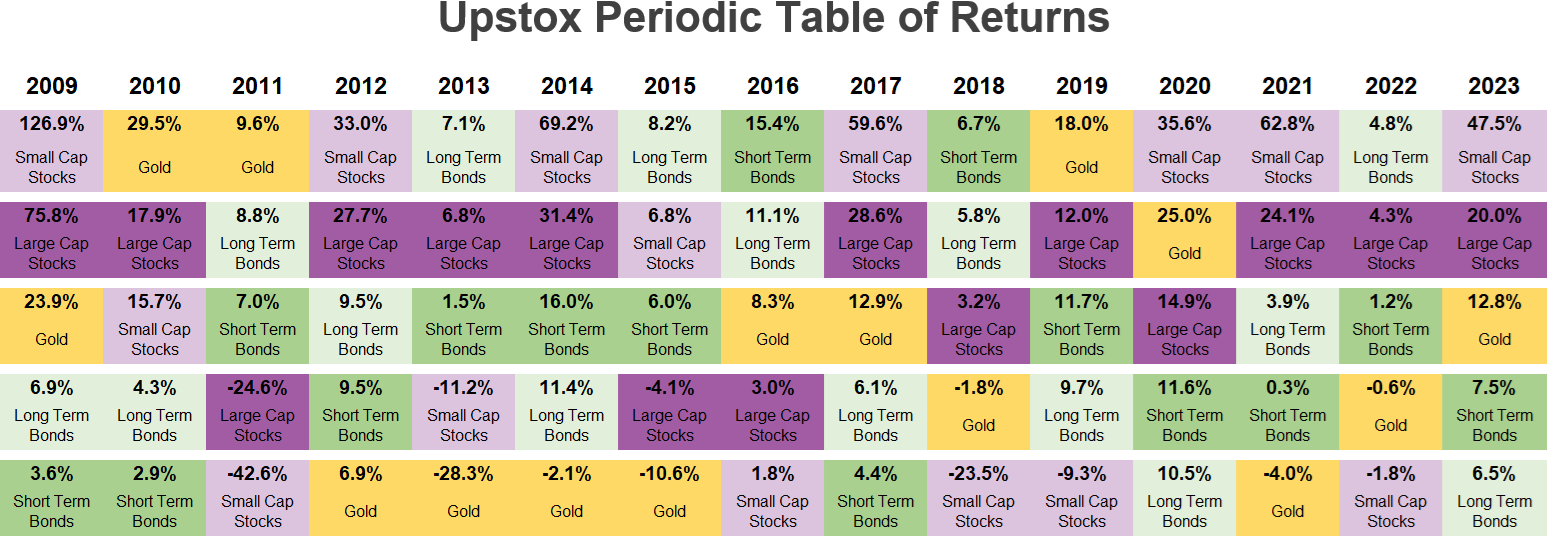

This is the Upstox Periodic Table of Returns. It provides an annual ranking of five asset classes where the best performing asset class each year is listed highest, followed by the next best performing asset class below that, and so on. The five asset classes are large cap stocks, small cap stocks, long term bonds, short term bonds, and gold. Since each asset class is color-coded, it is easy to notice that no asset class continually performs the best – there is a continual rotation from top to bottom and reverse.

