Personal Finance News

Budget 2024: Step-by-step guide to calculate tax on your annual income

.png)

4 min read | Updated on July 23, 2024, 13:38 IST

SUMMARY

Finance Minister Nirmala Sitharaman, while presenting the FY25 Budget, announced a revision in the tax slabs under the new tax regime. She also raised the standard deduction to ₹75,000 from ₹50,000 at present. Here are the key details along with your guide to use the Upstox Income Tax calculator.

Budget 2024: Govt likely to announce tax relief, here’s how to calculate tax on your annual income

The structure of new tax regime was revised by Finance Minister Nirmala Sitharaman, while presenting the Union Budget for fiscal year 2024-25.

Under the revised structure, the first taxable slab of ₹3-6 lakh has been changed to ₹3-7 lakh. Individuals falling under this income range will be taxed at 5%. Similarly, the slab of ₹6-9 lakh has been changed to ₹6-10 lakh. Individuals earnings in this group will be taxed at the rate of 10%.

| Income Range (₹) | Tax Rate (%) |

|---|---|

| ₹0 - ₹3,00,000 | Nil |

| ₹3,00,001 - ₹7,00,000 | 5% |

| ₹7,00,001 - ₹10,00,000 | 10% |

| ₹10,00,001 - ₹12,00,000 | 15% |

| ₹12,00,001 - ₹15,00,000 | 20% |

| Above ₹15,00,000 | 30% |

However, the old tax regime remains unchanged, with those earning from rom ₹2.5 lakh to ₹5 lakh being taxed at 5%, those from rom ₹5 lakh to ₹10 lakh taxed at the rate of 20%, and those earning more than ₹10 lakh being charged at 30%.

Notably, the old tax regime allows more deductions, in the form of house rent allowance (HRA), travel allowance, conveyance allowance and others.

Irrespective of whether you have opted for the new tax regime or the old tax regime, all you need to do is use the Upstox Income Tax Calculator to calculate your tax liability and estimate your net savings.

The Upstox Income Tax Calculator is an online tool designed to help taxpayers calculate their taxes in the simplest way based on their overall income, expenses, investments and tax slabs.

Its step-by-step process guides taxpayers in using all relevant details to calculate their final tax liability.

Using the Upstox Income Tax Calculator not only helps taxpayers estimate their taxable income and income tax but also guides them in comparing tax liability in the old and new regimes.

-

To use the calculator, you need to first keep handy all relevant details, such as your salary, rent, capital gains, or details regarding all exemptions and deductions you want to avail of (like provident fund, new pension scheme, mutual fund, and insurance, among others).

-

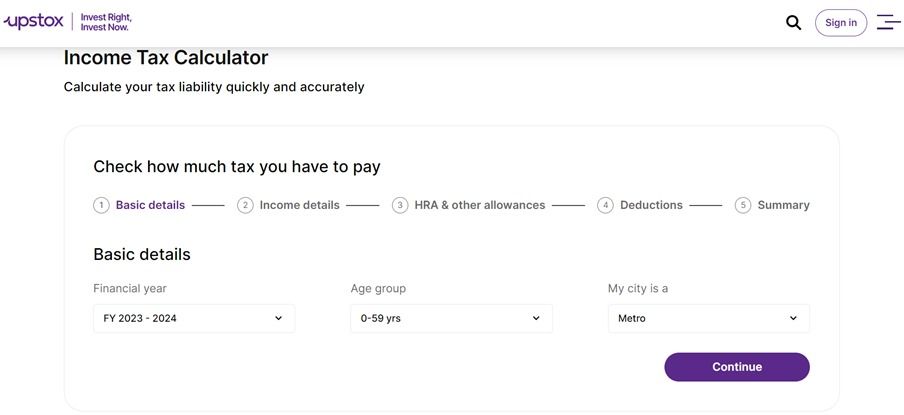

Visit the link https://upstox.com/calculator/income-tax-calculator/.

-

Choose the relevant financial year and the applicable age bracket and indicate whether you are a resident of a metro or non-metro city.

