Breakeven Points

This lesson is about breakeven points and is a concept that is most commonly discussed with options trading but can still be used for stock trading. Assume you are starting a small business and this will involve you selling small items on eBay. Since you are comfortable around electronics, you decide that you will find used or broken items like computer mice or keyboards, refurbish them, and sell them. Even though the items you will refurbish won’t initially work, you will still have an upfront cost to purchase them. The price at which you sell these refurbished items need to be higher than the upfront cost. The upfront cost for each item is the breakeven point – any amount that you can sell the item for on eBay that is higher than the breakeven point will result in a profit.

The breakeven point is an important concept to understand when trading because it helps you determine how much the underlying needs to move to be profitable and at any point in time, you can see how much more movement is needed to be profitable or not. When trading, you should also to take into consideration the total cost of the trade. This would include items such as brokerage costs, exchange fees, taxes, and other expenses. This helps you determine whether or not a trade has been profitable and how much you can make from it. Knowing your breakeven point can help you make informed decisions when trading and help you maximize your profits.

The breakeven point calculation will vary by strategy or asset class. As a trader, you will need to use a few parameters like how much you paid to enter the trade and the price of the asset at the time you enter the trade. For options, the strike price and specific option strategy used are also critical to know. When using stocks or ETFs as the asset class for your strategy, there will be only one breakeven point. If you are trading options, there will also only be one breakeven point unless you use a complex, multi-option strategy like a straddle or iron condor. In this case, there will be two breakeven points. In this lesson, we won’t cover complex option strategies.

Long Stock, ETF, or Mutual Fund

The breakeven point for a stock (or ETF or Mutual Fund) is the price that you bought the stock at plus commissions, taxes, and any applicable margin fees. Since you only pay commissions on the transaction rather than on each share, you need to divide your total charges by the number of shares purchased. The more shares purchased, the lower the amount that the stock will need to move in order to offset the transaction costs.

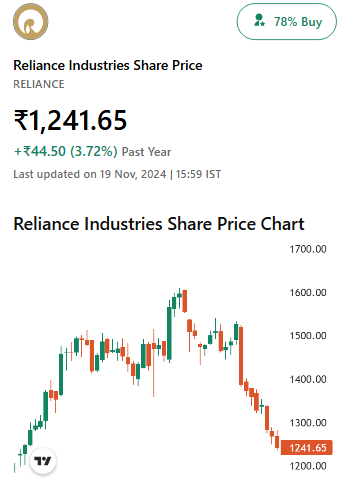

Illustration 1

Source: Upstox

Source: UpstoxHere is an example. Assume that you decide to buy shares in Reliance. It is currently trading at ₹1,240. The brokerage fees are ₹20 and taxes are ₹5 for a total transaction cost of ₹25.

If you buy only one share, then your per share transaction cost is ₹25. You add this to the price of ₹1,240 to get to a breakeven point of ₹1,265. This means that Reliance needs to go up about 2% in order to start turning a profit.

If you buy five shares, then your per share transaction cost is reduced to ₹5 (25 / 5 shares). Adding this ₹5 to the stock price of ₹1,240 results in a breakeven point of ₹1,245. In this case, the share price of Reliance only needs to rise by 0.4% in order for you to reach the beginning of profitability.

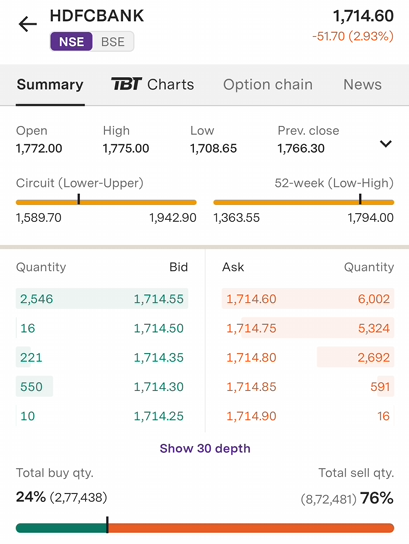

Something to also remember is the bid-ask spread. While you typically see the Last Traded Price, or LTP, within brokerage apps, the LTP isn’t necessarily the price you will pay to enter or exit a trade. In the Market Depth feature of the Upstox app, you will see the Bid and Ask prices. The ask price is the price that other traders are willing to sell this stock to you for; the ask price is what you pay to buy a stock (or option). Alternatively, the bid price is the price that others are willing to buy the stock from you for. The bid will always be lower than the ask.