Illustration 1

Source: Upstox

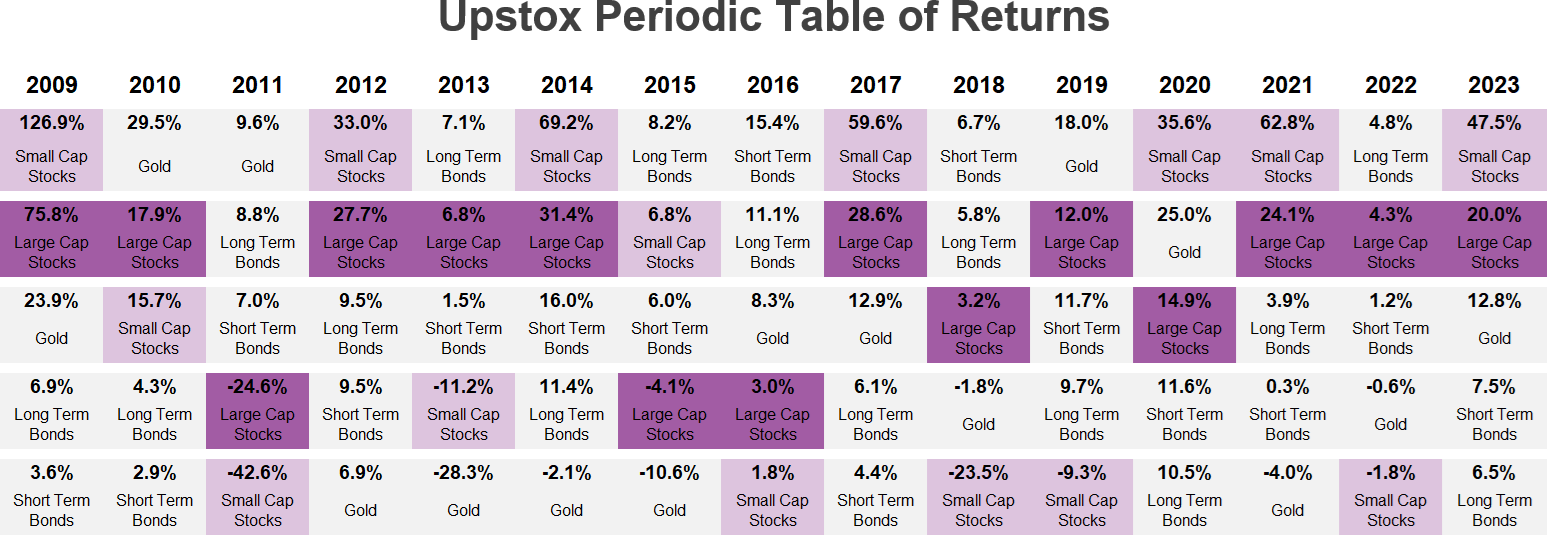

Source: UpstoxHere we are highlighting the performance of the large cap and small cap stocks. Small cap stocks have the largest swings. For instance, in 2017, they were the best performing asset class with a near 60% return. In the following years of 2018 and 2019, they were the worst performing asset class with returns of -23.5% and -9.3% respectively. Even large cap stocks have swings like this where the years of 2010 to 2012 had returns of 17.9%, -24.6%, and 27.7%.

Illustration 2

Source: Upstox

Source: UpstoxWhether you are investing in these asset classes or using them to trade – either intraday or for days or weeks at a time – you may want to consider parking a portion of your capital in “safe havens”. Safe haven investments are usually lower risk or low correlation to other asset classes. While they may regularly underperform other asset classes, when the markets get volatile, these assets tend to outperform.

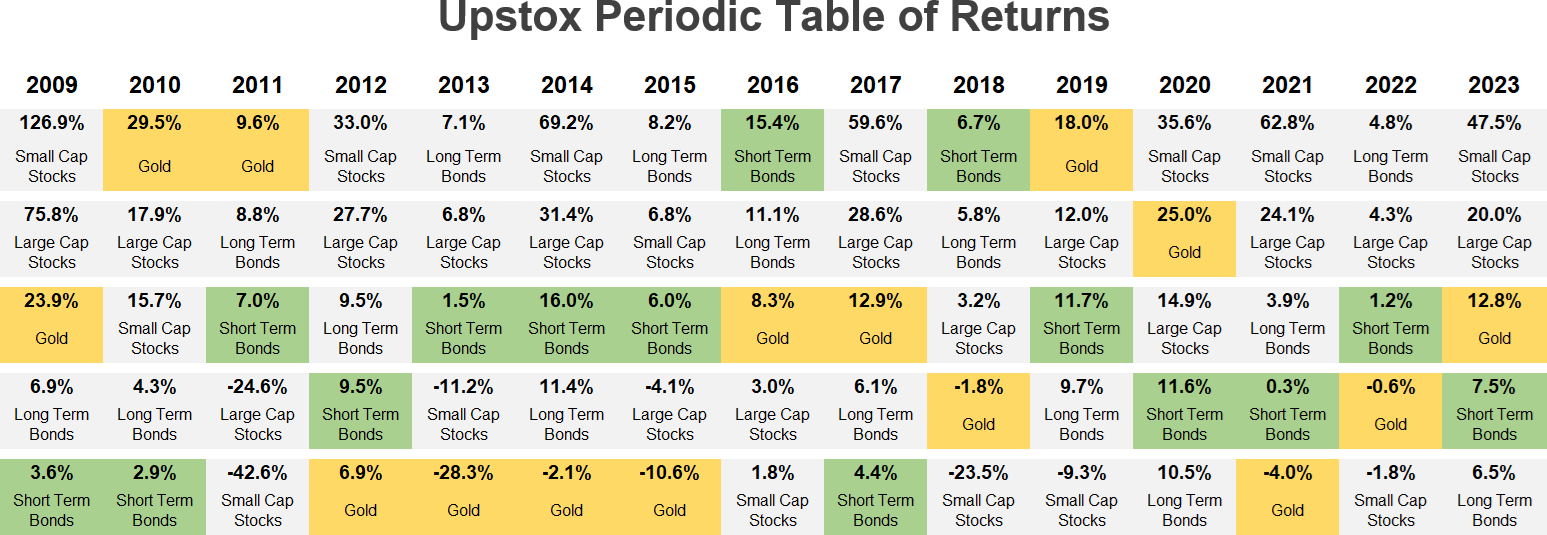

We are now highlighting two asset classes that are typically considered safe havens: short term bonds and gold. Short term bonds, or fixed deposits, are highly liquid, low risk, but provide low returns in exchange for that level of risk and liquidity. Gold is considered as an inflation hedge. While these asset classes aren’t necessarily correlated, as you can see in our periodic table of returns, they tend to perform better when equities are struggling. For example, in 2018 and 2019, short term bonds and gold generated positive returns compared to the losses of small cap stocks during those years.

Illustration 3

Source: Upstox

Source: UpstoxOf course, if you are a trader, you likely aren’t going to build strategies around gold and fixed deposits. However, what you should consider is not allocating every rupee to a live strategy. You never know when the markets will turn and conditions that are ripe for your strategies will all of a sudden no longer be in favor. Perhaps allocating a few percent, anywhere from one percent to ten percent of your capital to safe haven assets could help you survive long-term market drawdowns.

Is this chapter helpful?

- Home/

- Low Risk or Low Correlation Trades