Market News

Weekly Wrap September 2 to 6: SENSEX, NIFTY snap 3-week rally; tank up to 1.5% in 7 sessions

.png)

4 min read | Updated on September 07, 2024, 10:13 IST

SUMMARY

With no domestic triggers, Indian stock markets are likely to move in line with global trends. US jobs data, released on Friday, would influence the sentiment on Monday as it could be crucial in deciding the volume of rate cuts by the US Fed.

Stock list

- On a weekly basis, SENSEX dropped 1.43%, while NIFTY tanked 1.52%.

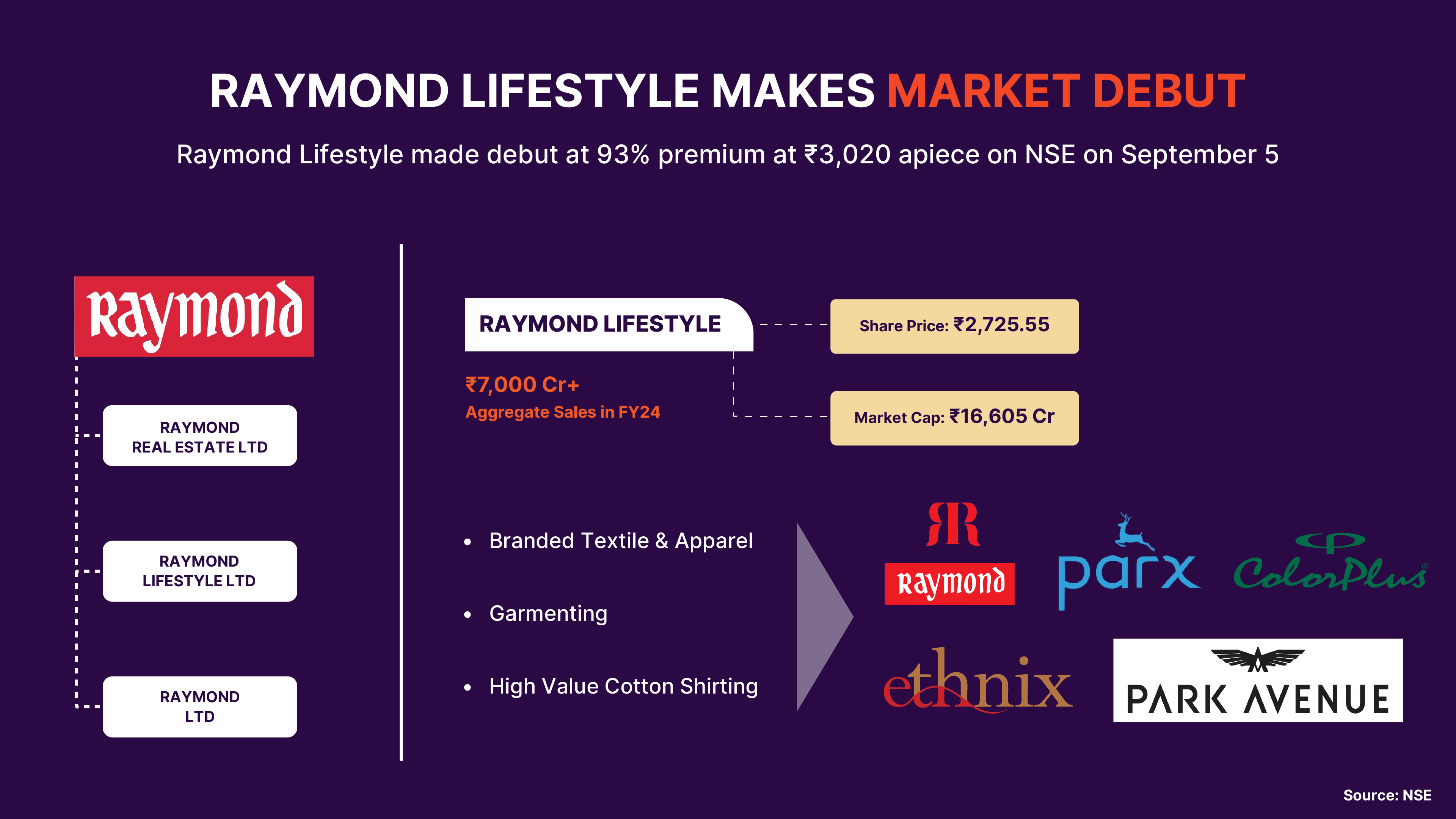

- Raymond Lifestyle Ltd shares dropped 10% in the first two trading sessions after listing on September 5.

- Reliance Industries announced a 1:1 bonus issue this week.

We are back with another quick recap of the markets this week, which was marked by volatility. Here’s a look at what kept D-Street busy, as NIFTY and SENSEX closed in the red in three out of five sessions.

Benchmark indices, SENSEX and NIFTY, halted their three-week winning run, settling lower by around 1.5% this week. Indian stock markets were influenced by global trends due to lack of domestic triggers.

Growth concerns in the US and China also impacted investor sentiment.

However, caution ahead of the release of US non-farm payroll data on Friday, which could have a bearing on the US Fed rate cut this month, weighed on the Indian markets.

SENSEX and NIFTY moved in a range in most trading sessions this week. On Friday, the indices came under heavy selling pressure due to FII selling and losses in global markets.

On a weekly basis, the BSE SENSEX dropped 1,181.84 points, or 1.43%, while NIFTY dropped 383.75 points, or 1.52%. The key indices logged their first loss in four weeks.

Stock markets started the week on a firm note on Monday, with NIFTY extending gains to the 12th straight day and SENSEX rising for the 10th day in a row. While SENSEX logged its longest winning streak in a year, the NIFTY’s winning run was the longest in decades.

