Market News

Trade Setup for Sept 11: Can BANK NIFTY break through the 50 DMA on expiry day?

.png)

5 min read | Updated on September 11, 2024, 07:44 IST

SUMMARY

BANK NIFTY reclaimed its 20 day moving average (DMA) and is now positioned between its 50 and 20 DMAs. Traders should keep a close watch on these levels, as a breakout above or below these DMAs could offer important directional signals.

Stock list

NIFTY50 formed a neutral candlestick pattern, similar to a doji, which signifies indecision among investors.

Asian markets update at 7 am

GIFT NIFTY is down 0.2%, signaling a subdued to negative opening for Indian equities today. Asian markets are also under pressure, with Japan’s Nikkei 225 dropping 1.1%, and Hong Kong’s Hang Seng index sliding 1.4%.

U.S. market update

- Dow Jones: 40,736 (▼0.2%)

- S&P 500: 5,495 (▲0.4%)

- Nasdaq Composite: 17,025 (▲0.8%)

U.S. indices ended mixed on Wednesday as the banks and oil stocks came under selling pressure, while technology stocks supported the markets. Going forward, the Street will be focusing on the consumer inflation report of August, which will be released later today.

Ahead of the U.S. Federal Reserve’s policy meeting, the Street is expecting the reading of headline Consumer Price Index (CPI) to have risen 0.2% month-on-month and 2.6% year-on-year. The CPI report will be crucial as it will help the Fed determine the size of the interest rate cut at its upcoming meeting. Meanwhile, Fed Funds Futures currently are pricing in a 69% probability of a 0.25% rate cut.

NIFTY50

- September Futures: 25,083 (▲0.4%)

- Open Interest: 5,31,550 (▼3.1%)

The NIFTY50 index started Tuesday’s session on a positive note and after a briefl dip, recovered most of the losses from the sharp decline on 6 September. The index formed a neutral candlestick pattern, similar to a doji, which signifies indecision among investors.

On the daily chart, we advised readers to watch the immediate resistance around the 25,100 zone. The index briefly breached this level during intraday trading on Tuesday but couldn’t hold it by the close. In the upcoming sessions, if the index sustains above this zone and closes above it, it could attempt to retest the recent all-time high of 25,333. However, a close below the doji pattern might shift the outlook towards the bears.

