Market News

Weekly Wrap September 9 to 13: Benchmark indices rally 2% as investors await key US Fed meet

.png)

4 min read | Updated on September 14, 2024, 19:24 IST

SUMMARY

Investors will keenly await the outcome of the US Fed meeting on September 16-17 next week for further cues. The expected rate cut would also bolster expectations of a rate cut by the RBI as India’s CPI inflation remained steady at 3.7% in August.

Stock list

- On a weekly basis, SENSEX gained around 1,700 points while NIFTY advanced 504 points.

- Benchmark indices gained 2% each on a weekly basis.

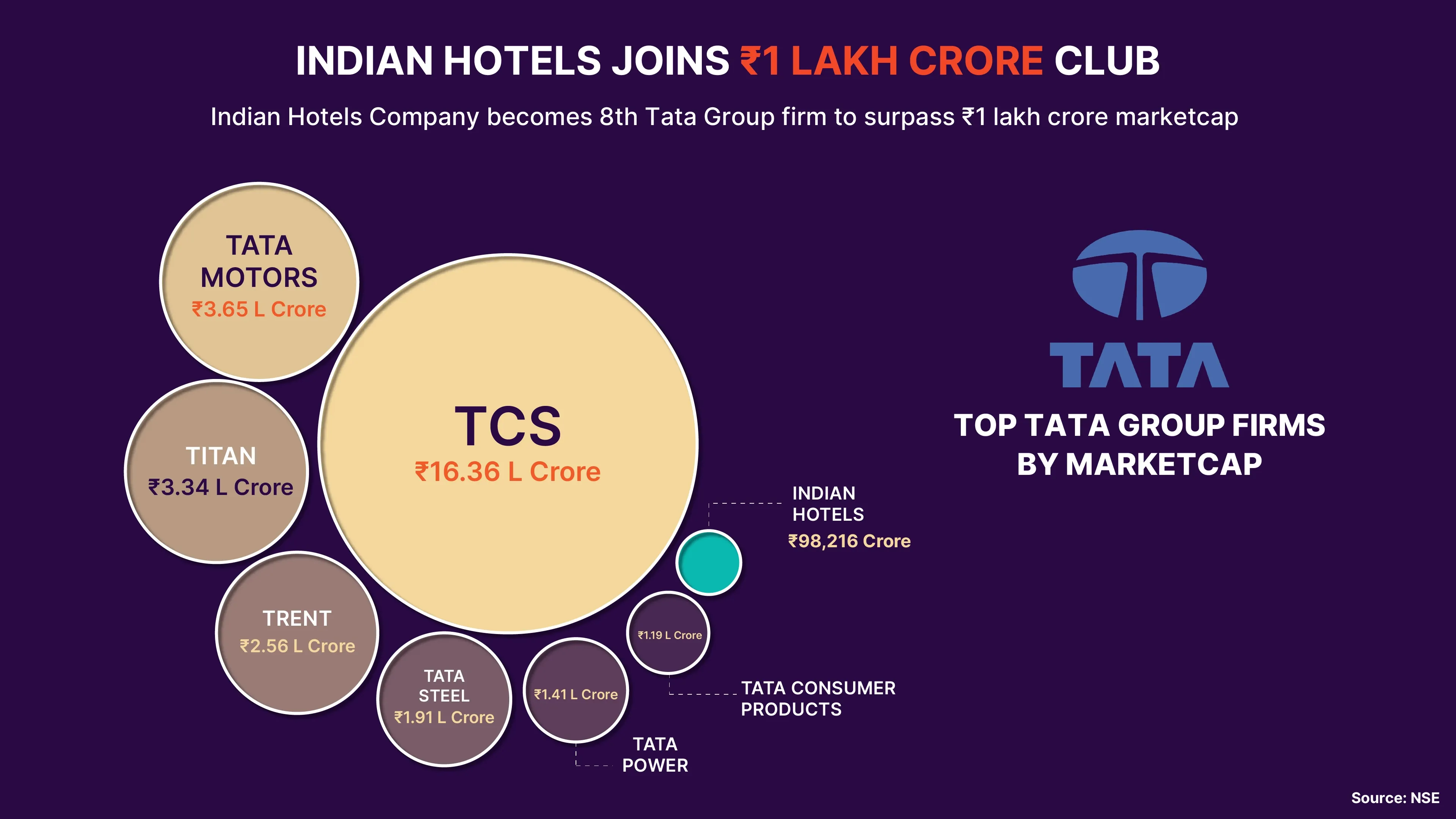

- Indian Hotels Company became the 8th Tata Group firm to surpass ₹1 lakh crore market cap.

