Market News

Trade Setup for Oct 17: Will NIFTY50 break its seven-day consolidation?

.png)

4 min read | Updated on October 17, 2024, 07:19 IST

SUMMARY

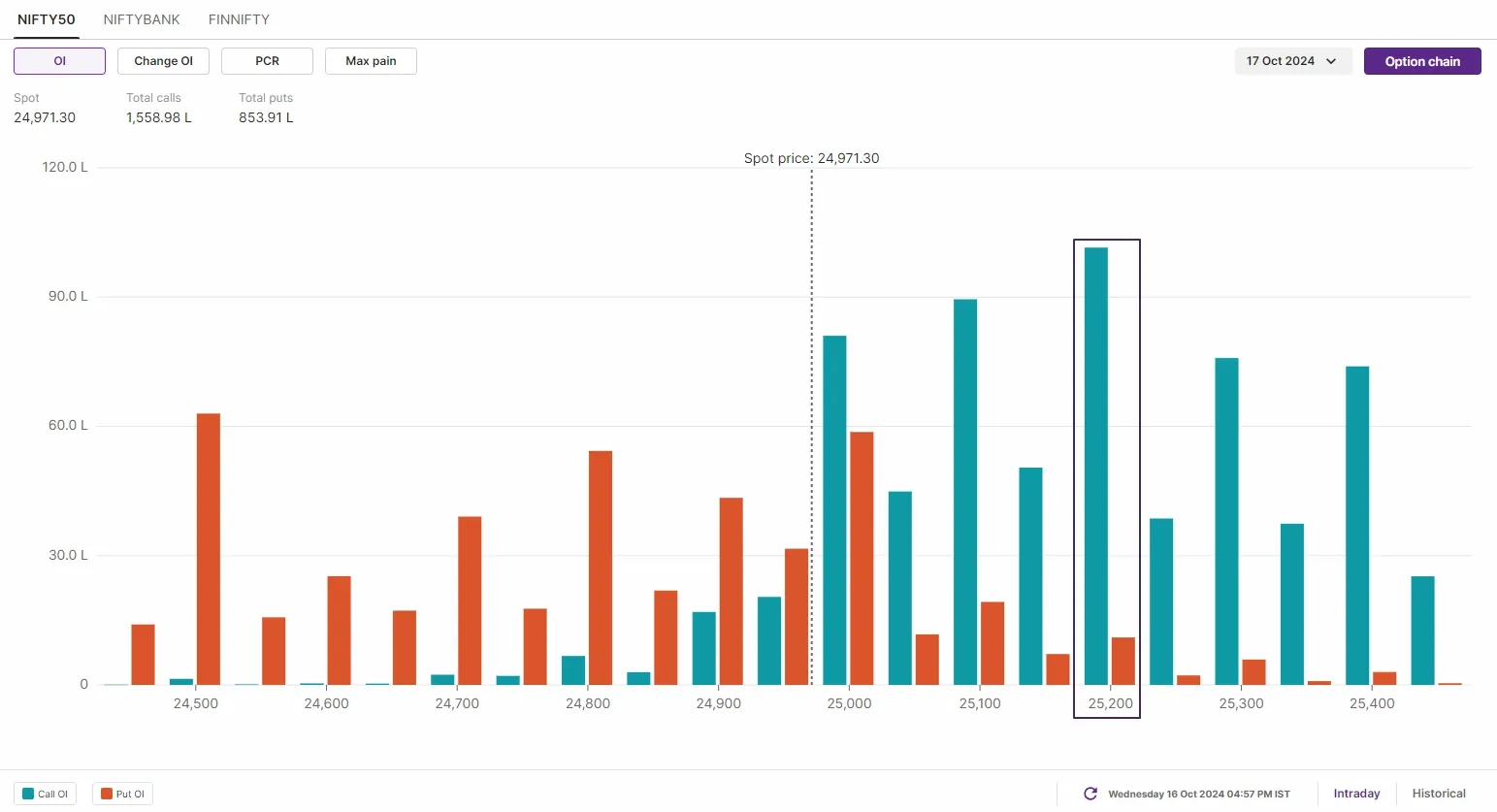

Options data shows the NIFTY50 index has the highest call build-up at the 25,200 strike, indicating strong resistance around this level. Conversely, the highest put base is concentrated at the 24,800 strike, suggesting solid support in this zone.

The BANK NIFTY continued its outperformance versus the benchmark peers for the third consecutive day and briefly climbed the 52,000 mark.

Asian markets update

The GIFT NIFTY is trading flat, signaling a muted opening for the NIFTY50 on the weekly expiry of its options contracts. Elsewhere in Asia, markets are showing mixed trends, with Japan's Nikkei 225 down 0.5%, while Hong Kong's Hang Seng index is up 1%.

U.S. market update

- Dow Jones: 43,077 (▲0.7%)

- S&P 500: 5,842 (▲0.4%)

- Nasdaq Composite: 18,367 (▲0.2%)

The U.S. market rebounded as investors digested Morgan Stanley's earnings and a recovery in chip stocks. Morgan Stanley's third-quarter results beat Street estimates on both the revenue and profit fronts, fueled by each of its three divisions of weath management, trading and investment banking.

NIFTY50

- October Futures: 25,048 (▼0.3%)

- Open Interest: 5,48,804 (▲0.8%)

The NIFTY50 index extended its range-bound movement for the fifth consecutive day, ending the day in negative territory amid profit booking in IT stocks. The index formed a doji candle on the daily chart, though not a clean one, reflecting investor indecision at the current levels.

On the daily chart, the index is largely consolidating between its 20 and 100-day moving averages from the past seven trading sessions. Positionally, the index will provide directional clues when it breaks these levels on a closing basis.

For today's expiry, traders can focus on the immediate support level near the 24,900 zone. As shown in the 15-minute chart below, the index has tested this support twice in the past four sessions. On the upside, there is resistance around the 25,150 level. Unless the index decisively breaks this range with a strong candlestick pattern, the market may continue to trade sideways. A clear breakout from this zone is likely to trigger a strong directional move.

The open interest positioning of the index for today’s expiry saw significant call open interest base at 25,200 and 25,100 strikes, suggesting that index may face resistance around these strikes. On the flip side, the put base was visible at 25,000 and 24,800 strikes, making them as immediate support strikes for the index.

BANK NIFTY

- October Futures: 52,042 (▼0.1%)

- Open Interest: 1,92,744 (▼0.6%)

The BANK NIFTY continued its outperformance versus the benchmark peers for the third consecutive day and briefly climbed the 52,000 mark. However, the index failed to sustain the crucial level on closing basis and saw profit-booking at higher levels.

On the daily chart, the index is holding above its important 50 and 100 day moving averages (DMAs) on a closing basis. However, it continues to face selling pressure near the 52,000 level. The index is now at a critical juncture, a close below the 50 DMA could signal further downside weakness, while a decisive close above 52,000 could trigger bullish momentum and potentially lead to a test of the 20 DMA.

FII-DII activity

Stock scanner

Short build-up: Zydus Lifesciences, Jindal Steel, Trent, Coforge and Mahanagar Gas

Under F&O ban: Bandhan Bank, Chambal Fertilisers, Gujarat Narmada Valley Fertilizers & Chemicals (GNFC), Granules India, Hindustan Copper, IDFC First Bank, IEX, L&T Finance Manappuram Finance, National Aluminium, Punjab National Bank, RBL Bank, Steel Authority of India and Tata Chemicals

Out of F&O ban: NIL

Added under F&O ban: NIL

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story