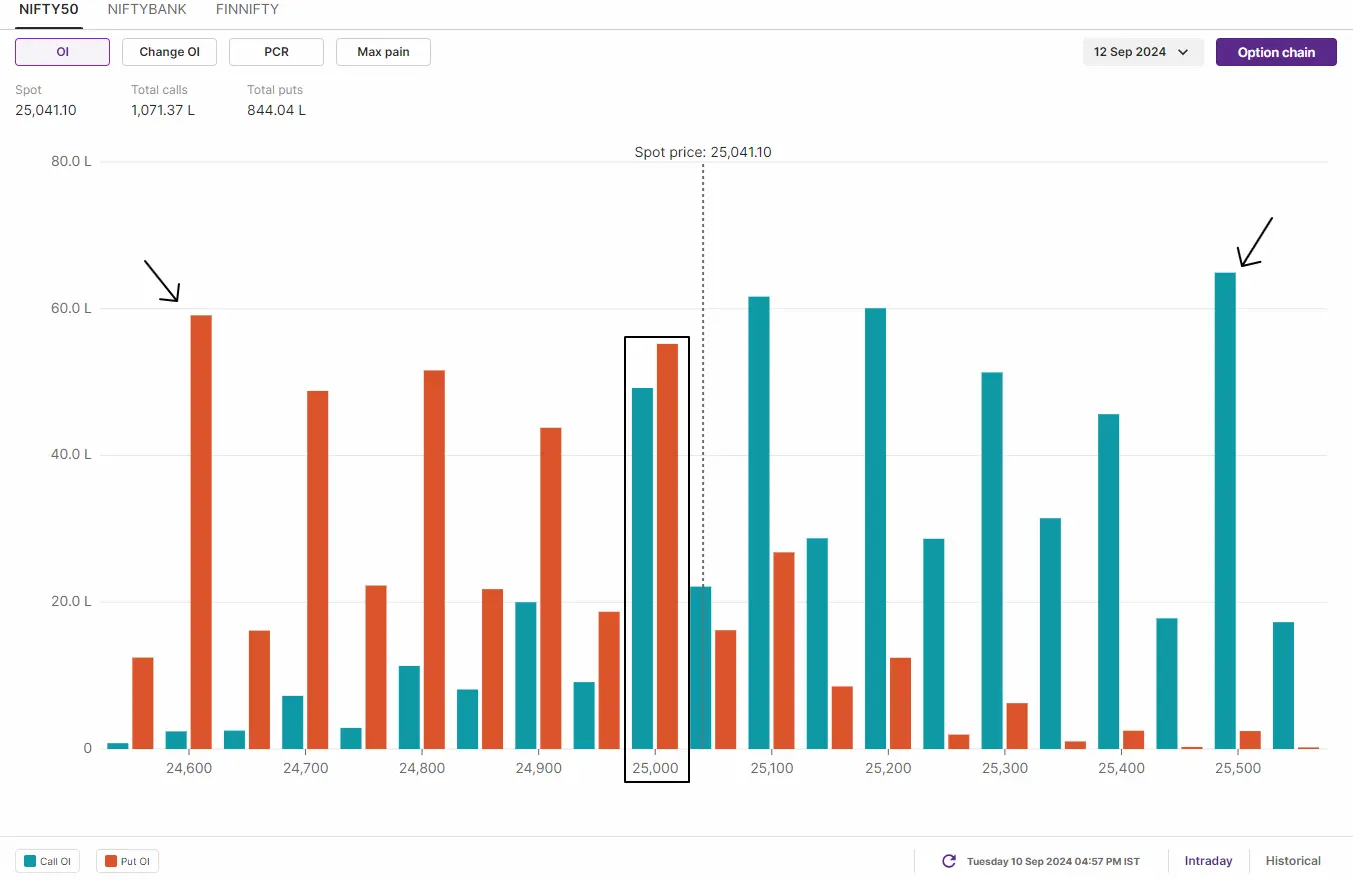

In terms of open interest for the 12 September expiry, there was significant put writing at the 24,600 to 24,900 strikes, suggesting support around these levels. Meanwhile, the call base remained at 25,100 and 25,200 strikes. Traders also placed considerable call and put contracts at the 25,000 strike, signaling potential range-bound movement around this level.

BANK NIFTY

- September Futures: 51,267 (▲0.1%)

- Open Interest: 1,56,377 (▼0.6%)