It’s that time of the week again! We are back with a quick recap of the stock markets this week as benchmark indices logged the most weekly gains in nearly two months.

Stock markets raced to fresh record high levels before taking a breather on Friday as US inflation data bolstered hopes of an interest rate cut by 25 basis points. Benchmark SENSEX scaled the record to 83,000 for the first time after a sharp rally on Thursday. NIFTY also hit the 25,440 mark for the first time following gains in select heavyweights. Both indices closed at lifetime high levels.

Indian stock markets were largely influenced by global equity movements this week. Crude oil prices falling to $70 per barrel also fanned concerns of a growth slowdown, but US inflation numbers strengthened hopes of a US Fed rate cut at the upcoming meeting on September 16-17.

Stock markets started the week in recovery mode, as benchmark indices settled around 0.4% higher despite weak global trends. FMCG and banking shares supported the recovery, while energy and metal shares restricted gains.

SENSEX and NIFTY continued the winning momentum for a second day on Tuesday and gained nearly 0.5%. Firm global markets also supported the uptrend. NIFTY reclaimed the 25,000 level as IT and pharma shares advanced and settled at 25,041.1. SENSEX gained 360 points to close above 81,900.

It was a volatile session on Wednesday ahead of the release of key inflation data in the United States. NIFTY retreated nearly 0.5% to settle at 24,918.45, mainly due to selling in select heavyweights in the second half of the session. Energy, metal and auto shares dropped the most.

Staging a dramatic recovery on Thursday, SENSEX and NIFTY closed at lifetime high levels, powered by a late rebound in stock markets. Indices were trading in a range until 1.50 p.m. A sharp rally after 2 pm propelled the indices to lifetime high levels. NIFTY jumped 1.9% to close at 25,388.9. SENSEX surged nearly 1,440 points to 82,962.71, logging its best single-day gain since June 2024. Foreign fund inflows and better US inflation data backed the rally.

The stock indices took a breather on Friday and ended marginally lower. SENSEX slipped 71 points and NIFTY by 32 points. SENSEX closed the week at 82,890.94 and NIFTY at 25,356.5.

On a weekly basis, SENSEX gained around 1,700 points while NIFTY advanced 504 points. The benchmark indices rallied 2% each.

Indian Hotels hits ₹1 lakh crore market cap, slips later

Indian Hotels Company Limited shares rallied more than 2.4% on Thursday to hit a 52-week high of ₹703.75 per share. The rally helped the Tata Group company to surpass ₹1 lakh crore mark in market capitalisation.

Indian Hotels became the 8th Tata Group firm to join the ₹1-lakh-crore marketcap club. The stock, however, slipped on Friday, dragging its valuation below ₹1 lakh crore.

Bajaj Auto, Divis Labs, Wipro lead gainer; ONGC, Tata Motors biggest drag

Broader markets posted gains, banking consumer durables outperform

Broader markets also posted gains amid a record rally in benchmark indices. Midcap indices gained around 3%, while smallcap indices rose by up to 2%, outperforming the benchmark index NIFTY.

Among sectoral indices, consumer durables rose by 4%. The bank, Media, IT, and Private bank indices gained 3% each. The Realty Metal and Finance Services indices rose by 2% each. NIFTY Oil & Gas was the sole loser, declining by 3%.

What lies ahead?

Investors will keenly await the outcome of the US Fed meeting on September 16-17 next week for further cues. The expected rate cut would also bolster expectations of a rate cut by the RBI as India’s CPI inflation remained steady at 3.7% in August. Investors will also keep a watch on any possible effect on markets as the polling process begins for Assembly elections in Haryana and Jammu and Kashmir.

About The Author

Next Story