Market News

Trade Setup for Oct 31: NIFTY50 remains range-bound, faces resistance at 24,500

.png)

4 min read | Updated on October 31, 2024, 07:27 IST

SUMMARY

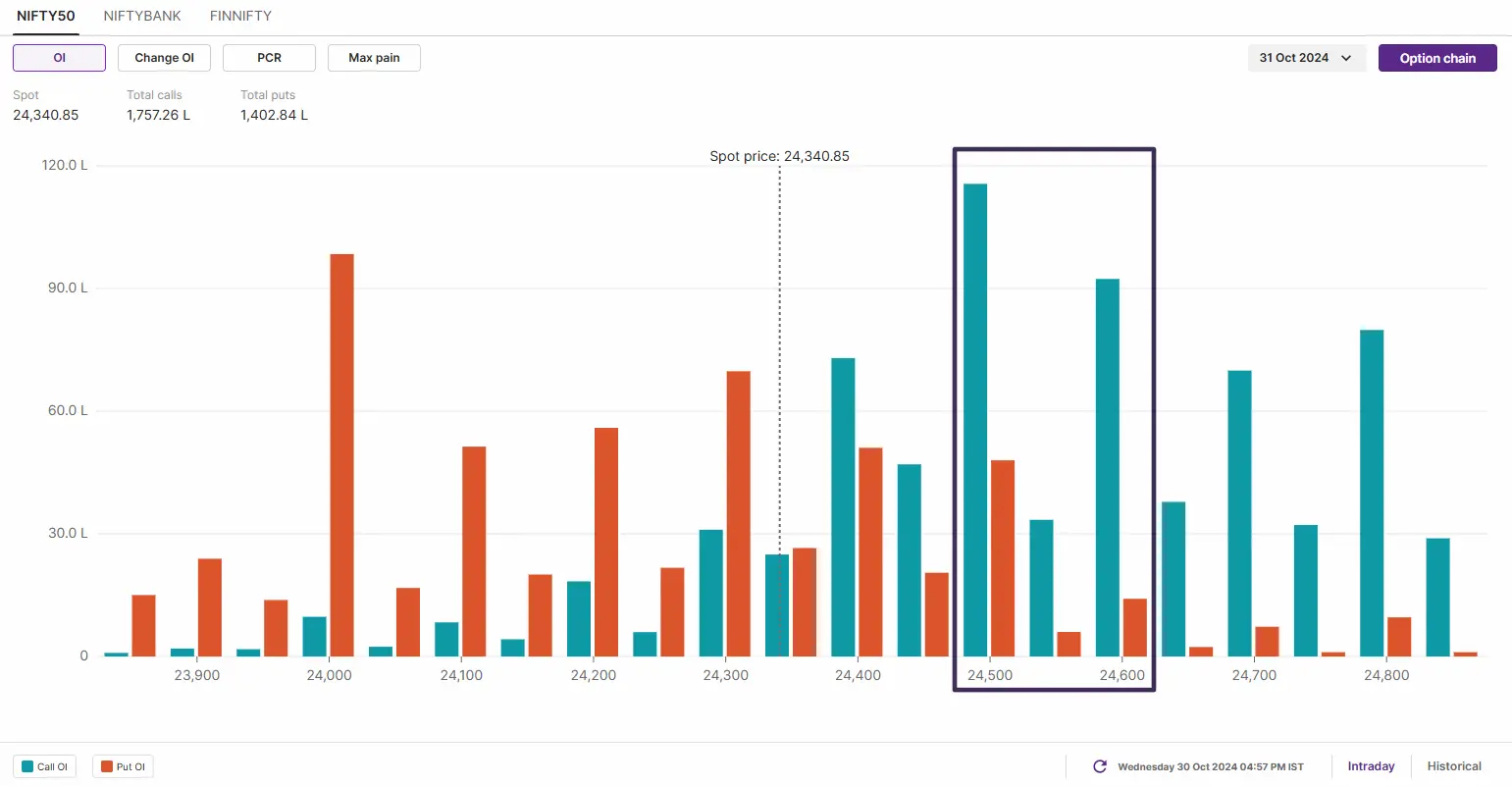

According to the options data for monthly expiry, the NIFTY50 index saw significant call open interest build-up at 24,500 and 24,600 strikes. This indicates that the index may face resistance around these levels.

Stock list

After a gap-down start, the BANK NIFTY index consolidated in a narrow range on the monthly expiry of its options contracts and formed an inside candle on the daily chart.

Asian markets update

The GIFT NIFTY is trading flat, indicating a subdued start for the NIFTY50 on the expiry of its monthly contracts. Meanwhile, the other Asian indices are trading mixed. Japan’s Nikkei 225 is down 0.5%, while Hong Kong’s Hang Seng index is up 0.1%.

U.S. market update

- Dow Jones: 42,141 (▼0.2%)

- S&P 500: 5,813 (▼0.3%)

- Nasdaq Composite: 18,607 (▼0.3%)

U.S. indices ended Wednesday's volatile session lower despite strong earnings from Alphabet. Meanwhile, the latest economic data showed that third quarter GDP slowed slightly to 2.8%, down from 3% in the second quarter.

After the session, Meta and Microsoft reported their third quarter results. Results from both companies were above Street estimates. However, Meta's aggressive spending plans weighed on the shares.

NIFTY50

- October Futures: 24,371 (▼0.4%)

- Open Interest: 2,43,207 (▼27.2%)

The NIFTY50 extended the consolidation for the third day in a row, broadly trading within the range of 25 October candle. The index formed a negative candle on the daily chart and failed to provide the follow-through of the previous session’s bullish momentum.

On the daily chart, the index has attempted to break the resistance zone one two time in last three sessions and witnessed selling pressure from this zone. Positionally, the trend may turn in favour of bulls if the price closes above resistance one. On the other hand, a close below the August low and the support zone of 24,000 will result in weakness.

As per the 15 minute time frame, the traders should also monitor yesterday’s low. A break below this level with a strong candle can result in a sharp move upto 24,000 zone. On the flip side, the close above resiatnce one can result in a short-covering rally upto 24,800 zone.

The open interest data for today’s expiry is tilted in favour of bears as the index witnessed significant additions at 24,500 and 24,600 strikes, making them as immediate resistance zone for the index. Conversely, the put base remained at 24,000 and no significant additions were seen on any other strikes.

BANK NIFTY

- November Futures: 52,260 (▼0.6%)

- Open Interest: 1,51,455 (▲43.8%)

After a gap-down start, the BANK NIFTY index consolidated in a narrow range on the monthly expiry of its options contracts and formed an inside candle on the daily chart. The index remained volatile within the range highlighted in our yesterday’s trade setup blog and closed above the immediate support zone of 51,500 and 51,700.

As highlighted above, the index has formed a inside candle on the daily chart after Tuesday’s sharp upmove and has taken support near the support zone one. Positional traders should monitor the resistance and support one along with 51,000 mark. Unless the index breaks this range on closing basis on daily chart, the trend may remain range-bound. However, a sharp close above the resistance and the gap zone may result in a strong bullish move.

FII-DII activity

Stock scanner

Short build-up: Voltas, Torrent Pharmaceuticals, Dixon Technologies, Samvardhana Motherson, Oberoi Realty and Alkem Laboratories

Under F&O ban: IDFC First Bank, Indiamart Intermesh, Punjab National Bank and RBL Bank

Out of F&O ban: L&T Finance and Manappuram Finance

Added under F&O ban: NIL

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story