Asymmetry of Returns

There is a common saying: “do not put all of your eggs in one basket”. Of course, the logic is that if something were to happen and the basket falls to the ground, then you lose all of your eggs. This concept is extremely appropriate for investing and trading. The last thing you want to do is to put all of your hard-earned capital into a single trade that may not work in your favor. For instance, you would never wager your entire life savings on a single lottery drawing. This is a recipe for disaster. Before we get into how much you should allocate into a particular trade or investment, we want to provide further context as to why it is important to not over-invest in a single trade.

Assume you have 1 lakh rupees to invest. You decide to put all of your capital in one stock. Unfortunately, soon after placing the trade, the stock pulls back in price. By the end of the first week of you holding this position, you are down 1 percent or 1,000 rupees. A bit painful to see on your screen but you still believe in the potential of this stock. In order for you to get back to “even”, the stock needs to rise 1,000 rupees since it has fallen by 1,000.

However, you know have 99,000 rupees instead of 100,000. To gain 1,000, you need to have a return of 1.01%. So, while you lost 1%, to get back to your original capital, you need to have a return of 1.01% (1,000 / 99,000) on your lower capital amount. At this point, this is a “rounding error” and this won’t realistically impact you. This becomes a more serious issue with greater losses.

What if the company you are invested in has a poor earnings announcement and the stock falls 10% in price? Let’s assume the value of your ₹100,000 investment has now dropped to ₹90,000. To gain 10,000 rupees with a current investment value of 90,000 will require a gain of 11.1% (10,000 / 90,000).

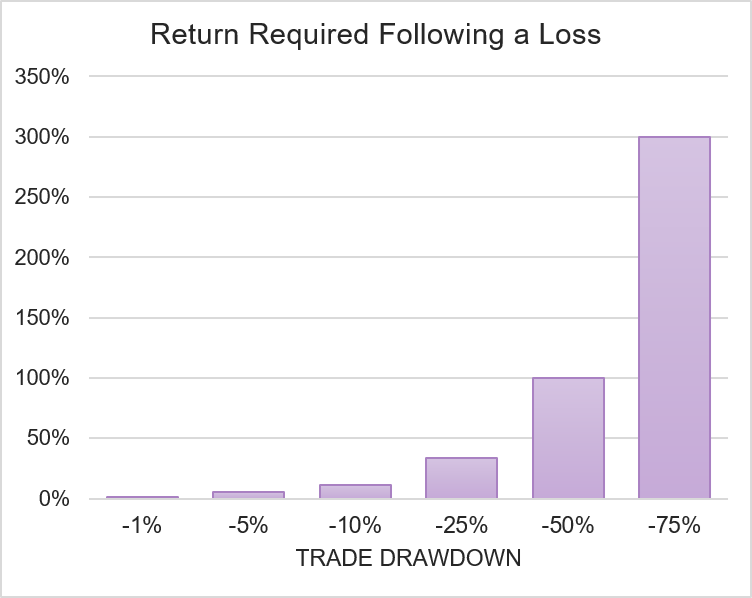

As you can see, there is a disparity that is becoming visible. If you lose a certain percentage, it will take a gain of a larger percentage to get back to reverse the drawn down. Let’s take this one more step forward with an extreme example. What if your trade lost 50% of its value? You now have half the capital that you had before. In order to get back to your original amount, you will need a return of 100%, or double, to get back to your prior capital levels.

In illustration 1 below, you show different levels of trade losses on the horizontal or x-axis. On the vertical axis, we display the return required to reverse the draw down and get back to the prior capital levels. The required returns scale exponentially with larger losses.

Illustration 1

Source: Upstox

Source: UpstoxThis concept is known is asymmetrical returns. Essentially, losses are tough to recover from and the greater the loss, the bigger the gain needed to return to prior levels. What does this mean? As traders and investors, we shouldn’t simply “sit on the sidelines” and avoid all risk to prevent all losses. If you don’t take risk, you can’t expect a gain. However, a critical rule to remember is to “never risk more than you can afford”. Throughout the rest of this course, we will discuss trade risk management best practices so that any risks you take are prudent ones.

Is this chapter helpful?

- Home/

- Asymmetry of Returns