Personal Finance News

NFO alert: UTI Mutual Fund launches UTI Nifty200 Quality 30 Index Fund

.png)

3 min read | Updated on September 06, 2024, 10:49 IST

SUMMARY

UTI Mutual Fund introduces the UTI Nifty200 Quality 30 Index Fund, aiming to provide the total return of the securities as represented by the Nifty200 index by investing in its 30 quality constituents. The NFO is open from September 2 to September 16, 2024, with a minimum investment of ₹5,000.

NFO alert: UTI Mutual Fund launches UTI Nifty200 Quality 30 Index Fund

UTI Nifty200 Quality 30 Index Fund is an open-ended index fund offered by UTI Mutual Fund. The investment objective of the UTI Nifty200 Quality 30 Index Fund is to provide the total return of the securities as represented by the Nifty200 index by investing in its 30 quality constituents. The new fund launch date is September 2, 2024, and the new fund offer closure date is September 16, 2024. The minimum subscription amount is ₹5000, and there is a Nil load on entry and exit.

UTI Nifty200 Quality 30 Index Fund

The investment objective of the UTI Nifty200 Quality 30 Index Fund is to provide returns that, before expenses, correspond to the total return of the securities as represented by the underlying index, subject to tracking error. However, there is no guarantee or assurance that the investment objective of the scheme will be achieved.

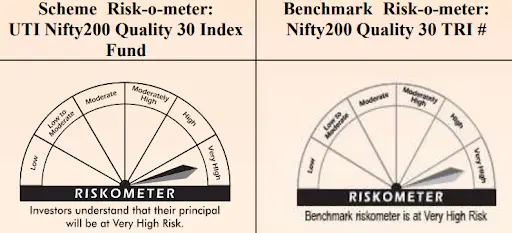

Risk-o-meter:

Funds Allocation

| Types of Instruments | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

|---|---|---|

| Equity and Equity related Securities of companies constituting Nifty200 Quality 30 Index | 95 | 100 |

| Debt / Money Market instruments including Tri Party Repo on Government Securities or treasury bill and units of Liquid Mutual Fund | 0 | 5 |

Who should invest in this fund?

UTI Nifty200 Quality 30 Index Fund is suitable for investors who are seeking returns that are commensurate with the performance of the Nifty200 Quality 30 Index over the long term, subject to tracking error and investment in securities covered by the Nifty200 Quality 30 Index.

Benchmark

The performance of the UTI Nifty200 Quality 30 Index Fund will be benchmarked to the performance of the Nifty 200 Index.

Peer Fund Schemes

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 1 Year Returns (%) | 3 Years Returns (%) | YTD Ret (%) | Since Launch Return (%) |

|---|---|---|---|---|---|---|

| UTI Nifty 200 Momentum 30 Index Fund | 7637.1 | 0.92 | 66.54 | 25.09 | 36.27 | 30.63 |

| Motilal Oswal Nifty 200 Momentum 30 Index Fund | 765.87 | 1 | 66.04 | - | 35.89 | 28.04 |

| Bandhan Nifty 200 Momentum 30 Index Fund | 130.52 | 1.07 | 65.82 | - | 35.4 | 36.83 |

| ICICI Pru Nifty 200 Momentum 30 Index Fund | 397.46 | 0.99 | 65.33 | - | 35.76 | 39.07 |

| Kotak Nifty 200 Momentum 30 Index Fund | 295.29 | 0.9 | 65.31 | - | 36.38 | 58.11 |

| Motilal Oswal BSE Quality Index Fund | 23.37 | 1.03 | 58.96 | - | 33.23 | 35.53 |

| Edelweiss Nifty 100 Quality 30 Index | 47.42 | 0.74 | 41.17 | - | 21.6 | 15.52 |

Who Manages the Scheme?

Sharwan Kumar Goyal – Fund Manager (AUM - ₹1,68,222.90crore, Schemes – 21)

Sharwan Kumar Goyal joined the Equity Fund Management team of UTI AMC in June 2006 and has 18 years of overall experience in Risk / Fund management. Presently he is working as an Equity Fund Manager & Head of Passive, Arbitrage & Quant Strategies.

Conclusion

The UTI Nifty200 Quality 30 Index Fund offers investors a chance to align with the Nifty200 Quality 30 Index. It's ideal for those seeking long-term returns with minimal tracking error.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story