Market News

Week ahead: Budget 2025, Q3 results, US Fed decision among key market triggers to watch

.png)

7 min read | Updated on January 27, 2025, 07:45 IST

SUMMARY

The market's direction in the coming week will likely be influenced by various factors, including third-quarter earnings reports, the U.S. Fed’s interest rate decision and potential outflows of funds by Foreign Institutional Investors (FIIs). Traders should closely observe the index's price action around the crucial support level of 23,000. A decisive close below this level could indicate further downside potential for the market.

Markets remained volatile in the previous week and host of key event in the coming week are expected to keep it volatile as well for this week.| Shutterstock

Markets extended their losing streak for the third consecutive week, consolidating broadly within the previous week’s range. The indices remained volatile amid mixed third-quarter earnings, persistent FII outflows, and policy announcements by U.S. President Donald Trump.

The NIFTY50 index declined by 0.4%, closing the week at 23,092, while the SENSEX dropped 0.5%, ending at 76,190. After a brief pause, broader markets resumed their downward trend, with the NIFTY Midcap 100 index falling 2.4% and the Smallcap 100 index losing over 4%.

The market witnessed a broad-based sell-off across sectors, with Real Estate (-9.1%) and Energy (-4.1%) recording the steepest declines. On the other hand, defensive sectors were the only gainers, with IT rising 3.5% and FMCG inching up 0.4%.

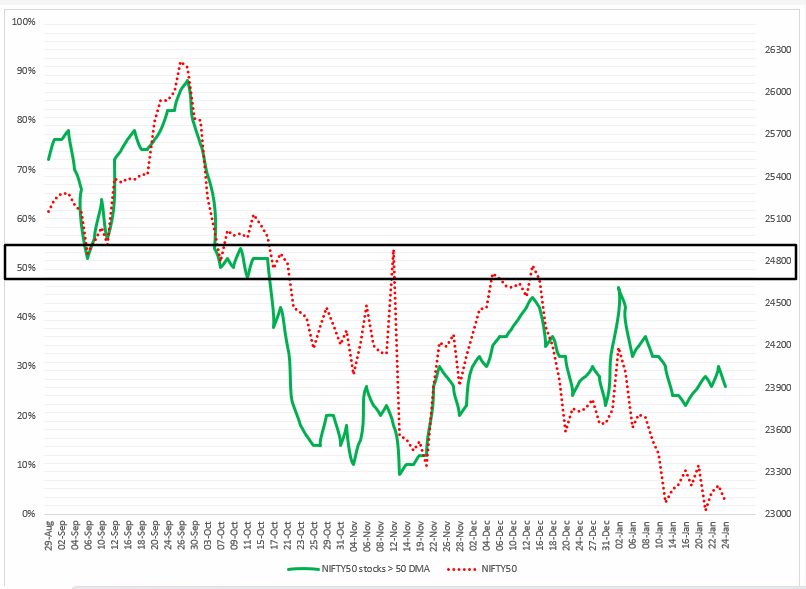

Index breadth

The breadth of the NIFTY50 index was subdued last week, with an average of only 27% of NIFTY50 stocks trading above their 50-day moving average (DMA). The breadth indicator, which measures the proportion of NIFTY50 stocks above their 50-DMA, continues to reflect weakness, currently standing at around 26%. This suggests that more than 70% of NIFTY50 stocks are trading below their respective 50-DMAs, reinforcing a bearish market sentiment.

As noted in our analysis over the past three weeks, the overall market trend is likely to stay under pressure unless the breadth indicator decisively surpasses the critical 50% mark.

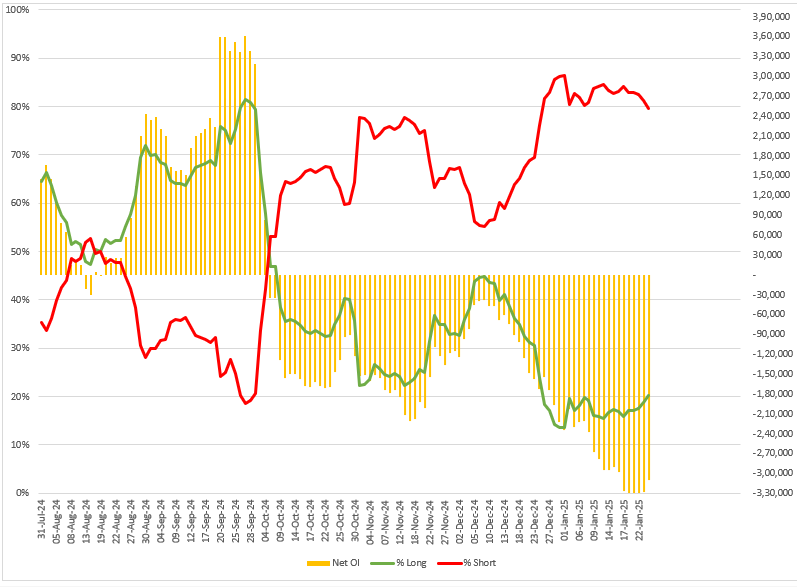

FIIs positioning in the index

Foreign Institutional Investors (FIIs) sustained their bearish stance in index futures last week, with 80% of their positions tilted towards the short side, sustaining the long-to-short ratio of 20:80. This underscores the prevailing negative sentiment, as net open interest in index futures of FIIs remains at -3 lac contracts.

