Market News

Does the Union Budget present trading opportunities?

7 min read | Updated on January 30, 2025, 12:15 IST

SUMMARY

Events like the Union Budget often move the markets. These movements on the budget day could be over- or under-reactions, leading to situations where the markets drift for several days afterwards. With options, traders can potentially profit from any market condition, whether it is up, down, or sideways. While we have provided you with historical data and backtests, you should remember that historical returns aren’t predictive of future results.

On average, the cumulative return of NIFTY50 was +3.54% on the 10th day following the Union Budget | Image: Shutterstock

As a trader, you are well aware that the Union Budget is coming up and that when this event happens – the markets will likely move. In this article, we will discuss how the NIFTY50 and Bank Nifty have moved on both the budget day itself as well as the following day because there is a possibility of over- or under-reaction to the budget. You may not be able to predict the direction of movement on the budget day itself, but perhaps you can identify that the markets are trending either up or down following the Union budget.

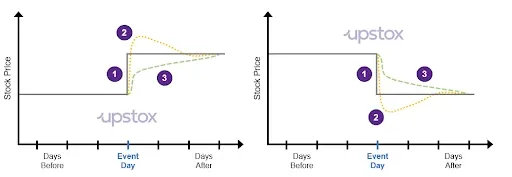

The reason for that is displayed below in illustration 1. The markets seldom react perfectly to new information. You see this price action quite frequently during events like earnings announcements where the price may jump up – or overreact – and then drift downward slightly over the coming days. Or the price may move up slightly on the announcement day and then continue to trend upward over time as more traders and investors buy in. This is shown on the left chart below. On the right chart, we show the opposite where there is a downward over-reaction and then a correction or a downward trend.

Before we discuss potential trading strategies, let’s examine the historical performance of the NIFTY50 and Bank Nifty.

So, what has happened on the budget day as well as subsequent trading days?

Image below shows the returns from the last 10 years for the NIFTY50 and the Bank Nifty. Generally, the Bank Nifty is more volatile than the NIFTY50. You can see that if you compare the best year and worst years. In the best year, the Bank Nifty cumulatively gained 12.75% in the 10 days after the budget day while in the worst year, the Bank Nifty cumulatively lost -7.56%. By comparison, the NIFTY50’s cumulative best 10-days post-budget day return was 12.75% and the worst 10-days was -7.56%.

The challenge is that once you examine this data, you can see that there isn’t a clear-cut strategy. The major indices don’t always react positively or negatively to the news announced on budget day. Of course, this makes sense as sometimes the information released regarding the allocation of investments in various sectors or changes in taxes aren’t always going to be positive or negative.

NIFTY50 return up to 10 days after Budget

| NIFTY50 | Budget Day | +1 Day | +3 Day | +5 Day | +10 Day |

|---|---|---|---|---|---|

| Best Year | 4.74% | 3.37% | 6.99% | 7.13% | 7.24% |

| 3rd Quartile | 0.83% | 0.83% | 2.08% | 2.09% | 2.67% |

| Median | -0.11% | 0.30% | 1.02% | 0.53% | -0.59% |

| 1st Quartile | -0.35% | -0.09% | -0.09% | -1.66% | -2.25% |

| Worst Year | -2.51% | -2.33% | -4.71% | -3.99% | -5.12% |

Bank Nifty return up to 10 days after Budget

| Bank Nifty | Budget Day | +1 Day | +3 Day | +5 Day | +10 Day |

|---|---|---|---|---|---|

| Best Year | 8.26% | 3.56% | 8.83% | 8.75% | 12.75% |

| 3rd Quartile | 1.69% | 1.74% | 2.59% | 3.05% | 3.10% |

| Median | 0.21% | 0.38% | 0.95% | 0.12% | -0.40% |

| 1st Quartile | -0.63% | -0.58% | -0.97% | -2.60% | -4.02% |

| Worst Year | -3.28% | -2.83% | -5.18% | -4.78% | -7.56% |

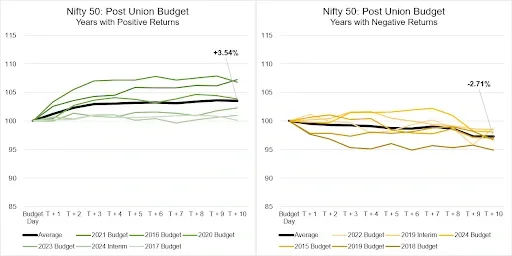

Let’s “zoom in” and look at the individual returns following the budget day for the last five years. In below image, we are displaying two charts. On the left chart, we plot the total returns over the 10 days following the budget day when NIFTY50 moved upwards. On the right chart, we plot the total returns but instead of when the NIFTY50 moved up following the budget, we are showing when the returns went down. On average, the cumulative returns for the NIFTY50 on the 10th day following the Union Budget were +3.54% when the returns were positive and -2.71% when the returns were negative.

