Hedges

For those of you that don’t trade options, here is a quick primer. There are two types of options: call options and put options. If you are bullish on a stock like TCS, you could buy the call option on that stock. If you are bearish, perhaps on the Bank Nifty, you could purchase a put option. A call option gives the holder the right, but not the obligation, to purchase the stock or index associated with that option. This purchase would be at a specific price and by a specific date. For instance, if TCS is now trading at ₹4,000 but you previously bought a call option that allows you to buy it at ₹3,800, you can claim a ₹200 profit.

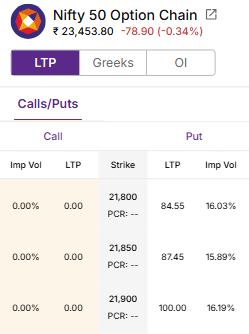

Put options are the opposite: they give the holder the right, but not the obligation to sell. Typically, traders would buy a put option if they believe that the stock or index will fall in the near future. However, you can also use put options to offset losses on bullish trades. Here is an example to help you understand this a bit better. This is a screenshot from the Upstox option chain on our website. The Nifty’s price is 23,453.80. In the first row highlighted here, there are two key data points: the Strike price which is 21800 and the associated LTP or last traded price of ₹84.55.

What this means is that if the Nifty falls to 21800 from its current price, which would be a drop of over 7.5%, and then falls a further ₹84.55 to account for the price of the option, then this trade will be profitable. For example, if the Nifty enters into bear market territory and falls by 10% while you own this option. You will first become profitable once the Nifty crosses 21715.45 (21800 – 84.55). A down ten percent move would place the Nifty at 21108.42. The profit on this trade would be the difference between 21715.45 and 21108.42 or ₹607.03. You get this potential return for a price of ₹84.55.

Illustration 1

Source: Upstox

Source: UpstoxYou can also think of it as a tradeoff: for 0.36% of the current price of the Nifty (84.55 / 23453.80), you get protection for losses greater than 7.5% during the period of you holding the put option.

Why would you consider something like this? Warren Buffett’s rule is to be “fearful when others are greedy and be greedy when others are fearful”. Looking at the second part of his statement, when the markets are falling, traders and investors will be fearful. The faster and steeper the price decline, the more that market participants will be scared. This is what can create opportunity. If people were buying stocks a few days ago at far higher valuation before the price fell, then what really changed fundamentally about the story? This is the type of buying opportunity that legendary traders and investors like Buffett look for. To take advantage of this, you need to have “dry powder”. You don’t want to exit your positions at the bottom to try to find another opportunity.

With hedges, these positions will regularly lose a small amount of money but when the markets fall, they can create outsized returns. While these returns won’t necessarily offset the losses across your portfolio, it can provide you with some capital, or “dry powder”, to make some purchases while at market lows.

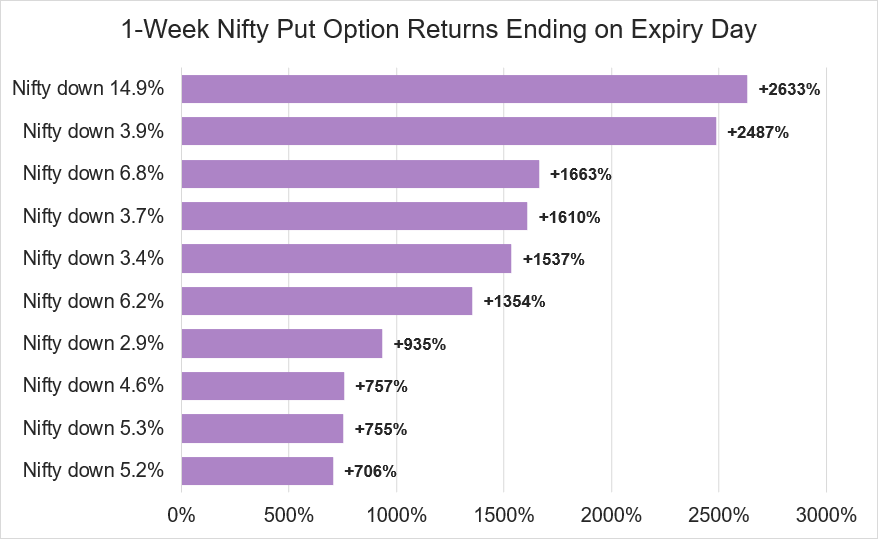

This is a simple historical backtest of put option performance. In this backtest, we are assuming to buy the put option one-week until expiration and hold through expiry. We look back at data for 2019 through 2023 and specifically looked at buying Nifty put options that are around 2-3% below the current market price of the index. In 93% of the trades, you lose money and the median, or most likely return for this hedge is -100%. The average premium for these options was ₹21.

In this chart, we show the best performing weeks for this backtest of using Nifty 1-week put options as a hedge. The best week was a gain of 2,633% when the Nifty was down 14.9%. This occurred at the start of Covid (12 March 2020 expiry). The fourth best week when the Nifty was down 3.7%, and the hedge was up 1,663%, also occurred during Covid (27 Feb 2020 expiry). As you can imagine, your trading strategies may not have performed well at all during this time period. However, having a little bit of extra capital from gains associated with hedges would have helped to offset some of the losses.

Illustration 2

Source: Upstox

Source: UpstoxHedges aren’t mandatory for a trading plan but are something that should be considered if you want to be a trader or investor for a long period of time. While our last example involved purchasing short term put options, a more common approach is to purchase longer term put options. You would typically do this when the market is performing well which would make the cost of buying the put options relatively cheaper. By purchasing further out, it becomes a “set it and forget it” type of trade. Perhaps you do this on a quarterly or semi-annual basis. This will also help you understand how much the hedge is financially holding back your portfolio when the markets are doing well. Unfortunately, while hedges can help during times of crisis – there are no free lunches on Wall Street. If you are buying hedges, and they aren’t necessary because the markets are moving upward, then the hedges will ultimately expire worthless and not add value to your portfolio despite the cost.

Is this chapter helpful?

- Home/

- Hedges