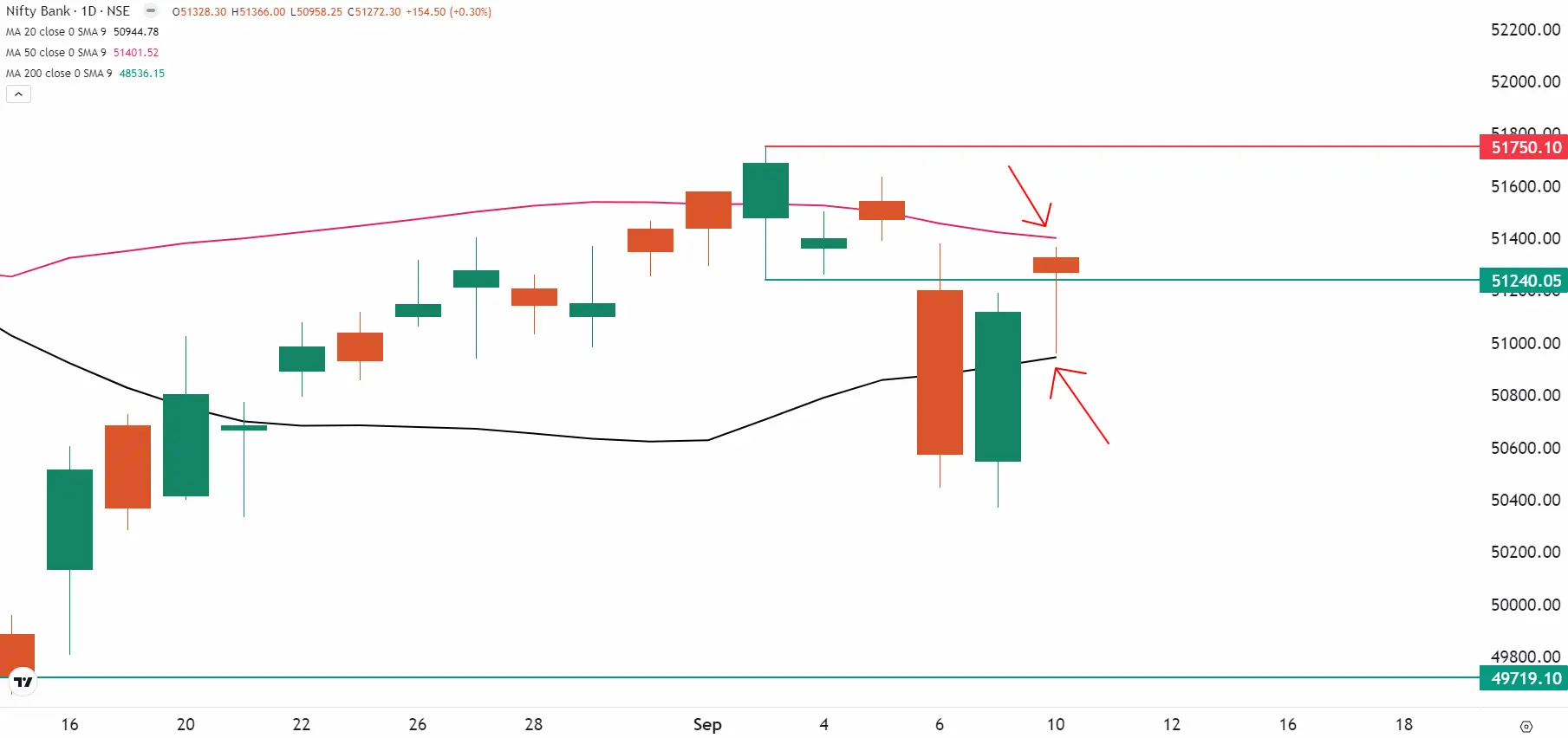

After initial volatility, BANK NIFTY rebounded from the day’s low and closed above the previous day’s high, confirming the bullish piercing pattern formed on 9 September. However, the confirmation candle was red, signaling some selling pressure at higher levels.

On the daily chart, the index reclaimed its 20-day moving average (DMA), suggesting support for the index around 51,000 level. The resistance is near the 50 DMA, around the 51,500 zone. As the index is currently positioned between its 50 and 20 DMAs, traders should monitor these levels closely, as a breakout above or below could trigger a directional move.

On the 15-minute chart, the index has formed a cup and handle pattern and hovering near its immediate resistance. A breakout above this zone with a strong candle could push the rally towards the 51,800 zone. Conversely, if the index slips below 51,000, the next support level is around 50,600.