-

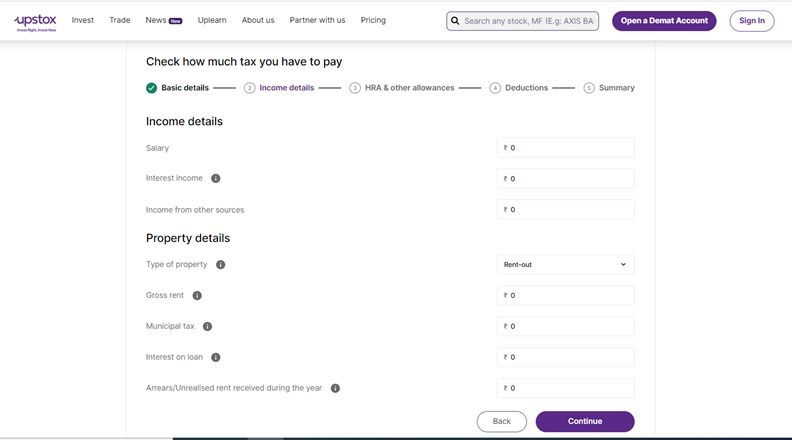

Go to the 'Income' tab and enter your gross salary, including your salary, income from self-occupied or rent-out property, interest income or income from any other sources.

-

If you earn income from property, share relevant property details, such as gross rent, municipal tax, interest on the loan taken for the property, etc.

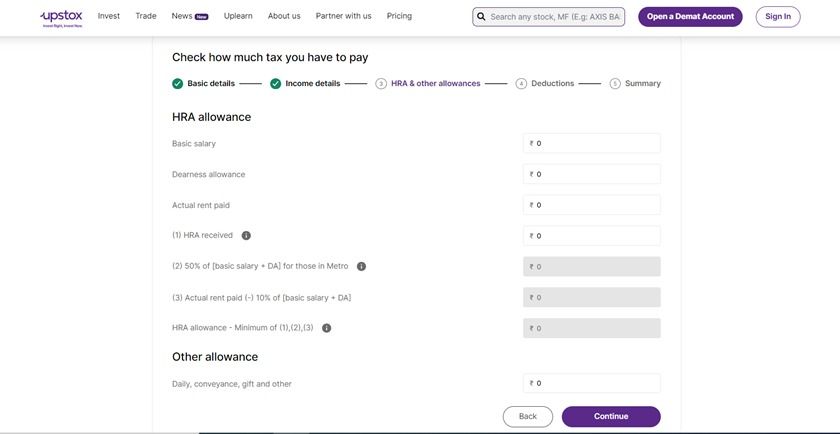

- Enter House Rent Allowance (HRA) details, if any. These would include details for HRA exemptions, including basic salary, dearness allowance, actual rent paid and HRA allowance.

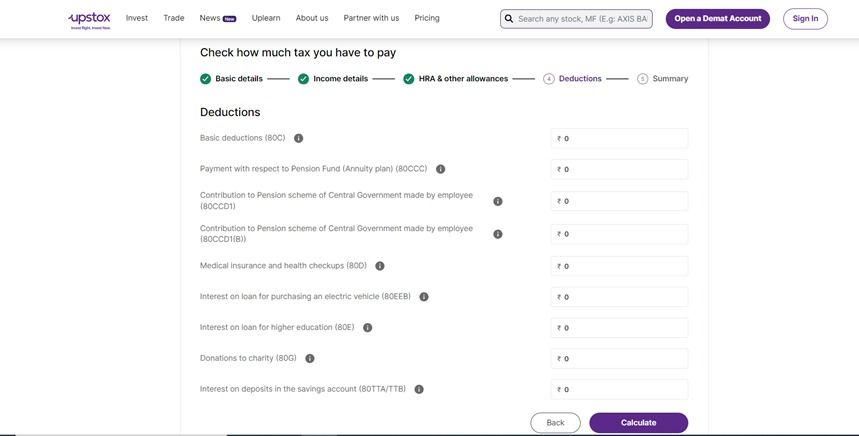

- Enter details of all applicable deductions under the old tax regime. These would include basic deductions under Sections 80C of the Income Tax Act, 1961, like investment in pension schemes, medical insurance and check-ups, interest on loans for higher education, interest on loans for purchasing an electric vehicle, donations to charity, interest on deposits in the savings account, etc.

- Click on the ‘Calculate’ button. The calculator will then compute and provide details of your tax liability.

It is important to note here that the Upstox Income Tax Calculator provides tax liabilities for both the old and new tax regimes as per the Income Tax Act provisions, enabling a better comparison for decision-making. So, be a smart taxpayer and use the calculator to make the most of your income.

About The Author

Next Story