Avoid Destructive Behaviors

Many novice traders, and even experienced traders, fall into common pitfalls that can lead to significant losses. Three behaviors to avoid are averaging down, forcing trades, and holding onto losing positions. By understanding these traps and learning from the wisdom of legendary traders, you can protect your capital and improve your odds of long-term success.

Don’t Average Down

Imagine this. You decide to buy 10 shares of a tech company that is priced at ₹500 in anticipation of the stock trading upwards following an earnings announcement. Unfortunately, the financial news wasn’t as anticipated and the next day, the stock price falls from ₹500 to ₹350, a drop of 30%. Instead of cutting your losses following the disappointing earnings release, you decide to double down and buy 10 more shares at ₹350. Now, your average price is ₹425 instead of the original ₹500. So, you only need this stock to rise by 21%, from ₹350 to ₹425, in order to breakeven. The problem is that you now have more exposure; you own twice as many shares and the capital at risk has gone up from ₹5,000 (10 shares x ₹500) to ₹8,500 (20 shares x ₹425). If the stock falls further, perhaps another 10%, instead of rising, you will have even greater losses than if you had just stuck with 10 shares.

The concept of averaging down – buying more of a declining stock to reduce your average cost – can be a tempting strategy, especially if you believe the stock will recover. However, as we’ve seen in our example, this behavior often leads to larger losses when the stock continues to drop. Jesse Livermore, one of history’s most famous traders, warned against this approach: "The stock market is never obvious. It is designed to fool most of the people, most of the time."

Don’t Force Trades

Once you start trading, you may think that you need to be doing something every day and if you aren’t doing something, then you aren’t trying hard enough. Even worse, maybe a strategy has been working for you recently stops performing and you have multiple losses in a row. You may have the urge to “claw your way back” by entering into trades that may not have as strong of a signal. In trading, patience is a virtue. Many traders, driven by the fear of missing out (FOMO) or the need to “make something happen,” force trades even when market conditions are unfavorable. The problem is that this behavior often leads to rash decisions and poor outcomes. Waiting for clear setups can save you from such frustrations.

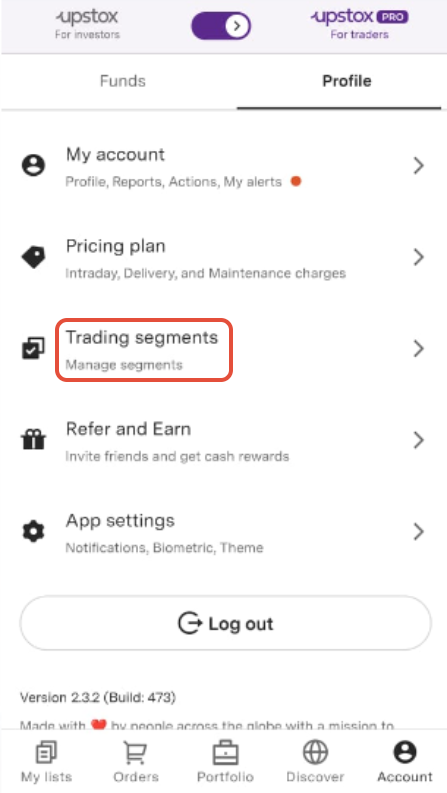

The good thing is that for this behavior, you don’t have to go it alone. The Upstox app has a kill switch that allows you to disable certain segments if you think that you are at risk of forcing trades or overtrading. If you click the ‘Account’ button in the bottom right of the app and then select ‘Profile’ and ‘Trading Segments’, you will be taken to the home page for your active and inactive segments.

Illustration 1

Source: Upstox

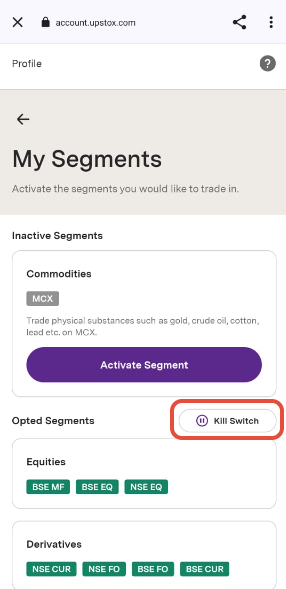

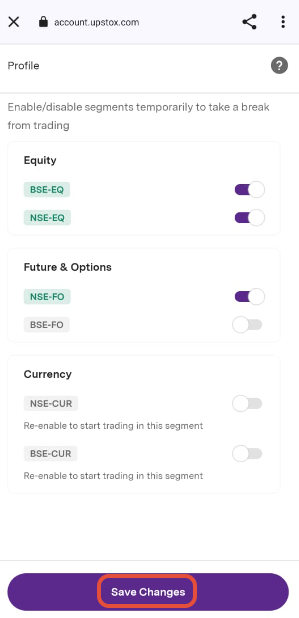

Source: UpstoxFor the active segments, you can click the ‘Kill Switch’ button and individually disable segments.

Illustration 2

Source: Upstox

Source: UpstoxOnce you have confirmed this, the segment will be deactivated for 12-hours. After this time, you can re-enable the segment.

Illustration 3

Source: Upstox

Source: UpstoxDon’t Hold on to Losing Trades

The last poor trading behavior we will discuss involves waiting too long to give up. Let’s assume that you have been bullish on the Nifty all year and this has been confirmed by fundamental analysis as well as short-term technical patterns. Each month, you are going long on Nifty futures and things are working out well. Nine months into the year, things take a turn for the worse.

You enter into a November contract in the middle of September. At the end of the month, the market peaks around 26400. Then, the Nifty trades down to 26100 followed by a gap down with further losses down to 25600. You keep holding as the prices slide even more down to 25600 – a loss of 3%. Shortly thereafter, the Nifty keeps falling to 25200. Exiting at this consolidation point would be a loss of 4.5%.

Illustration 4

Source: Upstox

Source: UpstoxHowever, if you kept holding, each day would bring further and further losses which now exceed 10%. Psychologically, as you keep holding, it will be harder for you to sell as you are mentally benchmarked to prior prices where you could have sold. Initially, you are hoping to get back to flat. As prices keep falling and you keep holding, you will start hoping to get to the last price level that was less of a loss. This can quickly result in a situation of trader paralysis.

Refusing to accept a loss is one of the most destructive habits a trader can develop. Holding on to a losing trade in the hope it will “come back” ties up capital and exposes you to further declines. Sticking to a trading plan that includes understanding the max loss you are willing to accept is critical.

A Final Thought

Being a great trader or investor is less about predicting markets and more about managing risk. Avoiding bad behaviors like averaging down, forcing trades, and holding losing positions can significantly improve your trading outcomes. By adopting disciplined habits and learning from past mistakes, you can keep your emotions in check and trade like a professional. Remember, success in trading isn’t about how many trades that you make – it is about making the right ones combined with the right behaviors.

Is this chapter helpful?

- Home/

- Avoid Destructive Behaviors