Market News

Week ahead: PM Modi’s U.S. visit, Fed chair's testimony, Q3 earnings and inflation data in focus

.png)

7 min read | Updated on February 10, 2025, 09:09 IST

SUMMARY

In the week ahead, markets will react to the Delhi election results, inflation data, Q3 earnings and testimony from Fed Chair Jerome Powell. Experts anticipate the market to remain range-bound with immediate support at the 23,200 level.

PM Modi's US visit, Fed chair meeting and more. Image source: shutterstock.

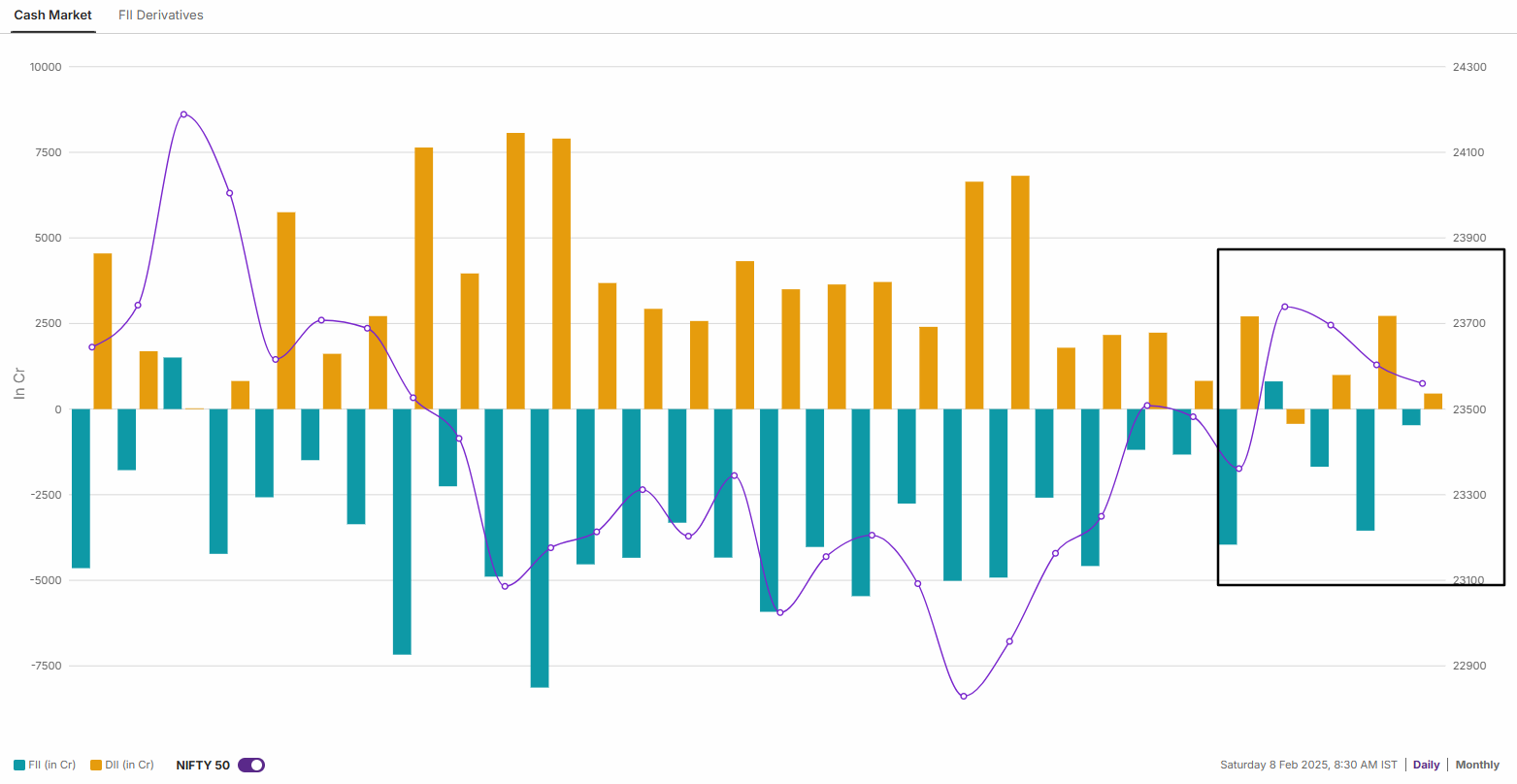

Markets extended their winning streak for the second consecutive week, driven by the widely expected 25-basis-point repo rate cut by the Reserve Bank of India and the positive spillover effects of key announcements in the Union Budget 2025.

