Market News

Week ahead: FOMC minutes, GDP data, F&O monthly expiry among key market triggers to watch

.png)

5 min read | Updated on November 25, 2024, 10:33 IST

SUMMARY

This week, key factors, including the outcome of the assembly election results, Q2 GDP data, F&O expiry, foreign fund flows, and global cues, will shape market trends.

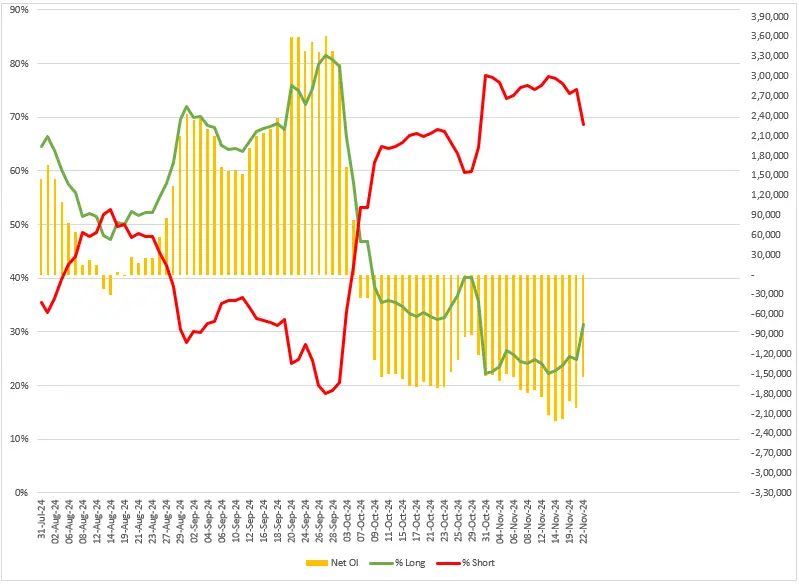

Foreign Institutional Investors (FIIs) reduced their net short positions in index futures on Friday

Markets broke their two-week losing streak with a robust recovery on Friday, driven by a short-covering rally ahead of the Maharashtra and Jharkhand state assembly election results. The benchmark indices surged over 2%, showing resilience despite persistent challenges, including geopolitical tensions, foreign fund outflows, and renewed bribery allegations surrounding the Adani Group.

The NIFTY50 index rose over 1.5% for the week, while SENSEX advanced 2% amid broad-based buying across sectors. Except for Energy (-1.4%) and Oil & Gas (-1.2%), all the major sectoral indices ended the week in green. Automobiles (+2.8%), Consumer Durables (+2.8%) and IT (+2.2%) advanced the most.

Meanwhile, markets are poised to react to today's state assembly elections. Experts believe that a landslide victory for the BJP-led Mahayuti alliance in Maharashtra could further boost market sentiment, potentially sustaining the recent positive momentum in the short term.

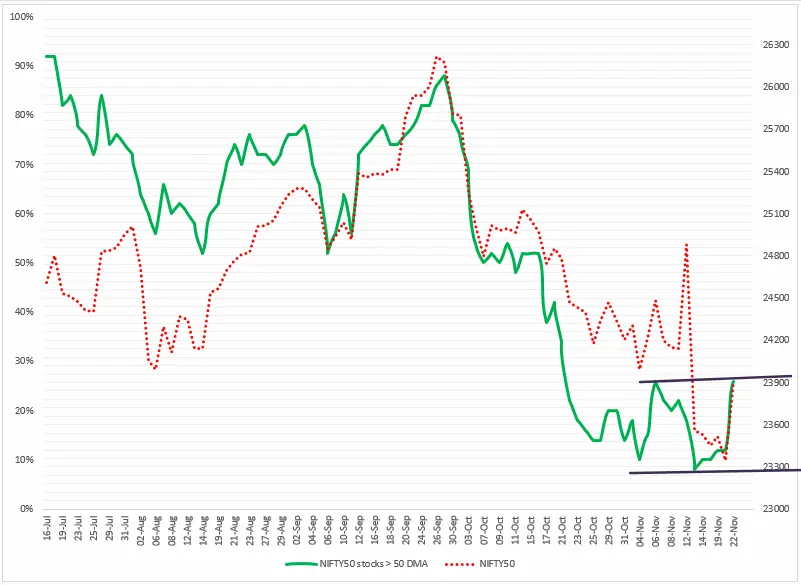

Index breadth

In last week's blog, we pointed out that the NIFTY50 index was in short-term oversold territory, with only 10% of its stocks trading above their 50-day moving average. Over the past month, the index has consistently maintained low double-digit breadth, ranging from 20% to 10%, further reinforcing its oversold status. After Friday’s rebound, the current reading of the breadth meter rebounded to 26%, suggesting a positive crossover in the short term.

FIIs positioning in the index

After maintaining a long-to-short ratio of up to 25:75 until November 21, Foreign Institutional Investors (FIIs) reduced their net short positions in index futures on Friday, taking the ratio to 31:69. Despite the broader open interest in index futures remaining net short, the significant 19% reduction signals a potential rebound and offers a breather for the index in the short term. In the coming week, traders should monitor the change in the net long contracts of the FIIs for further directional clues.

NIFTY50 outlook

After a sharp drop of over 10% from its recent all-time high, the NIFTY50 index found support at its 50 weekly exponential moving average (WEMA) and rebounded by over 1.5%. The index has formed a hammer candlestick pattern on the weekly chart, which is a bullish reversal pattern. However, the pattern will be confirmed if the close of the following candle is above the high of the bullish reversal pattern.

For the coming week, the index's immediate support will be at the 23,300 level, while resistance will be seen at the 24,600 level. The index may trade within this range, with short-term breadth remaining positive. However, a breach of this area could provide further directional clues.

SENSEX outlook

The SENSEX also took support from the crucial 50 WEMA zone and the 2024 general election high and staged a rebound of nearly 3%. It also formed a bullish hammer on the weekly chart, indicating that the short-term momentum has turned in favour of the bulls.

In the upcoming week, the crucial support for the index is around 76,800 zone, while the resistance is visible around 80,500. With the short-term momentum turning in favour of bulls, the index may extend its gains upto 80,500. A close above this level will signal further bullish momentum. However, if the index slips below the immediate support of the 78,500, it may turn range-bound.

Meanwhile, India's second-quarter GDP number will be released on Friday. Market participants are expecting a flat reading around the previous quarter’s 6.7%.

Meanwhile, for the upcoming week, the short-term momentum of the NIFTY50 index remains positive, with immediate support around the 23,300 zone, while the hurdle remains around the 50 exponential moving average (EMA).

To stay updated on any changes in these levels and all intraday developments, be sure to check out our daily morning trade setup blog, available before the market opens at 8 am.

About The Author

Next Story