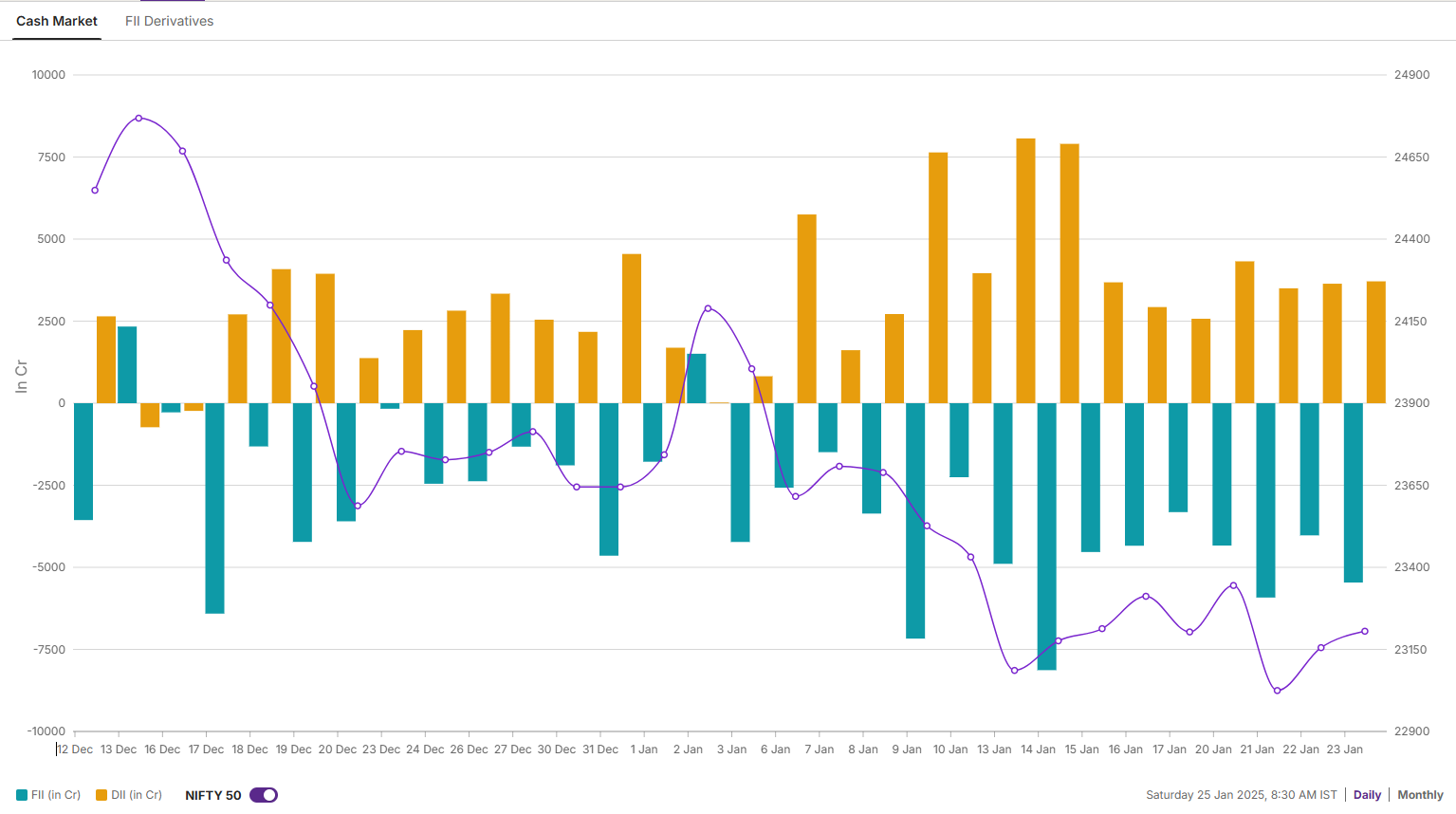

Meanwhile, the cash market activity of the FIIs maintained their downtrend and remained net sellers last week. The FIIs sold shares worth ₹22,504 crore and have largely remained net sellers in the month of January. On the other hand, the Domestic Institutional Investors (DIIs) remained net buyers and purchased equity worth ₹17,577 crore.

