Personal Finance News

Income tax slabs under new regime revised in Budget 2024; how it compares with the old regime

.png)

4 min read | Updated on July 25, 2024, 12:04 IST

SUMMARY

New Income Tax Slabs: Under the revised structure, the first taxable slab of ₹3 lakh to ₹6 lakh has been changed to ₹3 lakh to ₹7 lakh. Similarly, the slab of ₹6 lakh to ₹9 lakh has been changed to ₹6 lakh to ₹10 lakh. Here are the details.

The government has also raised the standard deduction to ₹75,000 from ₹50,000

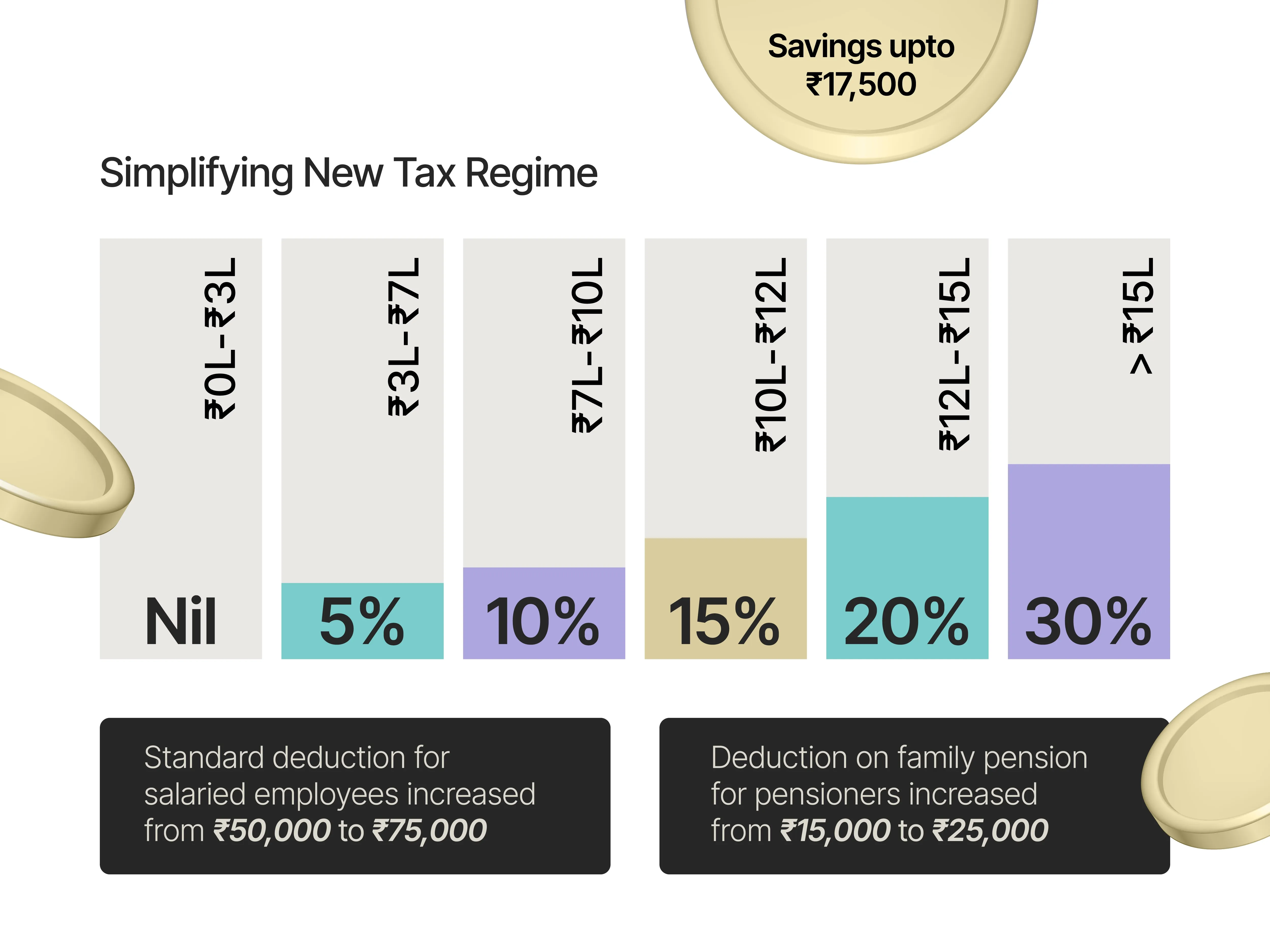

Finance Minister Nirmala Sitharaman announced a revision in the structure of the new tax regime, with the slabs being rejigged to benefit those with income of less than ₹10 lakh per annum.