However, despite the RBI delivering its first rate cut in five years, lowering the repo rate to 6.25%, the markets failed to generate significant investor enthusiasm. While sentiment remained positive, several factors kept markets range-bound, including subdued third-quarter earnings, the continued depreciation of the Indian Rupee against the U.S. Dollar and persistent foreign fund outflows.

For the week, the NIFTY50 index edged up 0.3% to close at 23,559, while the SENSEX gained 0.4%, settling at 77,860. Broader markets also maintained their positive momentum for the second straight week, with the NIFTY Midcap 100 rising 0.2% and the Smallcap 100 inching up 0.1%.

Among sectors, Pharmaceuticals (+3.4%) and Metals (+3.4%) led the gains, while Fast-Moving Consumer Goods (-5.5%) and Real Estate (-3.6%) were the biggest laggards.

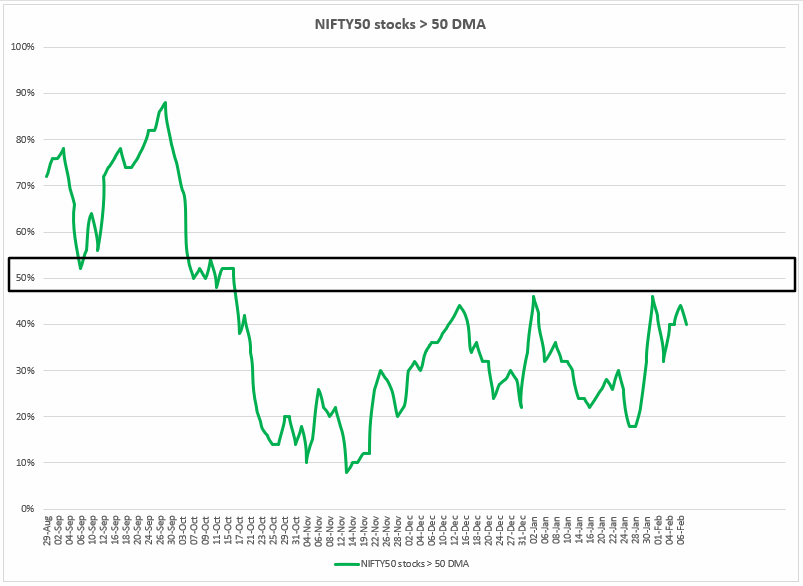

Index breadth

The percentage of NIFTY50 stocks trading above their 50-day moving average (DMA) has been hovering around the 40% mark this week, showing little change after its recent rebound from the lows of 10-15%. While this suggests a stabilisation in market breadth, it remains well below the critical 50% level needed to signal a broader recovery.

The key question now is whether this rebound can sustain and push past the 50% threshold or if it will act as a temporary pullback or breather. Until a decisive breakout occurs, market sentiment is likely to remain cautious, with uncertainty over the strength of the recovery.

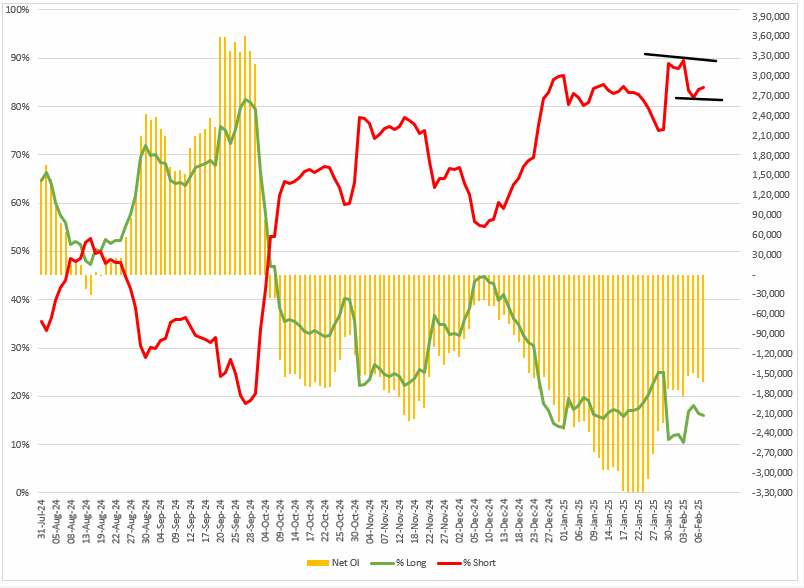

FIIs positioning in the index

Foreign Institutional Investors (FIIs) eased their bearish stance last week, trimming their short positions in index futures. They began the week with a long-to-short ratio of 10:90, which improved to 16:84 by the weekly expiry of NIFTY50 options contracts. This shift led to a 15% reduction in net short open interest (OI), bringing it down to 1.56 lakh contracts on expiry day.