NIFTY50 outlook

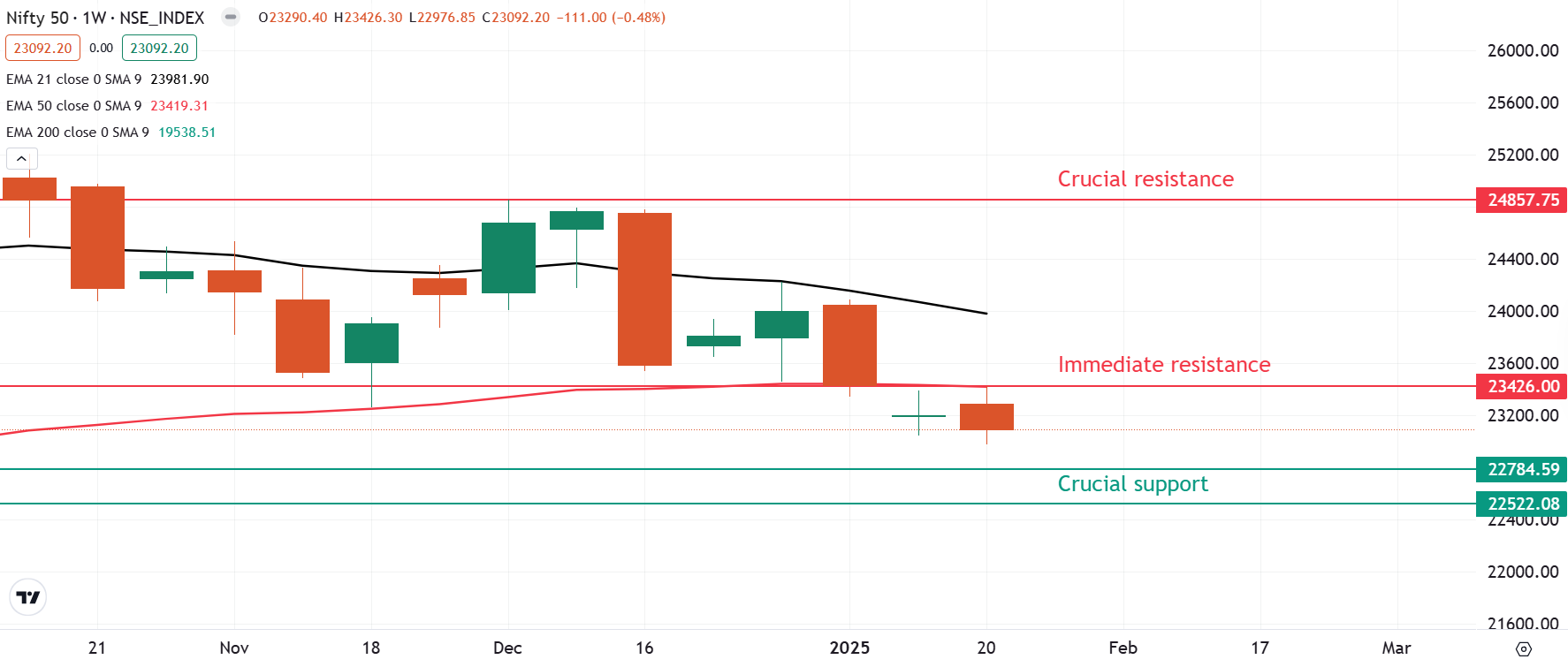

The NIFTY50 index decisively closed the week below its 50-week exponential moving average (EMA) for the first time in nearly a year, signaling underlying weakness. Additionally, the index ended the week on a negative note, closing below last week’s doji candle, further reinforcing the prevailing bearish trend.

SENSEX outlook

The SENSEX also remained volatile throughout the week and ended below previous week’s low, signalling weakness as per the weekly chart. The index faced resistance around the high of the previous week’s doji candlestick pattern, indicating presence of sellers at higher levels.

Meanwhile, on the domestic front the Finance Minister Nirmala Sitharaman will present the Union Budget on February 1. Industry stakeholders are eagerly anticipating whether the forthcoming budget will revive GDP growth and provide much-needed tax relief for salaried individuals? With GDP growth slowing to its lowest level in several quarters, the government is expected to prioritise economic recovery through Budget 2025.

Meanwhile, key companies which will declare their third quarter results on Dalal Street are ACC, Tata Steel, Indraprastha Gas, Federal Bank, Bajaj Auto, TVS Motor, Cipla, Tata Motors, Maruti Suzuki, Ambuja Cements, Kalyan Jewellers, Larsen & Toubro, BSE and Adani Enterprises.

Looking ahead, traders should closely monitor the resistance zone between 23,400 and 23,500. A failure to decisively break above this zone on a closing basis could signal a continuation of the bearish trend. Conversely, the crucial support level for the index now lies between 22,500 and 22,400

For intraday range updates and revisions to these levels, visit our daily morning trade setup blog, published at 8 AM before the market opens.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story