Market News

Stock Market Weekly Recap: SENSEX hits record high, Bajaj Housing Finance doubles, Vodafone crashes 21% & more

.png)

5 min read | Updated on September 21, 2024, 10:58 IST

SUMMARY

With the key trigger of the US Fed policy meeting over, Indian stock markets will focus on macro trends, inflation, and the global situation. Investors will also keep an eye on geopolitical concerns and their impact on crude oil prices.

Stock list

- SENSEX jumped 1,360 points to hit an all-time closing high of 84,544.31 on Friday.

- Bajaj Housing Finance shares more than doubled in the first week of trade.

- Vodafone shares tanked 21% this week after the SC verdict on the AGR issue.

- ICICI Bank's market cap breaches ₹9 lakh crore mark.

Hey there! We are back with a quick recap of the markets this week, which is marked by a roller-coaster ride.

Benchmark SENSEX breached the 84,000 mark for the first time, while NIFTY zoomed to the 25,750 level this week amid a rally in global markets.

Extending the gains for the second week in a row, SENSEX jumped 1,653 points, or nearly 2%, while NIFTY jumped 434 points, or 1.68%, on a weekly basis.

Domestic markets were driven by strong global cues after the US Federal Reserve cut interest rates by 50 basis points this week. The Federal Open Market Committee went for a deeper cut as inflation gradually moved toward the 2% target. Stock markets traded in a range for the most part of the week before a break-out rally on Friday.

Key indices traded in a range in the week’s opening session on Monday as investors awaited the US Fed rate cut decision. In a lacklustre session, SENSEX added 97 points to settle at its all-time high, while NIFTY inched up 27.25 points to end near record highs at 25,383.75. Energy and metal shares advanced while FMCG and IT shares dropped. Broader markets saw some buying interest.

SENSEX and NIFTY managed to end in the green in a range-bound trade on Tuesday as well. SENSEX closed above the 83,000 level for the first time, and NIFTY also ended above 25,400. Realty and auto shares supported gains, while metal and pharma shares were a drag.

Stocks witnessed profit-taking on Wednesday, ahead of the announcement of the US Federal Reserve policy outcome. Later in the day, SENSEX and NIFTY slipped from record levels and ended down 0.16%.

Stock markets experienced volatility on Thursday after the US Fed rate cut after four years. SENSEX and NIFTY opened higher and rallied up to 1% in the first half, which was in line with gains in Asian peers. However, profit-taking emerged in the second half of the session amid weekly expiry, limiting gains for the benchmark indices. SENSEX soared 825 points or nearly 1% to hit a lifetime trading high of 83,773.61. NIFTY also rallied 234 points to scale the 25,600 level for the first time. Indices, however, closed marginally due to selling towards the end of the trade.

NIFTY and SENSEX soared more than 1.5% following sharp gains in the US and Asian markets. A lower-than-expected job data allayed fears of a slowdown in the US market, and stocks rallied. SENSEX jumped 1,360 points to hit an all-time closing high of 84,544.31 while NIFTY closed higher 375 points at 25,790.95.