In this example, we have HDFC Bank with the last traded price of 1,714.60. The bid price is 1,714.55 and the ask price is 1,714.60. If you were to buy this stock, you would pay the asking price of 1,714.60. If you then decided to immediately sell it, you would sell it at a price of 1,714.55 – a loss of 0.05. This stock is highly liquid so the spread is narrow. For stocks, or any tradeable security, that are less liquid, you will see a wider bid-ask spread. With a wider bid-ask spread, the asset’s price needs to rise even more to account for this.

Illustration 2

Source: Upstox

Source: UpstoxOptions – Basic Strategies

There are two types of options: calls and puts. With calls and puts, you can enter into a long position or a short position. Combining this results in four basic strategies: long call, long put, short call, and short put. Let’s use this example option chain for the Bank Nifty to quickly illustrate how to calculate the breakeven point for each of these strategies.

Illustration 3

Source: Upstox

Source: Upstox-

Long Call – The breakeven point for a long call is the strike price plus the premium paid. Once the underlying asset price moves above this point, the trade will be profitable. Let’s look at the 51200-strike price. The premium for the call option is ₹185.75. The breakeven point for this trade is ₹51,385.75 or 51200 + ₹185.75. Once the Bank Nifty is above this price on expiry, you will be profitable.

-

Long Put – The breakeven point of a long put is the strike price minus the premium paid and commissions/taxes. Once the underlying asset price moves below this price point, the trade will be profitable. Looking at the 51100-strike price, the put option price is ₹152.25. You would subtract ₹152.25 from 51100. The leads you to a breakeven point of ₹50,947.75. If the Bank Nifty is below this price on expiry, you will be profitable.

-

Short Call – The breakeven point of this strategy is the strike price plus the premium received and commissions/taxes. Short strategies are slightly different in terms of breakeven points. Once the underlying asset moves beyond the breakeven point of a short strategy, the trade will go from profitable to unprofitable. This is the opposite of long strategies that start unprofitable and become profitable once the underlying is above the breakeven point. If you sell a call option on the 51400-strike, you will receive a premium of ₹111.80. Adding this value of ₹111.80 to 51400 provides you with the breakeven point of ₹51,511.80. If the Bank Nifty is above this price on expiry, you will suffer a loss.

-

Short Put – The breakeven point for this strategy is the strike price minus the premium received and commissions/taxes. If the underlying asset price moves below this point, the trade will no longer be profitable. Assume that you sell a put on the 50900-strike of the Bank Nifty. You would collect a premium of ₹83.25 by doing this. Subtracting this premium of ₹83.25 from 50900 will give you the breakeven point for this trade: ₹50816.75.

When you trade options, you will also pay brokerage commissions, taxes, and fees. You should account for these transaction costs in the same way that you do for stocks. You would divide the total transaction costs by the lot size that you purchase. For long and short calls, you would add this per lot transaction amount to calculate the breakeven point. For long and short puts, you would subtract the per lot transaction amount to get the breakeven point.

Conclusion

The breakeven point is an essential metric to understand before entering into a trade. Knowing this ahead of time will let you do a bit of a sanity check as you ask yourself: do I really think x can go up (or down) by this much? When was the last time it did this and under what conditions? If you are comfortable with your answers to these questions, then you that much further to building a robust trade plan that can help you manage risk.

Is this chapter helpful?

- Home/

- Breakeven Points