Stocks trading at record highs triggered profit booking on Tuesday. Mixed global trends ahead of the key US payroll data also restricted the trade. SENSEX took a breather and slipped 4 points at close. NIFTY settled flat.

SENSEX and NIFTY witnessed losses in the next two trading sessions on Wednesday and Thursday as well. Investors rushed for defensive bets amid growth concerns in key US and China markets.

SENSEX and NIFTY dropped up to 0.32% on Wednesday as weak US manufacturing data fueled concerns about a potential slowdown in the country’s economy. The indices extended losses of up to 0.2% on Thursday as the realty, energy, and auto sectors declined. Profit taking in Reliance Industries, as it announced a 1:1 bonus issue, also dragged the indices.

Extending losses to the third day, NIFTY declined 1.17% to close below the 25,000 mark at 24,852.15. SENSEX tanked 1017.23 points, or 1.24%, to a two-week low of 81,183.93.

In the broader market, midcap index dropped 1.4% and smallcap indices by 1% on Friday.

Raymond Lifestyle tanks 10% as group demerger takes shape

RLL shares dropped nearly 10% in the first two trading sessions to end lower at ₹2,725.55 per share against the listing price of ₹3,020 on the NSE on September 5.

Reliance bonus issue shakes up market sentiment

The issuance and listing of bonus shares will coincide with the upcoming festive season in India and will be an early Diwali Gift to its shareholders.

FIIs in a fix ahead of SEBI deadline

Foreign investors resumed selling spree in the last two sessions this week as the Securities and Exchange Board of India (SEBI) deadline of September 9 for beneficial ownership (BO) disclosures nears. FIIs were net buyers of shares in the first three sessions this week but reversed stance in the remaining.

What lies ahead?

With no domestic triggers, Indian stock markets are likely to move in line with global trends. US jobs data, released on Friday, would influence the sentiment on Monday as it could be crucial in deciding the volume of rate cuts by the US Fed. Growth concerns in the US and China have also affected crude prices, which could impact stocks.

About The Author

Next Story