Under the revised structure, the first taxable slab of ₹3-6 lakh has been changed to ₹3-7 lakh. Individuals falling under this income range will be taxed at 5%.

Similarly, the slab of ₹6-9 lakh has been changed to ₹6-10 lakh. Individuals earnings in this group will be taxed at the rate of 10%.

The next upper slab, of ₹9-12 lakh, has been trimmed to ₹10-12 lakh. This would group will be taxed at the rate of 15%. The remaining two upper slabs remain unchanged, with those earning between ₹12-15 lakh being taxed at 20% and those above ₹15 lakh being taxed at 30%, respectively.

Following are the new income tax slabs under the new tax regime:

| Income Range (₹) | Tax Rate (%) |

|---|---|

| ₹0 - ₹3,00,000 | Nil |

| ₹3,00,001 - ₹7,00,000 | 5% |

| ₹7,00,001 - ₹10,00,000 | 10% |

| ₹10,00,001 - ₹12,00,000 | 15% |

| ₹12,00,001 - ₹15,00,000 | 20% |

| Above ₹15,00,000 | 30% |

Here's how it compares with the tax slab that stood before the revision:

| Tax Slab for FY24 | Tax Rate | Tax Slab for FY25 | Tax Rate |

|---|---|---|---|

| Upto ₹3 lakh | NIL | Upto ₹3 lakh | NIL |

| ₹3 lakh to ₹6 lakh | 5% | ₹3 lakh to ₹7 lakh | 5% |

| ₹6 lakh to ₹9 lakh | 10% | ₹7 lakh to ₹10 lakh | 10% |

| ₹9 lakh to ₹12 lakh | 15% | ₹10 lakh to ₹12 lakh | 15% |

| ₹12 lakh to ₹15 lakh | 20% | ₹12 lakh to ₹15 lakh | 20% |

| ₹15 lakh and above | 30% | ₹15 lakh and above | 30% |

How this compares with the old tax regime?

The old tax regime remains unchanged, with those earning from ₹2.5 lakh to ₹5 lakh being taxed at 5%, those from ₹5 lakh to ₹10 lakh taxed at the rate of 20%, and those earning more than ₹10 lakh being charged at 30%. However, the old tax regime allows more deductions, in the form of house rent allowance (HRA), travel allowance, conveyance allowance and others.

| Annual taxable income | Tax rate |

|---|---|

| Upto ₹2.5 lakh | Nil |

| From ₹2.5 lakh to ₹5 lakh | 5% |

| From ₹5 lakh to ₹10 lakh | 20% |

| Above ₹10 lakh | 30% |

From fiscal year 2020-21 onwards, taxpayers in India have the option of getting assessed under two tax regimes: old and new. An option exists to change the tax regimes every year, but the default regime for individuals is the new tax regime.

While the new tax regime offers a lower rate of taxation, there are few deductions available for the assessees as compared to the old regime.

Standard deduction raised to ₹75,000

The standard deduction, which is the amount reduced from the taxable income of individuals, has been raised to ₹75,000 from ₹50,000. This benefit will apply to assessees under both, the new income tax regime and the old tax regime.

Experts, industry bodies and accountancy groups had called upon the government, in the run-up to the Budget, to increase the standard deduction to raise the disposable income.

Global accountancy major Ernst & Young (EY) had urged the government to raise income tax exemption limit to ₹5 lakh, and allow a standard deduction of ₹3 lakh, in order to raise the disposable income of the taxpayers.

Similarly, consultancy firm KPMG had urged the government to double the standard deduction to ₹1 lakh, and increase the tax break on interest paid on housing loan.

About The Author

Next Story