Personal Finance News

Investments to income tax: 5 big personal finance trends of 2024 to know as 2025 begins

5 min read | Updated on December 31, 2024, 15:57 IST

SUMMARY

There were several regulatory changes, trends, and new financial product launches in 2024 that will affect your personal finances in 2025. While it's not easy to recap the entire year in a single article, this piece looks at some of the top developments and trends that you should know going into the new year.

The year 2024 witnessed the deepening of the investors’ trust in mutual fund SIPs. Representational image

2024 was an eventful year for personal finance. During the year, more people invested in equity mutual funds through systematic investment plans (SIPs).

The number of dematerialised (demat) accounts—required for holding shares and other securities electronically—also increased by 22%. As of September 2024, total demat accounts reached 175.4 million, increasing by around 4 million per month since the start of the year.

There were also several regulatory changes, trends, and new financial product launches that will affect how you manage your money in the coming years.

While it's not easy to recap the entire year in a single article, this piece looks at some of the top developments and trends across different personal finance themes from 2024 that you should know going into the new year.

1. Investing

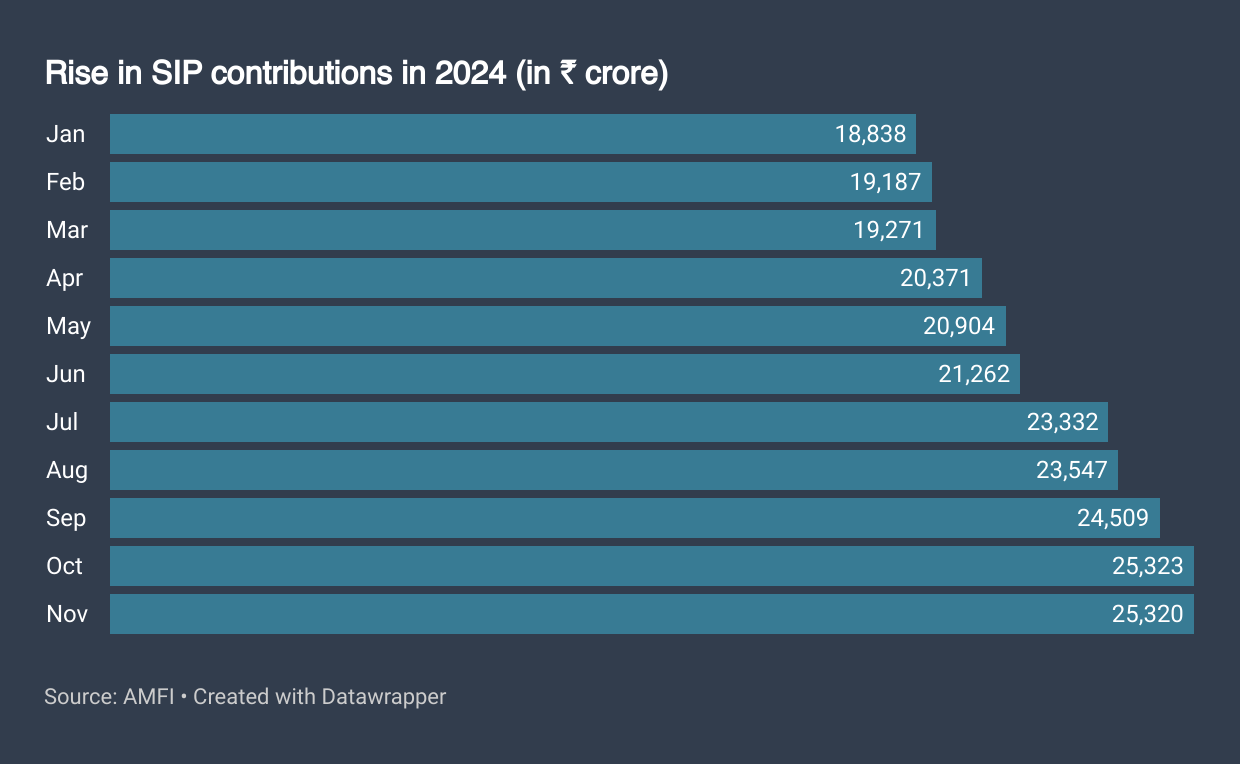

The year witnessed the deepening of the investors’ trust in mutual fund SIPs. Investing through SIP is becoming a go-to strategy for investors to participate in the equity markets.

The total number of SIP accounts crossed 10.22 crore in November with 10.32 lakh new additions. Till November, SIPs accounted for nearly 20% of the total assets of the mutual fund industry.

Moreover, SIP inflows increased month-on-month irrespective of whether the markets were up or crashing.

The Securities and Exchange Board of India (SEBI) introduced a new asset class—Specialized Investment Fund (SIF)—which will cater to investors with a high-risk profile who want to invest a minimum of ₹10 lakh.

SIF will allow mutual funds to launch advanced investment strategies, adding more variety to the investment landscape in India. This product is expected to bridge the gap between mutual funds and portfolio management services.

Besides, the market regulator also eased the norms for mutual funds to launch new passive schemes by introducing the ‘MF Lite’ framework.

2. Taxation

The increasing tax burden was a hot topic of discussion throughout 2024 from family dinner tables to social media platforms. The changes announced in Budget 2024 further fuelled those discussions.

- Tax on short-term capital gains from equity shares, equity mutual funds, and units of REITs and InVITS was increased from 15% to 20%.

- Tax on long-term capital gains (LTCG) from stocks and equity mutual funds was increased to 12.5% from 10%.

- LTCG exemption limit for equity investors increased to ₹1.25 lakh from ₹1 lakh.

3. Retirement

4. Borrowing and spending

As per RBI's November Bulletin, credit card outstanding increased by 9.5% in FY 2024-25 to ₹2,81,392 crore in October 2024, showing a year-on-year jump of 16.9%.

Defaulting on credit card dues payments is not good for anyone's finances. Recently, the Supreme Court also gave a reason to credit card users to think twice before defaulting on a payment.

The apex court dismissed a 2008 decision by the National Consumer Disputes Redressal Commission (NCDRC) that stopped banks from charging more than 30% interest per annum on credit card dues. The SC held that only RBI could put such limitations on interest rates.

5. Small savings and fixed deposits

Thanks to the RBI's decision to keep the repo rate unchanged throughout the year, the fixed deposit interest rates offered by banks and other financial institutions remained high.

Further, the RBI issued new guidelines for fixed deposits offered by non-banking financial companies (NBFCs) and housing finance companies (HFCs). With effect from January 1, 2025, these guidelines will allow depositors to fully withdraw small deposits up to ₹10,000 within three months of making the deposit.

Investors will also be allowed to make an early payment request for up to 50% of the principal or ₹5 lakh, whichever is less, before three months from the date of acceptance of such deposits. The RBI guidelines further allow 100% withdrawal of the principal amount on account of critical illness before three months from the date of acceptance of the deposit.

About The Author

Next Story