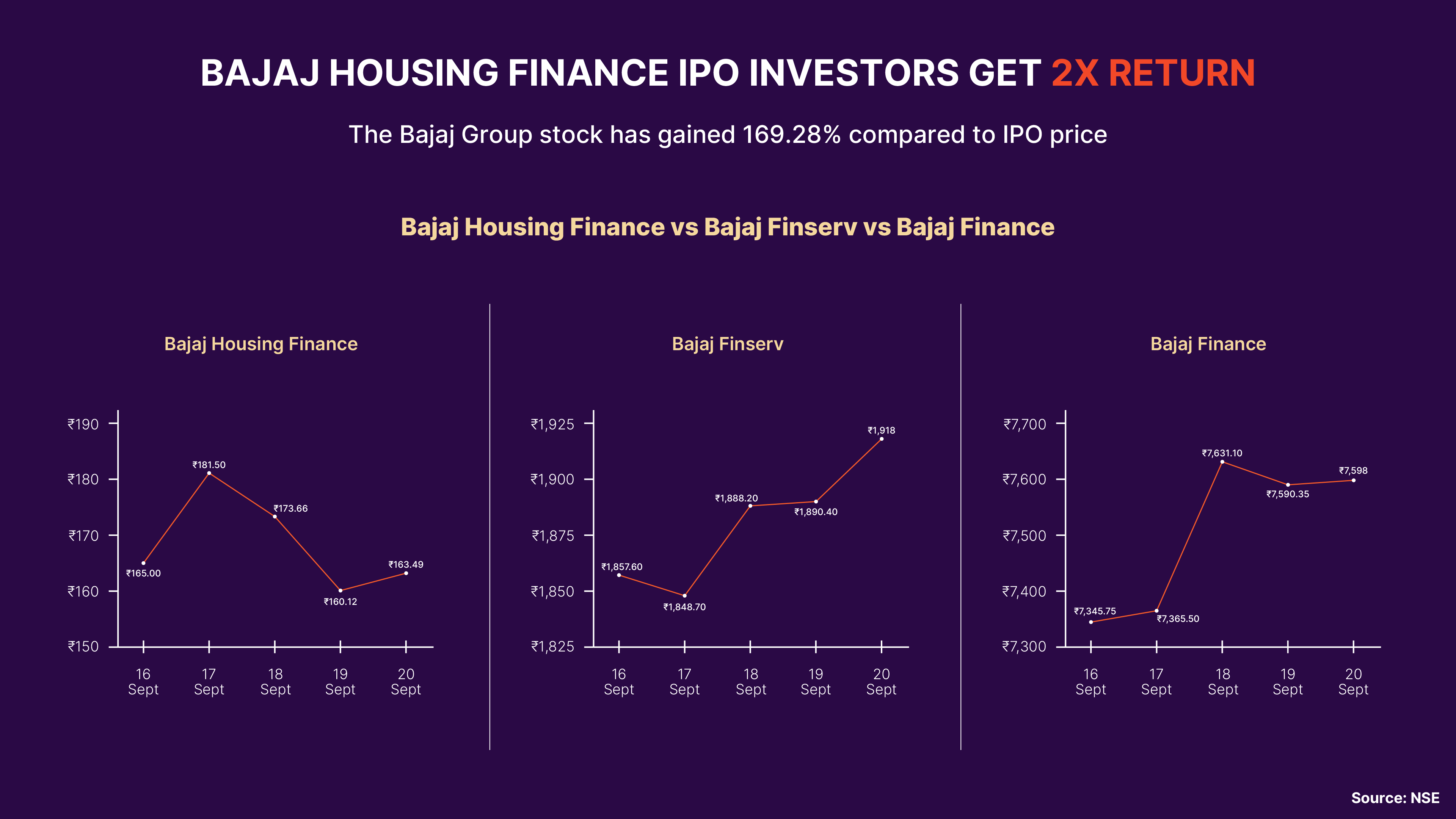

Bajaj Housing Finance gives 2x returns in opening week

Bajaj Finance, the parent company of Bajaj Housing Finance and promoter firm Bajaj Finserv, also gained this week.

Vodafone shares tanked 21% this week on adverse AGR ruling

Vodafone Idea shares dropped to a 52-week low of ₹9.79 on September 20 before recovering some ground to close at ₹10.52 per piece. In five days, the stock tanked 21%. The SC reaffirmed its order on the AGR ruling against telecom players.

The AGR demand amounts to ₹58,000 crore, which has inflated to ₹70,320 crore as of the end of FY24 due to the interest levy.

ICICI Bank shares race to 52-week high, market cap breaches ₹9 lakh crore mark

What lies ahead?

With the key trigger of the US Fed policy meeting over, Indian stock markets will focus on macro trends, inflation, and the global situation. Investors will also keep an eye on geopolitical concerns and their impact on crude oil prices. PMI data for services and manufacturing sectors, initial jobless claims, and GDP numbers scheduled to be released next week in the US will also influence the stock markets.

Related News

About The Author

Next Story