NIFTY50 outlook

The NIFTY50 index rebounded toward its 21-week exponential moving average but struggled to sustain its gains on a closing basis. It faced strong resistance in the critical 23,800-23,900 zone and failed to close above the previous week’s high.

SENSEX outlook

The SENSEX continued its winning streak for the second consecutive week but faced resistance near the 21-week exponential moving average (EMA). The index struggled to break past this level and closed slightly below the previous week’s high, signaling selling pressure from the resistance zone.

On the downside, immediate support is seen around the 74,200 level, which will be key to watch in the coming sessions.

🗓️Key events in focus: Globally, the inflation data will be focus in the U.S. The Bureau of Labor Statistics will publish the consumer price index for January on Wednesday. Experts anticipate CPI inflation to rise to 2.9% in January, unchanged from the previous month. On a core basis, which excludes food and energy prices, CPI is expected to have risen 3.1% year-on-year in January, down from 3.2% in December.

On the domestic front, investors will be watching the January CPI inflation data, set to be released on February 12. Inflation, a key factor for the RBI’s interest rate decisions, is expected to fall below 5% in January 2025, down from 5.22% in December 2024.

📈📉Earnings blitz: The third-quarter earnings season will enter the last-leg and the key companies which will declare results are Apollo Hospitals, Eicher Motors, Grasim Industries, IRCTC, Lupin, Steel Authority of India, Hindustan Aeronautics, IPCA Laboratories and Glenmark Pharmaceuticals. Globally, the investors will keenly focus on earnings reports from McDonald’s, Coca-Cola, Shopify, Super Micro Computer, Airbnb, Coinbase Global and Moderna.

📌Spotlight: Fed Chair Jerome Powell is set to deliver his scheduled testimony to Congress on Tuesday and Wednesday. His remarks follow the Fed's decision to keep interest rates unchanged in January, after three consecutive rate cuts. The central bank cited a robust job market and lingering inflation concerns as key factors behind its cautious stance.

📍Mark your calendars: Prime Minister Narendra Modi will visit the U.S. on 12-13 February for a meeting with President Donald Trump. Discussions will focus on strengthening defence ties and expanding trade relations. A key focus of the talks will be the India-Middle East Economic Corridor (IMEC), a multinational infrastructure initiative positioned as an alternative to China's Belt and Road Initiative (BRI).

🛢️Oil: Crude oil prices fell for the third week in a row, as investors grew increasingly concerned about the U.S. President Donald Trump's renewed trade tensions with China and potential tariffs on other countries. Oil prices fell further on Thursday after Trump reiterated his commitment to boosting US oil production, adding to market jitters. This came just a day after the U.S. reported a larger-than-expected rise in crude oil inventories, weighing on sentiment. The Brent Crude slipped 2.2% and ended the week at $74 a barrel, while the West Texas Intermediate (WTI) fell 4% to $71 a barrel.

📊Stocks in focus: Based on price and open interest, long build-up was seen in Chambal Fertilisers, JSW Steel, Glenmark Pharmaceuticals and Steel Authority of India. Similarly, to track the OI and price gainers, log in to Upstox ➡️F&O➡️Futures smart list ➡️OI losers.

📓✏️Takeaway: The NIFTY50 index encountered resistance near its 21-week exponential moving average (EMA) and struggled to break through this critical level on a closing basis. While the index ended the week in positive territory, it failed to close above the previous week’s high, signaling persistent selling pressure.

Looking ahead, key resistance remains around the 21-week EMA at 23,900, while immediate support is seen in the 23,200–23,000 zone. A decisive breakout beyond this range on a closing basis will offer clearer market direction.

For intraday range updates and revisions to these levels, visit our daily morning trade setup blog, published at 8 AM before the market opens.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story