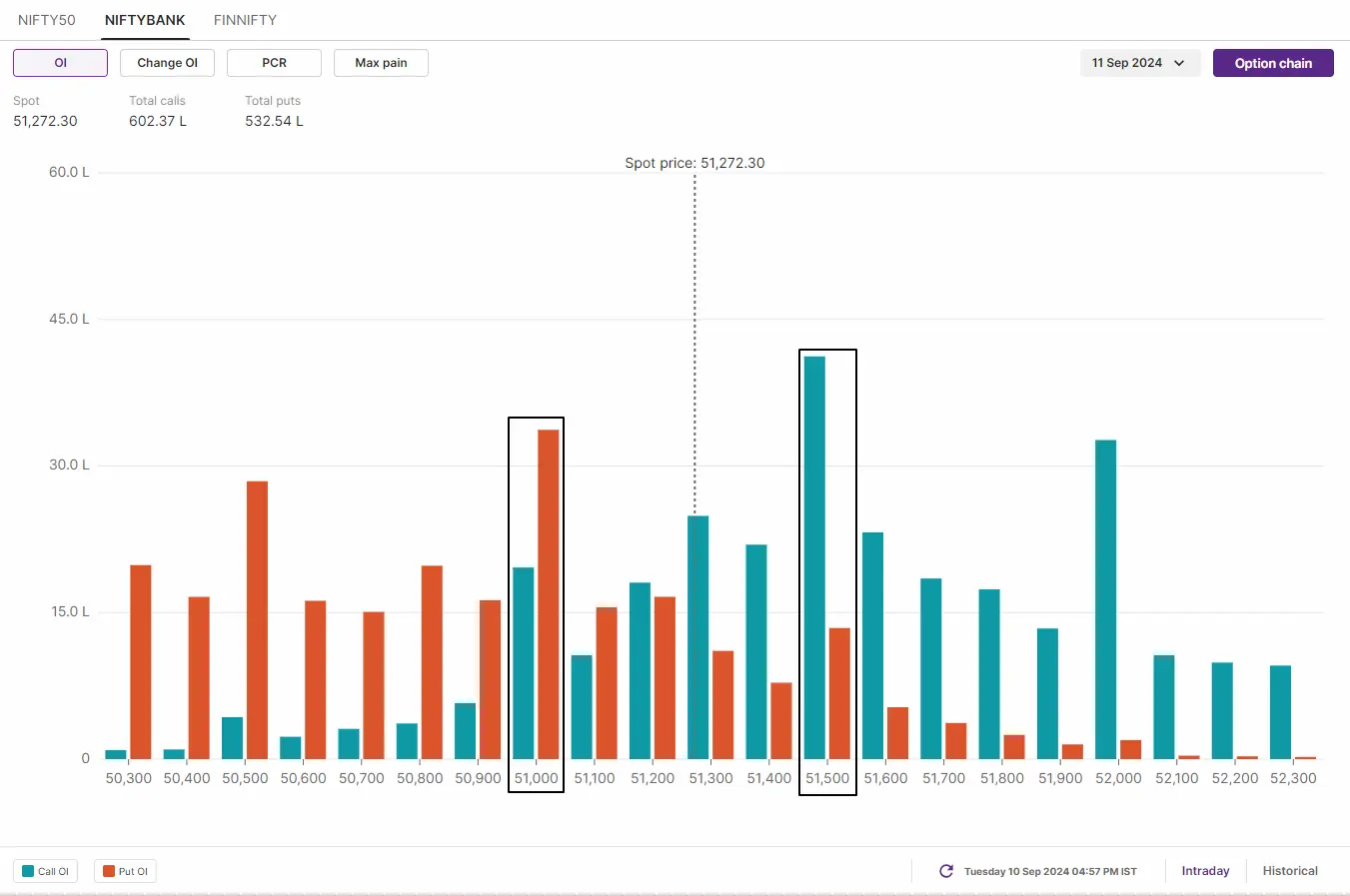

The open interest data for BANK NIFTY’s expiry today aligns with key support and resistance levels. Significant call open interest is positioned at the 51,500 strike, indicating resistance, while the put open interest base is set at the 51,000 strike, suggesting support around this level.

FII-DII activity

Stock scanner

Short build-up: HDFC Life Insurance, Power Finance Corporation and LIC Housing Finance

Under F&O ban: Aditya Birla Fashion and Retail, Balrampur Chini Mills, Bandhan Bank, Biocon, Chambal Fertilisers, Hindustan Copper and RBL Bank

Added under F&O ban: N/A

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story