Personal Finance News

UPS pension calculation: What will be the pension on basic salary of ₹60,000, ₹70,000 & more?

.png)

4 min read | Updated on August 28, 2024, 10:42 IST

SUMMARY

The new scheme provides a minimum assured amount and dearness allowance (DA) in the calculation of the pension. The pension amount will also vary according to the last basic pay drawn and the number of years of service. The UPS comes into effect on April 1, 2025.

Unified Pension Scheme: Check pension calculation for basic salary levels of ₹60,000, ₹70,000 and more

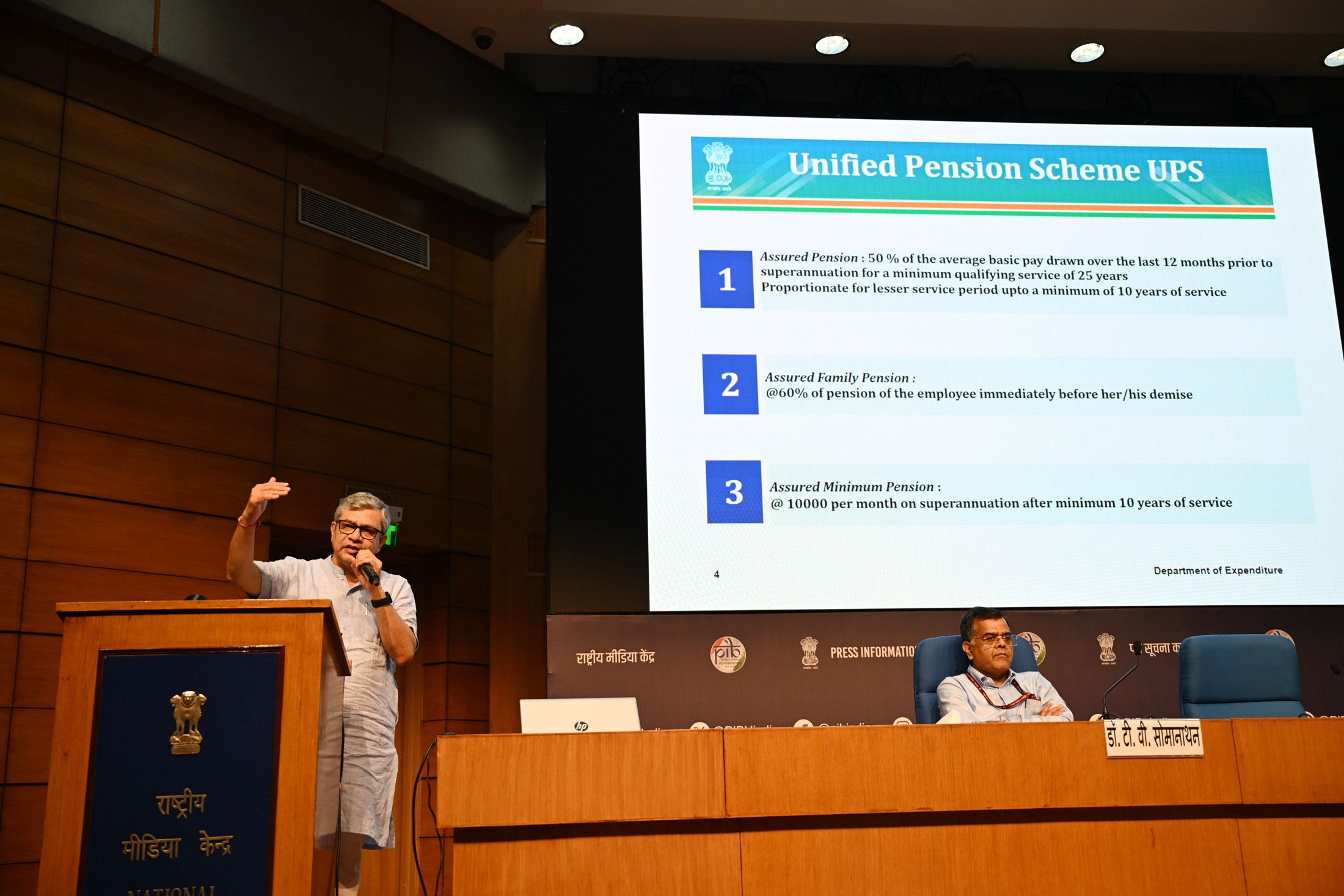

The Union government has introduced a new pension scheme that is likely to benefit more than 23 lakh employees. The new Unified Pension Scheme (UPS) assures 50% of the average basic pay drawn over the last 12 months before retirement. State governments can also opt for the new UPS in place of the existing National Pension System (NPS) for their employees.

Fulfilling employees' demand to make the NPS more beneficial, the new scheme provides a minimum assured amount and dearness allowance (DA) in the calculation of the pension.

Also, the pension amount will vary according to the last basic pay drawn and the number of years in service. Here is a brief representation of what the employees will get as a pension at a particular pay level and years of service.

First of all, let's know about the key features of the UPS scheme.

What’s on offer under UPS?

- Employees will receive an assured pension of 50% of the average basic pay drawn over the last 12 months before retirement. To be eligible for this, employees must have completed a service period of 25 years.

- The pension will be proportionate for a lesser service period of up to a minimum of 10 years.

- UPS will offer an assured family pension of 60% of the pension of the employee immediately before her/his demise.

- There will be an assured minimum pension of 10,000 per month on retirement after a minimum of 10 years of service.

- There will be inflation indexation on assured pension, assured family pension and assured minimum pension

What will be your pension? Let’s see the maths

Here is a brief calculation of the pension amount at various basic pay levels, such as ₹60,000, ₹70,000, and ₹80,000.

| Avg. basic Salary (₹) | Pension under UPS (₹) | Family pension under UPS (₹) |

|---|---|---|

| 60,000 | 30,000 + DR* | 18,000 + DR |

| 70,000 | 35,000 + DR | 21,000 + DR |

| 80,000 | 40,000 + DR | 24,000 + DR |

Pension amount for basic pay of ₹60,000

If the average basic pay is ₹60,000 in the last 12 months before retirement and the number of years of service is 25 years, the pension amount will be—50 % of ₹60,000 + dearness relief (DR) or ₹30,000 + DR.

So, the monthly pension amount will be ₹30,000, along with the DR. In case of the employee's death, the family pension will be ₹18,000 (60% of the pension amount) and the DR.

Pension amount for basic pay of ₹70,000

If the average basic pay is ₹70,000 in the last 12 months before the superannuation, and number of years of service is 25 years, the pension amount will be - 50% of ₹70,000 + DR or ₹35,000 +DR. Pension will be ₹35,000 + DR.

Similarly, the family pension will be ₹21,000 (60% of pension) + DR.

Pension amount for basic pay of ₹80,000

If the average basic pay is ₹80,000 in the last 12 months before retirement, and the number of years of service is 25 years, the pension amount will be - 50% of ₹80,000 + DR, or ₹40,000 +DR.

The family pension amount will be ₹24,000 (60% of ₹40,000) + DR.

The new pension scheme will come into effect from April 1, 2025. Employees can choose between the existing NPS and the new UPS. However, once they have made the selection, they cannot change the pension scheme.

Related News

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story