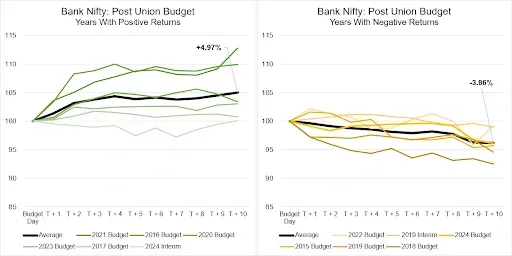

Now here are similar charts for the Bank Nifty for the past five years of budget days. When the index posted a positive cumulative return in the 10 days after the Union Budget, the average return was +4.97%. On the opposite side, when the Bank Nifty fell over the 10 days after the budget, the cumulative average return was -3.86%.

What if you thought that the NIFTY50 or Bank Nifty would trend upwards after the budget day?

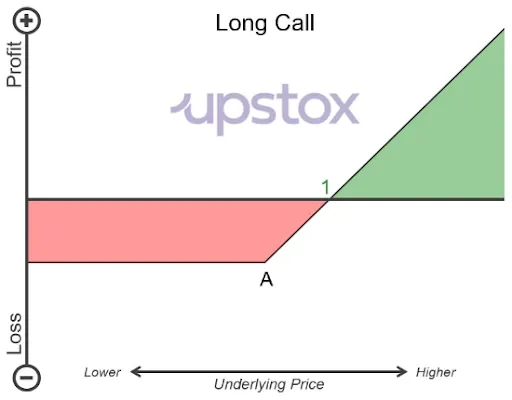

If you are an options trader and you are bullish, a strategy that you could use is a long call. You would want to use an expiration that is sufficiently past the Union Budget to capture any potential drift. The nearest expiration for the NIFTY50 is 6 Feb and 27 Feb for the Bank Nifty. If you believe that the NIFTY50 will continue to have a bullish trend beyond 6 Feb, you could also select the 13 Feb expiry or later.

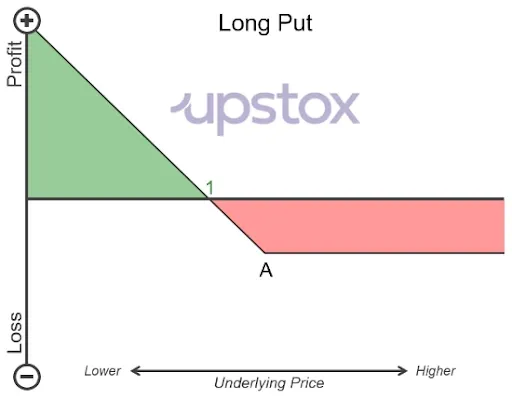

This is the payoff diagram for a long call. You pay an upfront premium for the right, but not the obligation, to purchase the underlying stock or index at a future date. In the diagram below, if the underlying security doesn’t rise in price enough before expiration, you will have a loss. However, a long call does have a potentially unlimited upside. This is shown by the green section in the diagram below. As the underlying price keeps rising, you will keep profiting with a call option as long as it hasn’t expired.

What has happened previously if you bought a call after the Union Budget?

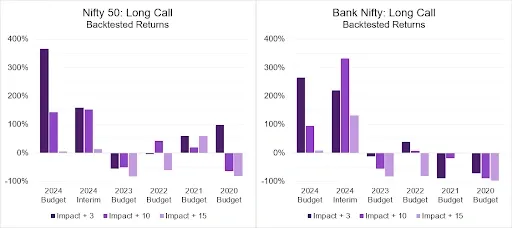

Image below displays the backtested returns of a long call strategy on the NIFTY50 and Bank Nifty over the last five years. There are three options that we explored. First, buy a call option at the market close of the budget day and close the option three trading days later. This is represented as the bar in dark purple. Second, do the same thing but exit at the market close 10 trading days after the budget day. This is shown as the middle bar in purple. Lastly, we assessed the performance of exiting after 15 trading days. What you can see is that there isn’t a consistent pattern emerging. However, the returns of the call options were extremely strong in 2024. In addition, holding for a shorter duration following the budget day seems to outperform longer holding periods.

Disclaimer

Investments in the securities market are subject to market risk, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory.

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

Related News

About The Author

Next Story