Personal Finance News

New Income Tax Bill 2025 in Parliament soon. Key updates and expected changes you should know

.png)

4 min read | Updated on February 13, 2025, 08:49 IST

SUMMARY

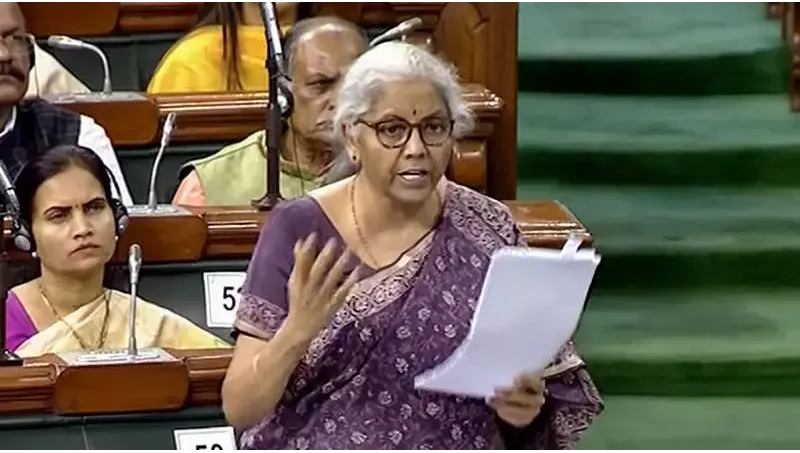

The Union Cabinet approved the Income Tax Bill 2025 on February 7, 2025. A day later on February 8, Finance Minister Nirmala Sitharaman said she is likely to introduce the new bill in the Lok Sabha in the coming week.

Income tax law was enacted about 60 years ago in 1961. | Image source: Shutterstock

The Government is expected to table the new Income Tax Bill 2025 in the Parliament on Thursday (February 13, 2025), according to media reports. Ahead of the introduction of the bill in the Parliament, the Government shared the draft bill with members of the Parliament.

"Yesterday, the Cabinet cleared the New Income Tax proposal, I hope to have it introduced in the Lok Sabha in the coming week. Post that it will go to a committee," Sitharaman said in a media briefing on February 8, 2025.

The new bill will replace the six-decade-old Income-Tax Act, 1961. This article explains all the recent updates about the new income tax bill and the expected changes you should know.

New income tax bill replaces previous year and assessment year with tax year

At present, for income earned in the previous year (say 2023-24), tax is paid in assessment year (say 2024-25). This previous year and assessment year concept has been removed in the new income tax bill and only tax year has been brought in. The new bill defines tax year as follows.

"For the purposes of this Act, “tax year” means the twelve months period of the financial year commencing on the 1st April."

How many sections and chapters the new bill may have?

The new income tax bill may have 536 sections, and 23 chapters running into 622 pages. The proposed law may replace the term 'previous year' as mentioned in the Income Tax Act, 1961 with 'tax year'. Also, the concept of assessment year may be removed in the new law.

What has the finance minister said in previous budgets?

In Budget 2024 presented in July 2024, Finance Minister Nirmala Sitharaman proposed a comprehensive review of the Income Tax Act, 1961, within six months. In Budget 2025 speech on February 1, 2025, the FM said the Bill will be introduced in Parliament in the ongoing Budget session.

How will the new income tax act look like?

According to the Finance Minister, the new Income Tax Act will be concise, lucid, easy to read and understand. It will reduce disputes and litigations, providing tax certainty to the taxpayers. It will also bring down the tax litigations.

What were the key changes expected in the income tax bill 2025?

According to Harsh Bhuta, Partner, Bhuta Shah & Co, the following are some of the changes expected in the new income tax bill.

-

Simplified tax residency: The new income tax bill may address the issue of complexity in determining tax residency of an individual in India. Currently, it involves multiple conditions for qualifying an individual as a tax resident.

-

Streamline tax provisions: Currently, the income tax law comprises of humongous tax provisions. The new income tax bill is anticipated to eliminate certain redundant as well as obsolete provisions and reducing its volume considerably.

-

Increased transparency: The new income tax bill may raise the level of transparency in tax laws by adopting clear and unambiguous language in tax provisions.

-

No new taxes: The new income tax bill may not introduce any new tax but concentrate on facilitating tax compliance in a better way.

-

No dependence on Union Budget for tax reliefs: It is expected that announcements for income-tax reliefs or amendments to the income-tax law will now no longer be required to wait till budget proposals. Government may make such changes by executive orders only.

-

Reduced litigation: The new bill may focus on reducing the number of scrutiny in case of gross non-compliance to avoid undue harassment of honest taxpayers and reduce litigation.

-

Taxpayer-friendly compliance: The new income tax bill may reduce the complex compliance burden by simplifying the compliance process.

Related News

About The Author

Next Story